The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: June 8. Wrote off account of Kathy Quantel, $8,440. Aug. 14. Received $3,000 as partial payment on the $12,500 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible. Oct. 16. Received the $8,440 from Kathy Quantel, whose account had been written off on June 8. Reinstated the account and recorded the cash receipt. Dec. 31. Wrote off the following accounts as uncollectible (record as one journal entry): Wade Dolan $4,600 3,600 7,150 Greg Gagne Amber Kisko Shannon Poole 2,975 6,630 Niki Spence 31. If necessary, record the year-end adjusting entry for uncollectible accounts. a. Journalize the transactions under the direct write-off method. b. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning credit balance of $36,000 on January 1 and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedule for its accounts receivable: Aging Class (Number of Days Past Due) Receivables Balance on December 31 Estimated Percent of Uncollectible Accounts 0-30 days 31-60 days 61-90 days 91-120 days More than 120 days Total receivables $320,000 110,000 24,000 18,000 43.000 $515,000 1% 10 33 75 (Continued) How much higher (lower) would Rustic Tables' net income have been under C. the direct write-off method than under the allowance method?

The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: June 8. Wrote off account of Kathy Quantel, $8,440. Aug. 14. Received $3,000 as partial payment on the $12,500 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible. Oct. 16. Received the $8,440 from Kathy Quantel, whose account had been written off on June 8. Reinstated the account and recorded the cash receipt. Dec. 31. Wrote off the following accounts as uncollectible (record as one journal entry): Wade Dolan $4,600 3,600 7,150 Greg Gagne Amber Kisko Shannon Poole 2,975 6,630 Niki Spence 31. If necessary, record the year-end adjusting entry for uncollectible accounts. a. Journalize the transactions under the direct write-off method. b. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning credit balance of $36,000 on January 1 and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedule for its accounts receivable: Aging Class (Number of Days Past Due) Receivables Balance on December 31 Estimated Percent of Uncollectible Accounts 0-30 days 31-60 days 61-90 days 91-120 days More than 120 days Total receivables $320,000 110,000 24,000 18,000 43.000 $515,000 1% 10 33 75 (Continued) How much higher (lower) would Rustic Tables' net income have been under C. the direct write-off method than under the allowance method?

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter2: T Accounts, Debits And Credits, Trial Balance, And Financial Statements

Section: Chapter Questions

Problem 4PB: On July 1, K. Resser opened Ressers Business Services. Ressers accountant listed the following chart...

Related questions

Question

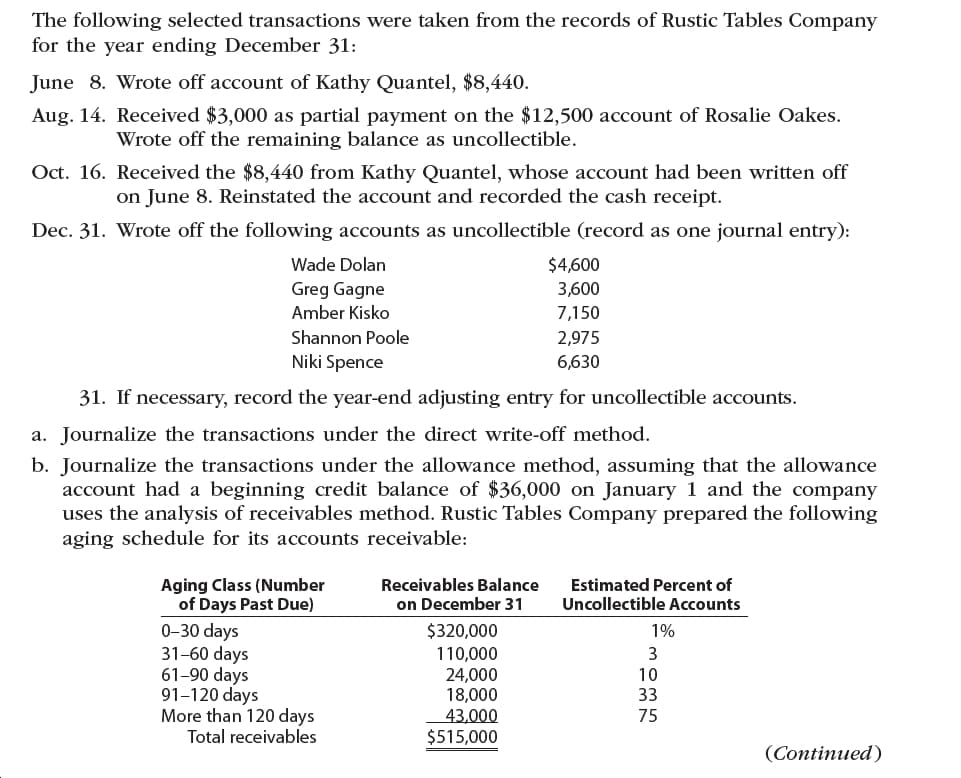

Transcribed Image Text:The following selected transactions were taken from the records of Rustic Tables Company

for the year ending December 31:

June 8. Wrote off account of Kathy Quantel, $8,440.

Aug. 14. Received $3,000 as partial payment on the $12,500 account of Rosalie Oakes.

Wrote off the remaining balance as uncollectible.

Oct. 16. Received the $8,440 from Kathy Quantel, whose account had been written off

on June 8. Reinstated the account and recorded the cash receipt.

Dec. 31. Wrote off the following accounts as uncollectible (record as one journal entry):

Wade Dolan

$4,600

3,600

7,150

Greg Gagne

Amber Kisko

Shannon Poole

2,975

6,630

Niki Spence

31. If necessary, record the year-end adjusting entry for uncollectible accounts.

a. Journalize the transactions under the direct write-off method.

b. Journalize the transactions under the allowance method, assuming that the allowance

account had a beginning credit balance of $36,000 on January 1 and the company

uses the analysis of receivables method. Rustic Tables Company prepared the following

aging schedule for its accounts receivable:

Aging Class (Number

of Days Past Due)

Receivables Balance

on December 31

Estimated Percent of

Uncollectible Accounts

0-30 days

31-60 days

61-90 days

91-120 days

More than 120 days

Total receivables

$320,000

110,000

24,000

18,000

43.000

$515,000

1%

10

33

75

(Continued)

Transcribed Image Text:How much higher (lower) would Rustic Tables' net income have been under

C.

the direct write-off method than under the allowance method?

Expert Solution

Trending now

This is a popular solution!

Step by step

Solved in 9 steps with 7 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning