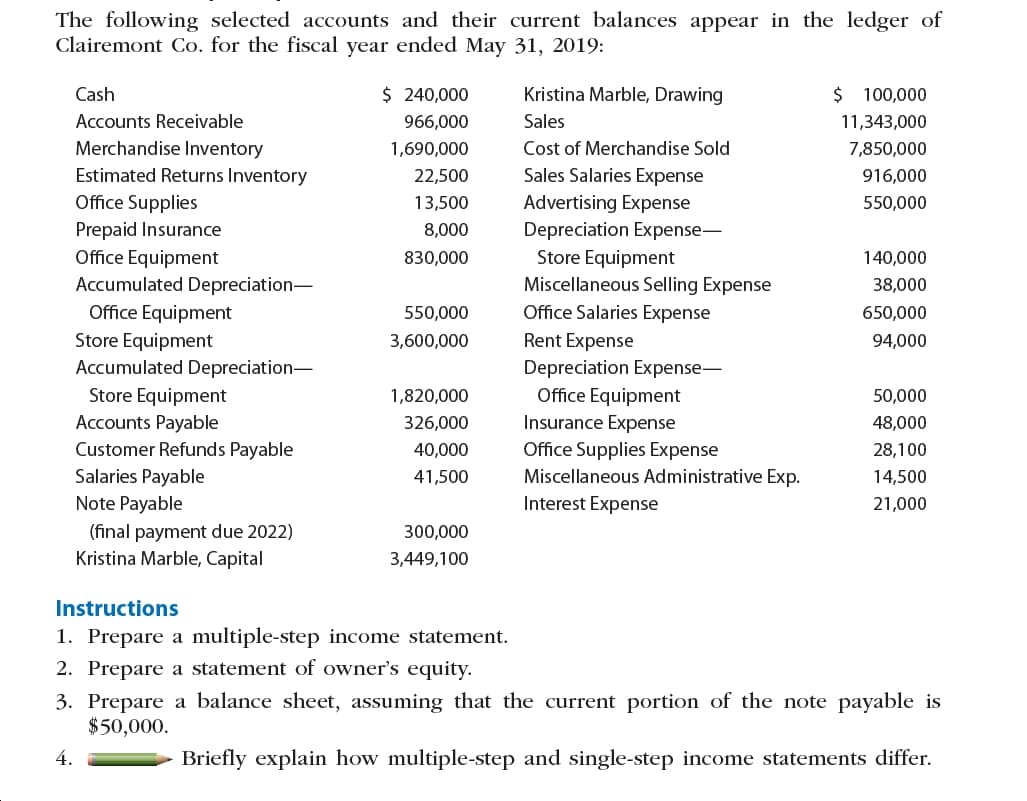

The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Kristina Marble, Drawing $ 100,000 $ 240,000 Cash Sales Accounts Receivable 966,000 11,343,000 Merchandise Inventory Cost of Merchandise Sold 1,690,000 7,850,000 Estimated Returns Inventory Sales Salaries Expense 916,000 22,500 Office Supplies Prepaid Insurance Office Equipment Advertising Expense Depreciation Expense- Store Equipment Miscellaneous Selling Expense 13,500 550,000 8,000 140,000 830,000 Accumulated Depreciation- 38,000 Office Salaries Expense Office Equipment Store Equipment Accumulated Depreciation- 650,000 550,000 Rent Expense 3,600,000 94,000 Depreciation Expense- Office Equipment Insurance Expense Office Supplies Expense Store Equipment Accounts Payable 50,000 1,820,000 48,000 326,000 Customer Refunds Payable 40,000 28,100 Salaries Payable Note Payable Miscellaneous Administrative Exp. 41,500 14,500 Interest Expense 21,000 (final payment due 2022) Kristina Marble, Capital 300,000 3,449,100 Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owner's equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is $50,000. Briefly explain how multiple-step and single-step income statements differ. 4.

The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Kristina Marble, Drawing $ 100,000 $ 240,000 Cash Sales Accounts Receivable 966,000 11,343,000 Merchandise Inventory Cost of Merchandise Sold 1,690,000 7,850,000 Estimated Returns Inventory Sales Salaries Expense 916,000 22,500 Office Supplies Prepaid Insurance Office Equipment Advertising Expense Depreciation Expense- Store Equipment Miscellaneous Selling Expense 13,500 550,000 8,000 140,000 830,000 Accumulated Depreciation- 38,000 Office Salaries Expense Office Equipment Store Equipment Accumulated Depreciation- 650,000 550,000 Rent Expense 3,600,000 94,000 Depreciation Expense- Office Equipment Insurance Expense Office Supplies Expense Store Equipment Accounts Payable 50,000 1,820,000 48,000 326,000 Customer Refunds Payable 40,000 28,100 Salaries Payable Note Payable Miscellaneous Administrative Exp. 41,500 14,500 Interest Expense 21,000 (final payment due 2022) Kristina Marble, Capital 300,000 3,449,100 Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owner's equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is $50,000. Briefly explain how multiple-step and single-step income statements differ. 4.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5PA: The following selected accounts and their current balances appear in the ledger of Clairemont Co....

Related questions

Question

Transcribed Image Text:The following selected accounts and their current balances appear in the ledger of

Clairemont Co. for the fiscal year ended May 31, 2019:

Kristina Marble, Drawing

$ 100,000

$ 240,000

Cash

Sales

Accounts Receivable

966,000

11,343,000

Merchandise Inventory

Cost of Merchandise Sold

1,690,000

7,850,000

Estimated Returns Inventory

Sales Salaries Expense

916,000

22,500

Office Supplies

Prepaid Insurance

Office Equipment

Advertising Expense

Depreciation Expense-

Store Equipment

Miscellaneous Selling Expense

13,500

550,000

8,000

140,000

830,000

Accumulated Depreciation-

38,000

Office Salaries Expense

Office Equipment

Store Equipment

Accumulated Depreciation-

650,000

550,000

Rent Expense

3,600,000

94,000

Depreciation Expense-

Office Equipment

Insurance Expense

Office Supplies Expense

Store Equipment

Accounts Payable

50,000

1,820,000

48,000

326,000

Customer Refunds Payable

40,000

28,100

Salaries Payable

Note Payable

Miscellaneous Administrative Exp.

41,500

14,500

Interest Expense

21,000

(final payment due 2022)

Kristina Marble, Capital

300,000

3,449,100

Instructions

1. Prepare a multiple-step income statement.

2. Prepare a statement of owner's equity.

3. Prepare a balance sheet, assuming that the current portion of the note payable is

$50,000.

Briefly explain how multiple-step and single-step income statements differ.

4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning