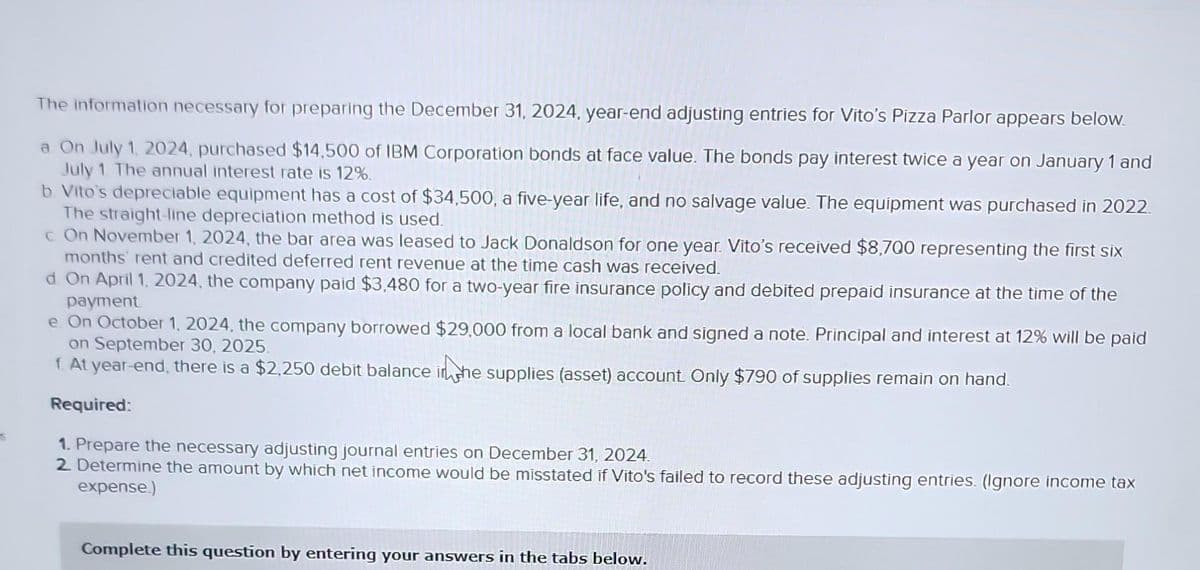

The information necessary for preparing the December 31, 2024, year-end adjusting entries for Vito's Pizza Parlor appears below. a On July 1, 2024, purchased $14,500 of IBM Corporation bonds at face value. The bonds pay interest twice a year on January 1 and July 1 The annual interest rate is 12%. b. Vito's depreciable equipment has a cost of $34,500, a five-year life, and no salvage value. The equipment was purchased in 2022 The straight-line depreciation method is used. c. On November 1, 2024, the bar area was leased to Jack Donaldson for one year. Vito's received $8,700 representing the first six months rent and credited deferred rent revenue at the time cash was received. d. On April 1, 2024, the company paid $3,480 for a two-year fire insurance policy and debited prepaid insurance at the time of the payment e On October 1, 2024, the company borrowed $29,000 from a local bank and signed a note. Principal and interest at 12% will be paid on September 30, 2025. 1. At year-end, there is a $2,250 debit balance in the supplies (asset) account. Only $790 of supplies remain on hand. Required: 1. Prepare the necessary adjusting journal entries on December 31, 2024. 2. Determine the amount by which net income would be misstated if Vito's failed to record these adjusting entries. (Ignore income tax expense.)

The information necessary for preparing the December 31, 2024, year-end adjusting entries for Vito's Pizza Parlor appears below. a On July 1, 2024, purchased $14,500 of IBM Corporation bonds at face value. The bonds pay interest twice a year on January 1 and July 1 The annual interest rate is 12%. b. Vito's depreciable equipment has a cost of $34,500, a five-year life, and no salvage value. The equipment was purchased in 2022 The straight-line depreciation method is used. c. On November 1, 2024, the bar area was leased to Jack Donaldson for one year. Vito's received $8,700 representing the first six months rent and credited deferred rent revenue at the time cash was received. d. On April 1, 2024, the company paid $3,480 for a two-year fire insurance policy and debited prepaid insurance at the time of the payment e On October 1, 2024, the company borrowed $29,000 from a local bank and signed a note. Principal and interest at 12% will be paid on September 30, 2025. 1. At year-end, there is a $2,250 debit balance in the supplies (asset) account. Only $790 of supplies remain on hand. Required: 1. Prepare the necessary adjusting journal entries on December 31, 2024. 2. Determine the amount by which net income would be misstated if Vito's failed to record these adjusting entries. (Ignore income tax expense.)

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.1P: Adjusting Entries Kretz Corporation prepares monthly financial statements and therefore adjusts its...

Related questions

Question

Transcribed Image Text:S

The information necessary for preparing the December 31, 2024, year-end adjusting entries for Vito's Pizza Parlor appears below.

a. On July 1, 2024, purchased $14,500 of IBM Corporation bonds at face value. The bonds pay interest twice a year on January 1 and

July 1. The annual interest rate is 12%.

b. Vito's depreciable equipment has a cost of $34,500, a five-year life, and no salvage value. The equipment was purchased in 2022.

The straight-line depreciation method is used.

c On November 1, 2024, the bar area was leased to Jack Donaldson for one year. Vito's received $8,700 representing the first six

months' rent and credited deferred rent revenue at the time cash was received.

d. On April 1, 2024, the company paid $3,480 for a two-year fire insurance policy and debited prepaid insurance at the time of the

payment

e On October 1, 2024, the company borrowed $29,000 from a local bank and signed a note. Principal and interest at 12% will be paid

on September 30, 2025.

f. At year-end, there is a $2,250 debit balance in the supplies (asset) account. Only $790 of supplies remain on hand.

Required:

1. Prepare the necessary adjusting journal entries on December 31, 2024.

2. Determine the amount by which net income would be misstated if Vito's failed to record these adjusting entries. (Ignore income tax

expense.)

Complete this question by entering your answers in the tabs below.

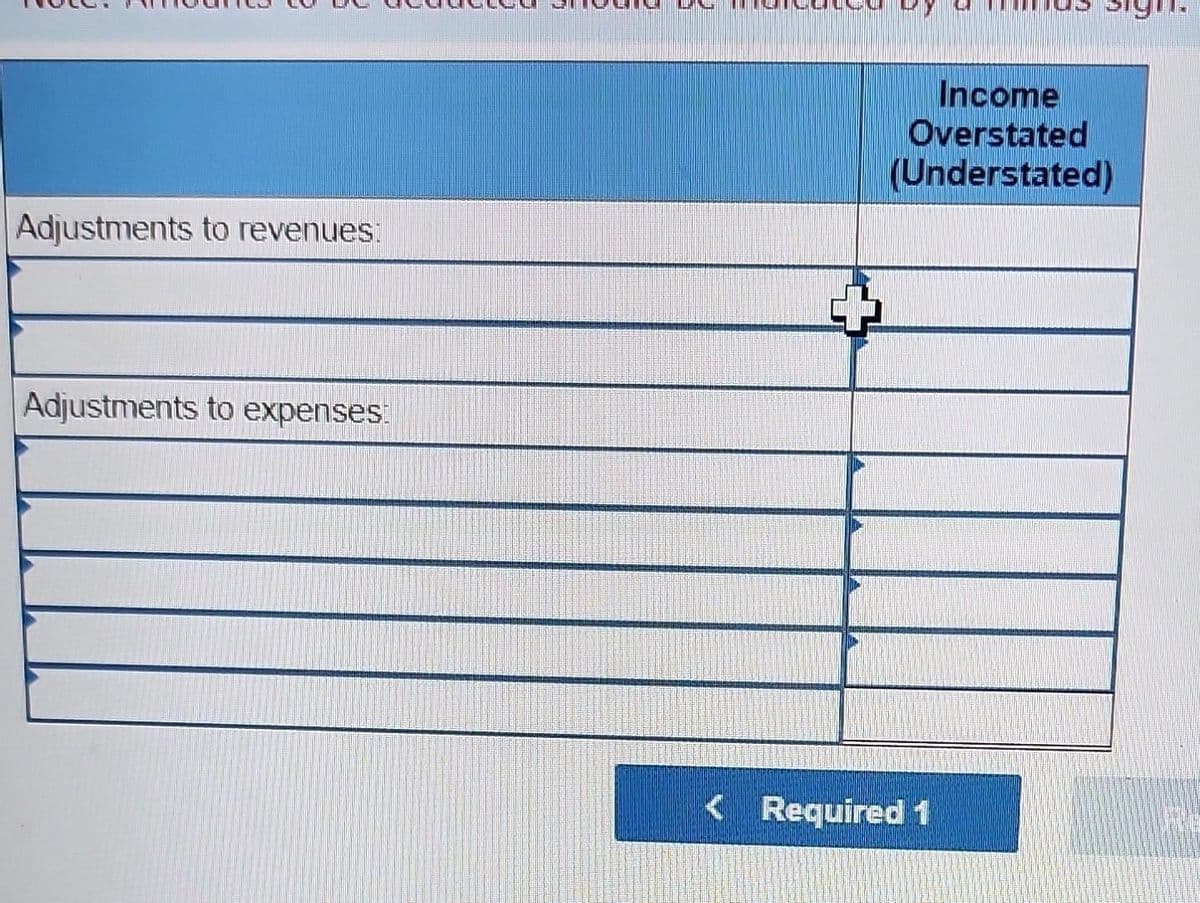

Transcribed Image Text:Adjustments to revenues:

Adjustments to expenses:

siguta

Income

Overstated

(Understated)

< Required 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning