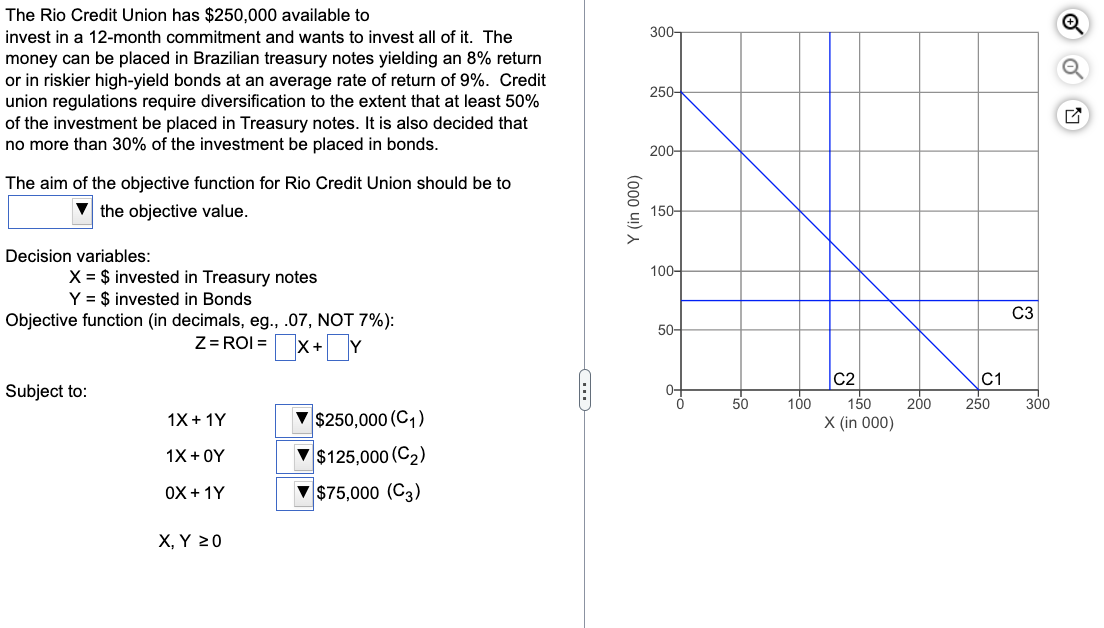

The Rio Credit Union has $250,000 available to invest in a 12-month commitment and wants to invest all of it. The money can be placed in Brazilian treasury notes yielding an 8% return or in riskier high-yield bonds at an average rate of return of 9%. Credit union regulations require diversification to the extent that at least 50% of the investment be placed in Treasury notes. It is also decided that no more than 30% of the investment be placed in bonds. The aim of the objective function for Rio Credit Union should be to the objective value. Decision variables: X = $ invested in Treasury notes Y = $ invested in Bonds Objective function (in decimals, eg., .07, NOT 7%): Z=ROI=X+Y Subject to: 1X+1Y 1X+0Y OX+1Y X, Y 20 ▼$250,000 (C₁) ▼$125,000 (C₂) $75,000 (C3) CD Y (in 000) 300- 250- 200- 150- 100- 50- 50 100 C2 150 X (in 000) 200 C1 250 C3 300 Q

The Rio Credit Union has $250,000 available to invest in a 12-month commitment and wants to invest all of it. The money can be placed in Brazilian treasury notes yielding an 8% return or in riskier high-yield bonds at an average rate of return of 9%. Credit union regulations require diversification to the extent that at least 50% of the investment be placed in Treasury notes. It is also decided that no more than 30% of the investment be placed in bonds. The aim of the objective function for Rio Credit Union should be to the objective value. Decision variables: X = $ invested in Treasury notes Y = $ invested in Bonds Objective function (in decimals, eg., .07, NOT 7%): Z=ROI=X+Y Subject to: 1X+1Y 1X+0Y OX+1Y X, Y 20 ▼$250,000 (C₁) ▼$125,000 (C₂) $75,000 (C3) CD Y (in 000) 300- 250- 200- 150- 100- 50- 50 100 C2 150 X (in 000) 200 C1 250 C3 300 Q

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter9: Decision Making Under Uncertainty

Section: Chapter Questions

Problem 34P

Related questions

Question

Transcribed Image Text:The Rio Credit Union has $250,000 available to

invest in a 12-month commitment and wants to invest all of it. The

money can be placed in Brazilian treasury notes yielding an 8% return

or in riskier high-yield bonds at an average rate of return of 9%. Credit

union regulations require diversification to the extent that at least 50%

of the investment be placed in Treasury notes. It is also decided that

no more than 30% of the investment be placed in bonds.

The aim of the objective function for Rio Credit Union should be to

the objective value.

Decision variables:

X = $ invested in Treasury notes

Y = $ invested in Bonds

Objective function (in decimals, eg., .07, NOT 7%):

Z=ROI =

X+ Y

Subject to:

1X + 1Y

1X + OY

OX + 1Y

X, Y 20

$250,000 (C₁)

▼$125,000 (C₂)

▼$75,000 (C3)

CD

Y (in 000)

300-

250-

200-

150-

100-

50-

50

100

C2

150

X (in 000)

200

C1

250

C3

300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,