The following selected information is taken from the records of Good Repair Services for the year 2018: Accounts payable Accounts receivable Advertising expense Cash Supplies expense Rent expense P 35,000 65,000 20,000 19,500 46,000 10,000 2.000

The following selected information is taken from the records of Good Repair Services for the year 2018: Accounts payable Accounts receivable Advertising expense Cash Supplies expense Rent expense P 35,000 65,000 20,000 19,500 46,000 10,000 2.000

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter3: Journalizing Transactions

Section: Chapter Questions

Problem 3AP

Related questions

Question

Transcribed Image Text:0,000

000

000

ment

ng it

al of

ated

h of

two

2

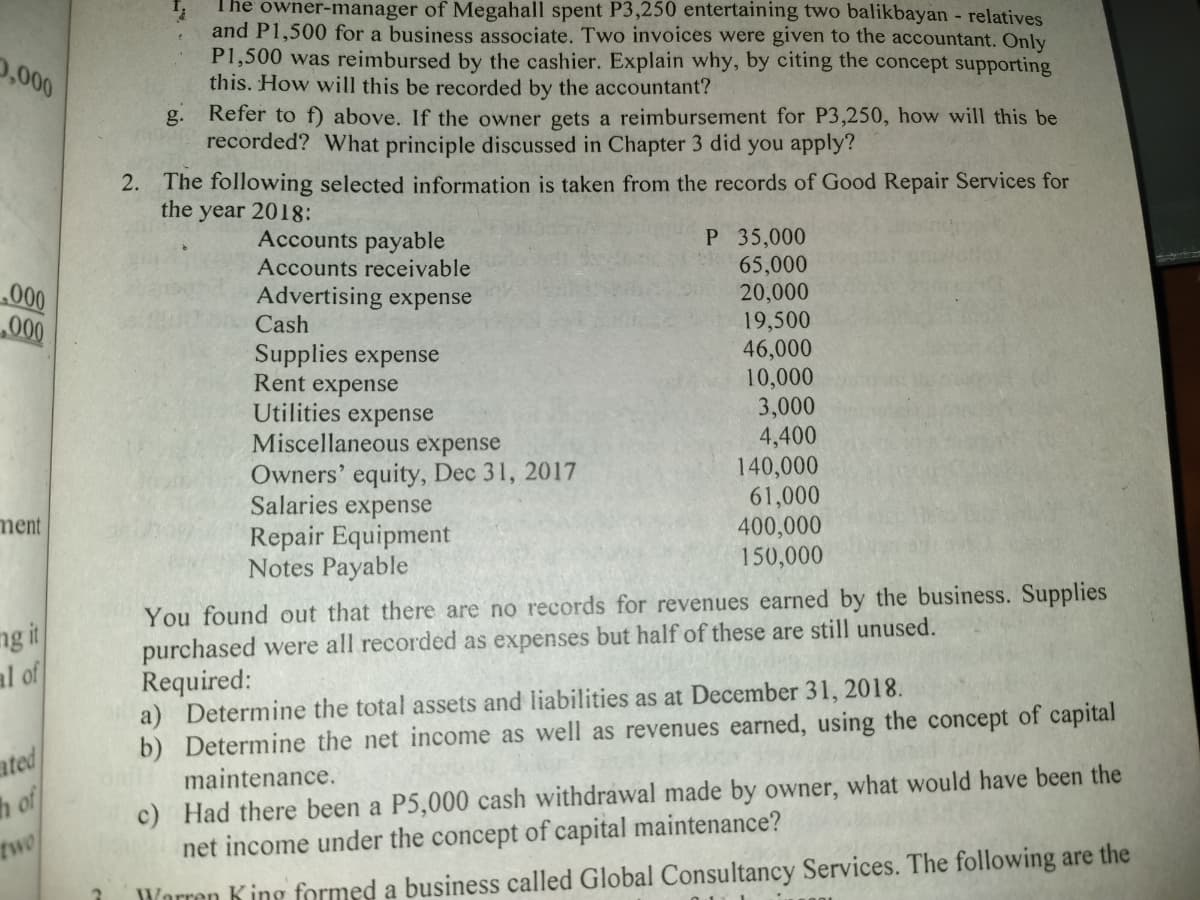

The owner-manager of Megahall spent P3,250 entertaining two balikbayan - relatives

and P1,500 for a business associate. Two invoices were given to the accountant. Only

P1,500 was reimbursed by the cashier. Explain why, by citing the concept supporting

this. How will this be recorded by the accountant?

g. Refer to f) above. If the owner gets a reimbursement for P3,250, how will this be

recorded? What principle discussed in Chapter 3 did you apply?

2. The following selected information is taken from the records of Good Repair Services for

the year 2018:

a)

b)

Accounts payable

Accounts receivable

Advertising expense

Cash

Supplies expense

Rent expense

Utilities expense

Miscellaneous expense

Owners' equity, Dec 31, 2017

Salaries expense

Repair Equipment

Notes Payable

P 35,000

65,000

20,000

19,500

46,000

10,000

3,000

4,400

140,000

61,000

400,000

150,000

You found out that there are no records for revenues earned by the business. Supplies

purchased were all recorded as expenses but half of these are still unused.

Required:

Determine the total assets and liabilities as at December 31, 2018.

Determine the net income as well as revenues earned, using the concept of capital

maintenance.

c) Had there been a P5,000 cash withdrawal made by owner, what would have been the

net income under the concept of capital maintenance?

Warren King formed a business called Global Consultancy Services. The following are the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,