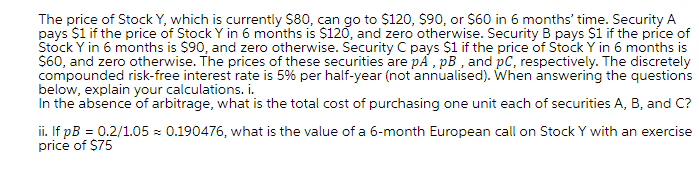

The price of Stock Y, which is currently $80, can go to $120, $90, or $60 in 6 months’ time. Security A pays $1 if the price of Stock Y in 6 months is $120, and zero otherwise. Security B pays $1 if the price of Stock Y in 6 months is $90, and zero otherwise. Security C pays $1 if the price of Stock Y in 6 months is $60, and zero otherwise. The prices of these securities are ??, ??, and ??, respectively. The discretely compounded risk-free interest rate is 5% per half-year (not annualized). When answering the questions below, explain your calculations. i. In the absence of arbitrage, what is the total cost of purchasing one unit each of securities A, B, and C? ii. If ?? = 0.2/1.05 ≈ 0.190476, what is the value of a 6-month European call on Stock Y with an exercise price of $75

The price of Stock Y, which is currently $80, can go to $120, $90, or $60 in 6 months’ time. Security A pays $1 if the price of Stock Y in 6 months is $120, and zero otherwise. Security B pays $1 if the price of Stock Y in 6 months is $90, and zero otherwise. Security C pays $1 if the price of Stock Y in 6 months is $60, and zero otherwise. The prices of these securities are ??, ??, and ??, respectively. The discretely compounded risk-free interest rate is 5% per half-year (not annualized). When answering the questions below, explain your calculations. i. In the absence of arbitrage, what is the total cost of purchasing one unit each of securities A, B, and C? ii. If ?? = 0.2/1.05 ≈ 0.190476, what is the value of a 6-month European call on Stock Y with an exercise price of $75

Step by step

Solved in 4 steps with 2 images