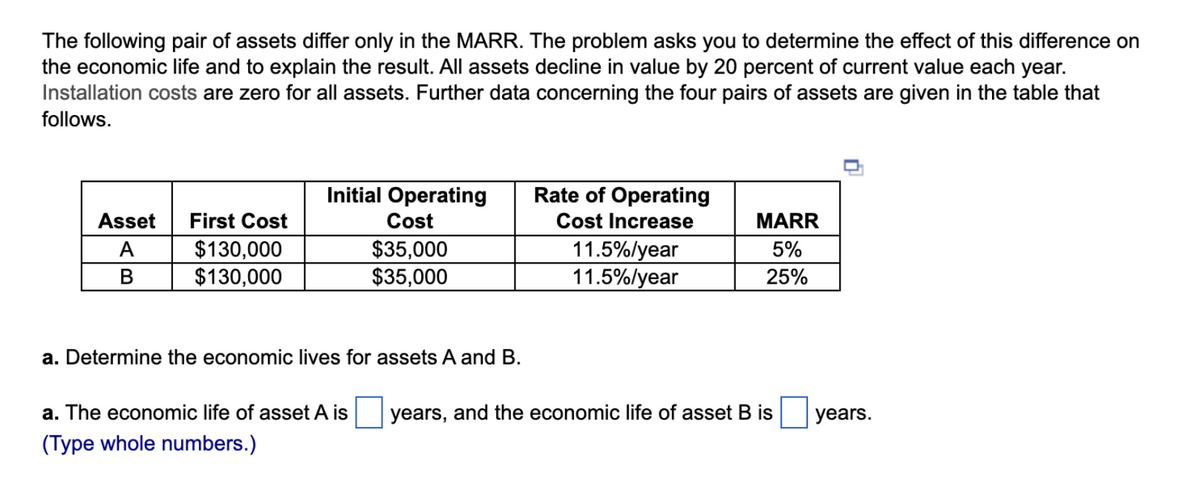

The following pair of assets differ only in the MARR. The problem asks you to determine the effect of this difference or the economic life and to explain the result. All assets decline in value by 20 percent of current value each year. Installation costs are zero for all assets. Further data concerning the four pairs of assets are given in the table that follows. Asset First Cost A B $130,000 $130,000 Initial Operating Cost $35,000 $35,000 Rate of Operating Cost Increase 11.5%/year 11.5%/year MARR 5% 25%

The following pair of assets differ only in the MARR. The problem asks you to determine the effect of this difference or the economic life and to explain the result. All assets decline in value by 20 percent of current value each year. Installation costs are zero for all assets. Further data concerning the four pairs of assets are given in the table that follows. Asset First Cost A B $130,000 $130,000 Initial Operating Cost $35,000 $35,000 Rate of Operating Cost Increase 11.5%/year 11.5%/year MARR 5% 25%

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 2E

Related questions

Question

Transcribed Image Text:The following pair of assets differ only in the MARR. The problem asks you to determine the effect of this difference on

the economic life and to explain the result. All assets decline in value by 20 percent of current value each year.

Installation costs are zero for all assets. Further data concerning the four pairs of assets are given in the table that

follows.

Asset First Cost

A

B

$130,000

$130,000

Initial Operating

Cost

$35,000

$35,000

a. Determine the economic lives for assets A and B.

Rate of Operating

Cost Increase

11.5%/year

11.5%/year

MARR

5%

25%

a. The economic life of asset A is years, and the economic life of asset B is

(Type whole numbers.)

years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning