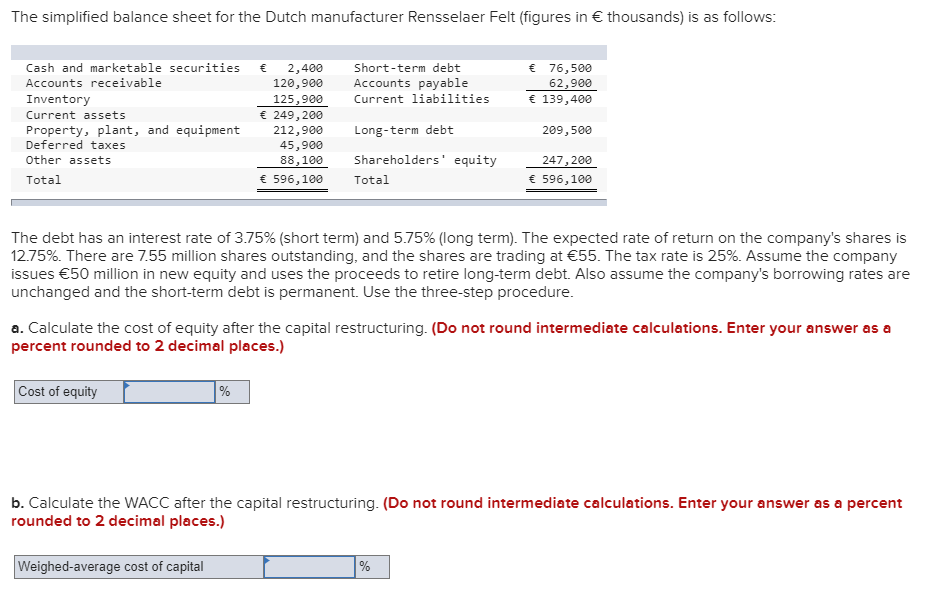

The simplified balance sheet for the Dutch manufacturer Rensselaer Felt (figures in € thousands) is as follows: € 76,500 Cash and marketable securities Short-term debt € 2,400 120,900 Accounts payable Accounts receivable 62,900 € 139,400 Current liabilities Inventory 125,900 € 249, 200 Current assets Property, plant, and equipment Deferred taxes 212,900 45,900 88,100 Long-term debt 209,500 Shareholders' equity Other assets 247, 200 € 596,100 € 596,100 Total Total The debt has an interest rate of 3.75% (short term) and 5.75% (long term). The expected rate of return on the company's shares is 12.75%. There are 7.55 million shares outstanding, and the shares are trading at €55. The tax rate is 25%. Assume the company issues €50 million in new equity and uses the proceeds to retire long-term debt. Also assume the company's borrowing rates are unchanged and the short-term debt is permanent. Use the three-step procedure. a. Calculate the cost of equity after the capital restructuring. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Cost of equity b. Calculate the WACC after the capital restructuring. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Weighed-average cost of capital

The simplified balance sheet for the Dutch manufacturer Rensselaer Felt (figures in € thousands) is as follows: € 76,500 Cash and marketable securities Short-term debt € 2,400 120,900 Accounts payable Accounts receivable 62,900 € 139,400 Current liabilities Inventory 125,900 € 249, 200 Current assets Property, plant, and equipment Deferred taxes 212,900 45,900 88,100 Long-term debt 209,500 Shareholders' equity Other assets 247, 200 € 596,100 € 596,100 Total Total The debt has an interest rate of 3.75% (short term) and 5.75% (long term). The expected rate of return on the company's shares is 12.75%. There are 7.55 million shares outstanding, and the shares are trading at €55. The tax rate is 25%. Assume the company issues €50 million in new equity and uses the proceeds to retire long-term debt. Also assume the company's borrowing rates are unchanged and the short-term debt is permanent. Use the three-step procedure. a. Calculate the cost of equity after the capital restructuring. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Cost of equity b. Calculate the WACC after the capital restructuring. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Weighed-average cost of capital

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 27P

Related questions

Question

Transcribed Image Text:The simplified balance sheet for the Dutch manufacturer Rensselaer Felt (figures in € thousands) is as follows:

€ 76,500

Cash and marketable securities

Short-term debt

€

2,400

120,900

Accounts payable

Accounts receivable

62,900

€ 139,400

Current liabilities

Inventory

125,900

€ 249, 200

Current assets

Property, plant, and equipment

Deferred taxes

212,900

45,900

88,100

Long-term debt

209,500

Shareholders' equity

Other assets

247, 200

€ 596,100

€ 596,100

Total

Total

The debt has an interest rate of 3.75% (short term) and 5.75% (long term). The expected rate of return on the company's shares is

12.75%. There are 7.55 million shares outstanding, and the shares are trading at €55. The tax rate is 25%. Assume the company

issues €50 million in new equity and uses the proceeds to retire long-term debt. Also assume the company's borrowing rates are

unchanged and the short-term debt is permanent. Use the three-step procedure.

a. Calculate the cost of equity after the capital restructuring. (Do not round intermediate calculations. Enter your answer as a

percent rounded to 2 decimal places.)

Cost of equity

b. Calculate the WACC after the capital restructuring. (Do not round intermediate calculations. Enter your answer as a percent

rounded to 2 decimal places.)

Weighed-average cost of capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning