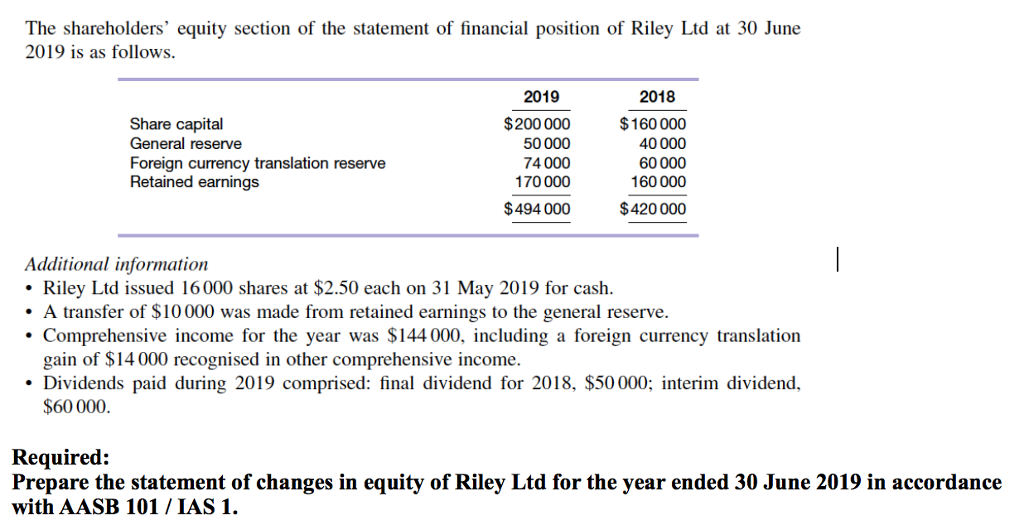

The shareholders' equity section of the statement of financial position of Riley Ltd at 30 June 2019 is as follows Share capital General reserve Foreign currency translation reserve Retained earnings 2019 $200000 50000 74000 170000 $494000 2018 $160 000 40000 60000 160000 $420 000 Additional information Riley Ltd issued 16000 shares at $2.50 each on 31 May 2019 for cash A transfer of $10000 was made from retained earnings to the general reserve. Comprehensive income for the year was $144 000, including a foreign currency translation gain of $14 000 recognised in other comprehensive income. Dividends paid during 2019 comprised: final dividend for 2018, $50 000; interim dividend, $60 000 Required: Prepare the statement of changes in equity of Riley Ltd for the year ended 30 June 2019 in accordance with AASB 101 IAS 1.

The shareholders' equity section of the statement of financial position of Riley Ltd at 30 June 2019 is as follows Share capital General reserve Foreign currency translation reserve Retained earnings 2019 $200000 50000 74000 170000 $494000 2018 $160 000 40000 60000 160000 $420 000 Additional information Riley Ltd issued 16000 shares at $2.50 each on 31 May 2019 for cash A transfer of $10000 was made from retained earnings to the general reserve. Comprehensive income for the year was $144 000, including a foreign currency translation gain of $14 000 recognised in other comprehensive income. Dividends paid during 2019 comprised: final dividend for 2018, $50 000; interim dividend, $60 000 Required: Prepare the statement of changes in equity of Riley Ltd for the year ended 30 June 2019 in accordance with AASB 101 IAS 1.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 80E: Stockholders' Equity Terminology A list of terms and a list of definitions or examples are presented...

Related questions

Question

Transcribed Image Text:The shareholders' equity section of the statement of financial position of Riley Ltd at 30 June

2019 is as follows

Share capital

General reserve

Foreign currency translation reserve

Retained earnings

2019

$200000

50000

74000

170000

$494000

2018

$160 000

40000

60000

160000

$420 000

Additional information

Riley Ltd issued 16000 shares at $2.50 each on 31 May 2019 for cash

A transfer of $10000 was made from retained earnings to the general reserve.

Comprehensive income for the year was $144 000, including a foreign currency translation

gain of $14 000 recognised in other comprehensive income.

Dividends paid during 2019 comprised: final dividend for 2018, $50 000; interim dividend,

$60 000

Required:

Prepare the statement of changes in equity of Riley Ltd for the year ended 30 June 2019 in accordance

with AASB 101 IAS 1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning