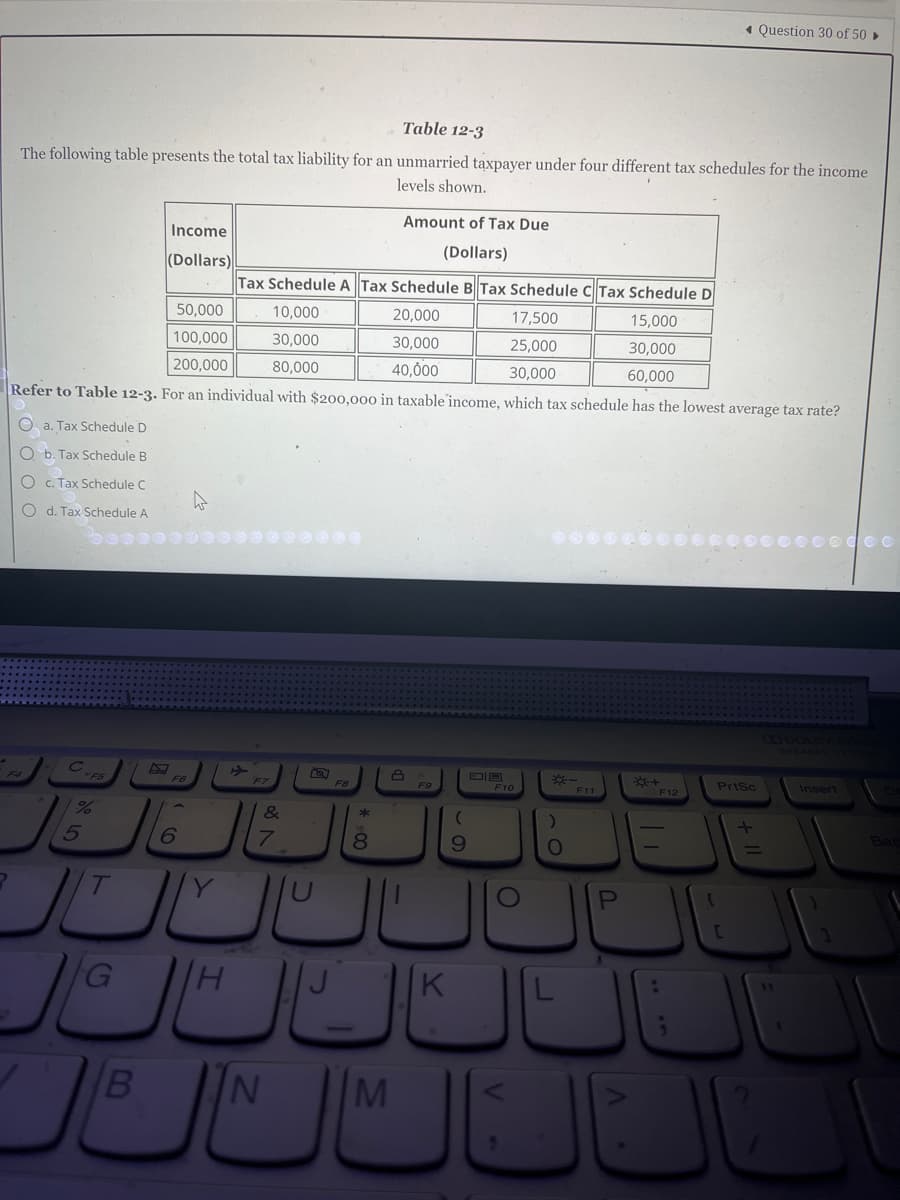

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown. Income (Dollars) a. Tax Schedule D O b. Tax Schedule B O c. Tax Schedule C O d. Tax Schedule A Amount of Tax Due (Dollars) Tax Schedule A Tax Schedule B Tax Schedule C Tax Schedule D 50,000 10,000 20,000 17,500 15,000 100,000 30,000 30,000 25,000 30,000 200,000 80,000 40,000 30,000 60,000 Refer to Table 12-3. For an individual with $200,000 in taxable income, which tax schedule has the lowest average tax rate?

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown. Income (Dollars) a. Tax Schedule D O b. Tax Schedule B O c. Tax Schedule C O d. Tax Schedule A Amount of Tax Due (Dollars) Tax Schedule A Tax Schedule B Tax Schedule C Tax Schedule D 50,000 10,000 20,000 17,500 15,000 100,000 30,000 30,000 25,000 30,000 200,000 80,000 40,000 30,000 60,000 Refer to Table 12-3. For an individual with $200,000 in taxable income, which tax schedule has the lowest average tax rate?

Chapter3: Economic Decision Makers

Section: Chapter Questions

Problem 3.10P

Related questions

Question

Transcribed Image Text:Table 12-3

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income

levels shown.

Income

(Dollars)

S

50,000

20,000

10,000

30,000

100,000

30,000

200,000

80,000

40,000

Refer to Table 12-3. For an individual with $200,000 in taxable income, which tax schedule has the lowest average tax rate?

Oa. Tax Schedule D

O b. Tax Schedule B

O c. Tax Schedule C

O d. Tax Schedule A

с

%

JE JE

5

6

JUL

G

Ін

B

Tax Schedule A Tax Schedule B Tax Schedule C Tax Schedule D

17,500

15,000

25,000

30,000

30,000

60,000

&

7

IN

FB

U

Amount of Tax Due

(Dollars)

*

8

Ĉ

UL

JO

K

(

9

O

*-

)

O

F11

P

+

F12

11

:

M

JUJU

Question 30 of 50

PrtSc

[

Insert LO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning