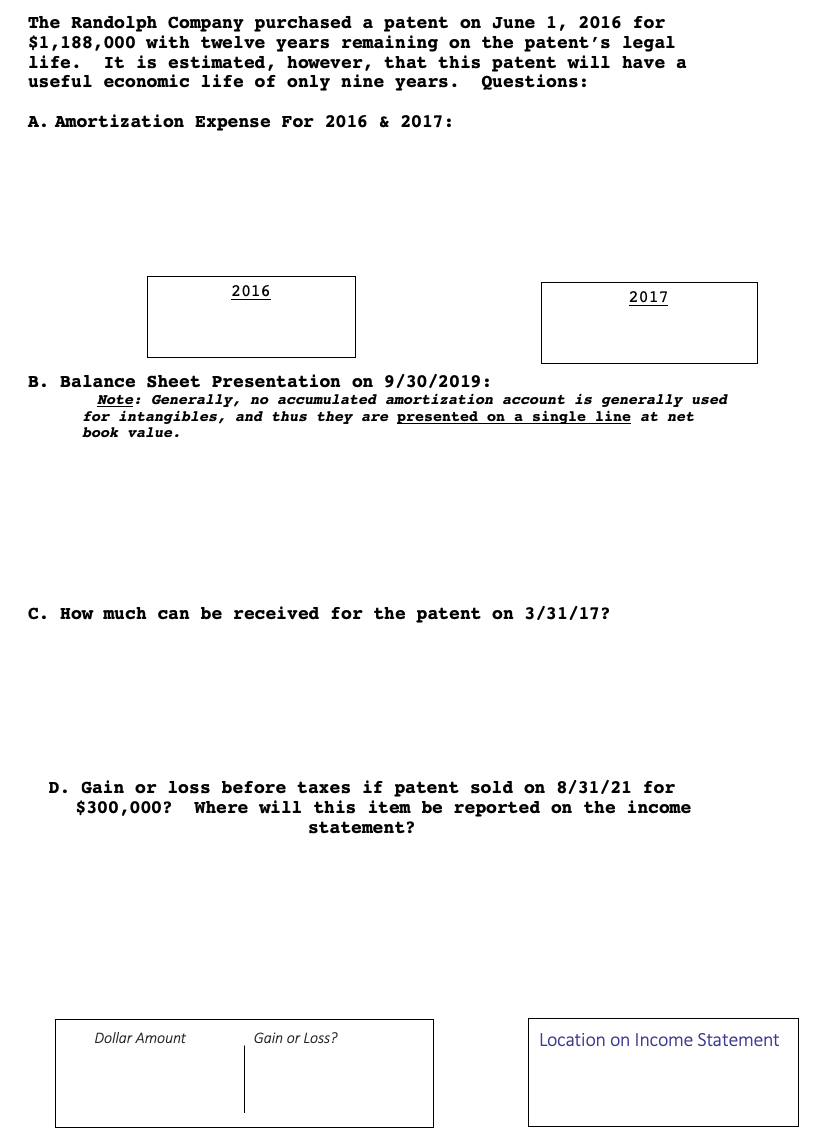

The Randolph Company purchased a patent on June 1, 2016 for $1,188,000 with twelve years remaining on the patent's legal life. useful economic life of only nine years. It is estimated, however, that this patent will have a Questions: A. Amortization Expense For 2016 & 2017: 2016 2017 B. Balance Sheet Presentation on 9/30/2019: Note: Generally, no accumulated amortization account is generally used for intangibles, and thus they are presented on a single line at net book value. c. How much can be received for the patent on 3/31/17? D. Gain or loss before taxes if patent sold on 8/31/21 for $300,000? Where will this item be reported on the income statement? Dollar Amount Gain or Loss? Location on lncome Statement

The Randolph Company purchased a patent on June 1, 2016 for $1,188,000 with twelve years remaining on the patent's legal life. useful economic life of only nine years. It is estimated, however, that this patent will have a Questions: A. Amortization Expense For 2016 & 2017: 2016 2017 B. Balance Sheet Presentation on 9/30/2019: Note: Generally, no accumulated amortization account is generally used for intangibles, and thus they are presented on a single line at net book value. c. How much can be received for the patent on 3/31/17? D. Gain or loss before taxes if patent sold on 8/31/21 for $300,000? Where will this item be reported on the income statement? Dollar Amount Gain or Loss? Location on lncome Statement

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 11E: On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated...

Related questions

Question

Transcribed Image Text:The Randolph Company purchased a patent on June 1, 2016 for

$1,188,000 with twelve years remaining on the patent's legal

life.

useful economic life of only nine years.

It is estimated, however, that this patent will have a

Questions:

A. Amortization Expense For 2016 & 2017:

2016

2017

B. Balance Sheet Presentation on 9/30/2019:

Note: Generally, no accumulated amortization account is generally used

for intangibles, and thus they are presented on a single line at net

book value.

C. How much can be received for the patent on 3/31/17?

D. Gain or loss before taxes if patent sold on 8/31/21 for

$300,000?

Where will this item be reported on the income

statement?

Dollar Amount

Gain or Loss?

Location on Income Statement

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning