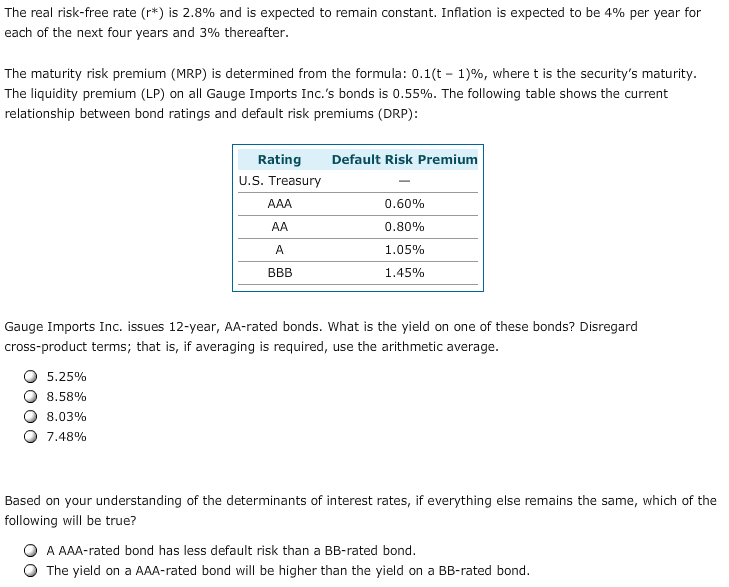

The real risk-free rate (r*) is 2.8% and is expected to remain constant. Inflation is expected to be 4% per year for each of the next four years and 3% thereafter. The maturity risk premium (MRP) is determined from the formula: 0.1(t - 1)%, where t is the security's maturity. The liquidity premium (LP) on all Gauge Imports Inc.'s bonds is 0.55%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Rating Default Risk Premium U.S. Treasury AAA 0.60% AA. 0.80% 1.05% A. ВB 1.45% Gauge Imports Inc. issues 12-year, AA-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. 5.25% 8.58% 8.03% 7.48% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? A AAA-rated bond has less default risk than a BB-rated bond. The yield on a AAA-rated bond will be higher than the yield on a BB-rated bond

The real risk-free rate (r*) is 2.8% and is expected to remain constant. Inflation is expected to be 4% per year for each of the next four years and 3% thereafter. The maturity risk premium (MRP) is determined from the formula: 0.1(t - 1)%, where t is the security's maturity. The liquidity premium (LP) on all Gauge Imports Inc.'s bonds is 0.55%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Rating Default Risk Premium U.S. Treasury AAA 0.60% AA. 0.80% 1.05% A. ВB 1.45% Gauge Imports Inc. issues 12-year, AA-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. 5.25% 8.58% 8.03% 7.48% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? A AAA-rated bond has less default risk than a BB-rated bond. The yield on a AAA-rated bond will be higher than the yield on a BB-rated bond

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 10P

Related questions

Question

Transcribed Image Text:The real risk-free rate (r*) is 2.8% and is expected to remain constant. Inflation is expected to be 4% per year for

each of the next four years and 3% thereafter.

The maturity risk premium (MRP) is determined from the formula: 0.1(t - 1)%, where t is the security's maturity.

The liquidity premium (LP) on all Gauge Imports Inc.'s bonds is 0.55%. The following table shows the current

relationship between bond ratings and default risk premiums (DRP):

Rating

Default Risk Premium

U.S. Treasury

AAA

0.60%

AA.

0.80%

1.05%

A.

ВB

1.45%

Gauge Imports Inc. issues 12-year, AA-rated bonds. What is the yield on one of these bonds? Disregard

cross-product terms; that is, if averaging is required, use the arithmetic average.

5.25%

8.58%

8.03%

7.48%

Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the

following will be true?

A AAA-rated bond has less default risk than a BB-rated bond.

The yield on a AAA-rated bond will be higher than the yield on a BB-rated bond

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning