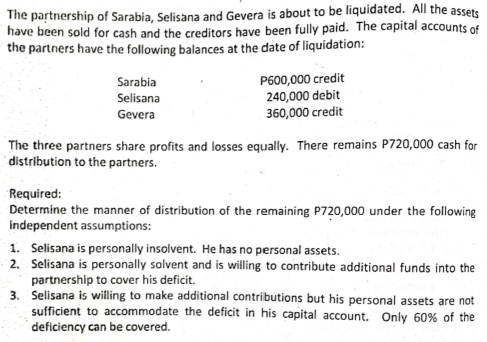

The partnership of Sarabia, Selisana and Gevera is about to be liquidated. All the assets have been sold for cash and the creditors have been fully paid. The capital accounts of the partners have the following balances at the date of liquidation: P600,000 credit 240,000 debit 360,000 credit Sarabia Selisana Gevera The three partners share profits and losses equally. There remains P720,000 cash for distribution to the partners. Required: Determine the manner of distribution of the remaining P720,000 under the following independent assumptions: 1. Selisana is personally insolvent. He has no personal assets. 2. Selisana is personally solvent and is willing to contribute additional funds into the partnership to cover his deficit. 3. Selisana is willing to make additional contributions but his personal assets are not sufficient to accommodate the deficit in his capital acount. Only 60% of the deficiency can be covered.

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Final Cash Distribution to Partners

Step by step

Solved in 2 steps