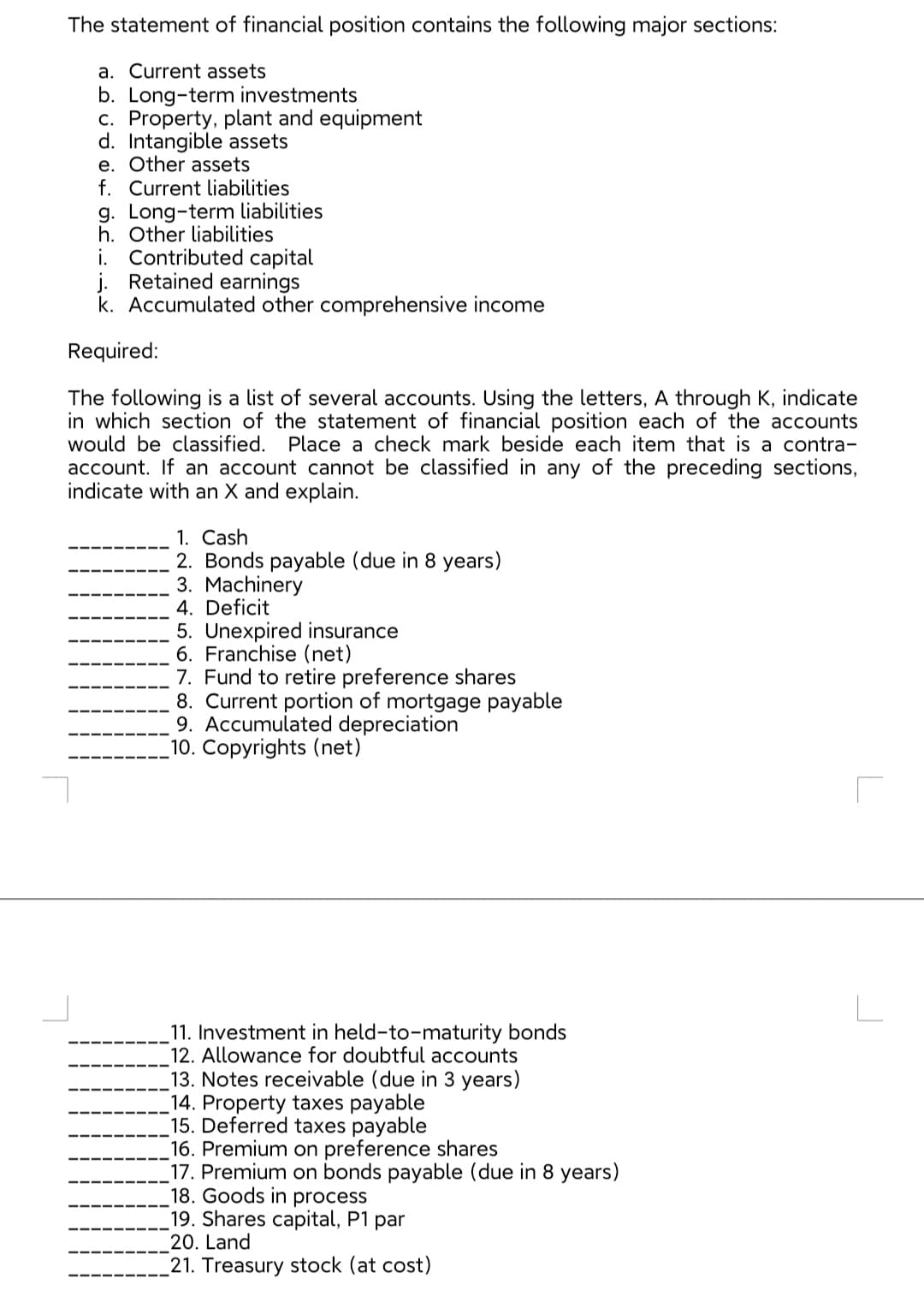

The statement of financial position contains the following major sections: a. Current assets b. Long-term investments c. Property, plant and equipment d. Intangible assets e. Other assets f. Current liabilities g. Long-term liabilities h. Other liabilities i. Contributed capital j. Retained earnings k. Accumulated other comprehensive income Required: The following is a list of several in which section of the statement of financial position each of the accounts would be classified. account. If an account cannot be classified in any of the preceding sections, indicate with an X and explain. unts. Using the letters, A through indicate Place a check mark beside each item that is a contra- 1. Cash 2. Bonds payable (due in 8 years) 3. Machinery 4. Deficit 5. Unexpired insurance 6. Franchise (net) 7. Fund to retire preference shares 8. Current portion of mortgage payable 9. Accumulated depreciation 10. Copyrights (net) 11. Investment in held-to-maturity bonds 12. Allowance for doubtful accounts 13. Notes receivable (due in 3 years) 14. Property taxes payable 15. Deferred taxes payable 16. Premium on preference shares 17. Premium on bonds payable (due in 8 years) 18. Goods in process 19. Shares capital, P1 par 20. Land 21. Treasury stock (at cost)

The statement of financial position contains the following major sections: a. Current assets b. Long-term investments c. Property, plant and equipment d. Intangible assets e. Other assets f. Current liabilities g. Long-term liabilities h. Other liabilities i. Contributed capital j. Retained earnings k. Accumulated other comprehensive income Required: The following is a list of several in which section of the statement of financial position each of the accounts would be classified. account. If an account cannot be classified in any of the preceding sections, indicate with an X and explain. unts. Using the letters, A through indicate Place a check mark beside each item that is a contra- 1. Cash 2. Bonds payable (due in 8 years) 3. Machinery 4. Deficit 5. Unexpired insurance 6. Franchise (net) 7. Fund to retire preference shares 8. Current portion of mortgage payable 9. Accumulated depreciation 10. Copyrights (net) 11. Investment in held-to-maturity bonds 12. Allowance for doubtful accounts 13. Notes receivable (due in 3 years) 14. Property taxes payable 15. Deferred taxes payable 16. Premium on preference shares 17. Premium on bonds payable (due in 8 years) 18. Goods in process 19. Shares capital, P1 par 20. Land 21. Treasury stock (at cost)

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter4: Balance Sheet: Presenting And Analyzing Resources And Financing

Section: Chapter Questions

Problem 14E

Related questions

Question

following is a list of several accounts. Using the letters, A through K, indicate in which section of the

Transcribed Image Text:The statement of financial position contains the following major sections:

a. Current assets

b. Long-term investments

c. Property, plant and equipment

d. Intangible assets

e. Other assets

f. Current liabilities

g. Long-term liabilities

h. Other liabilities

i. Contributed capital

j. Retained earnings

k. Accumulated other comprehensive income

Required:

The following is a list of several accounts. Using the letters, A through K, indicate

in which section of the statement of financial position each of the accounts

would be classified. Place a check mark beside each item that is a contra-

account. If an account cannot be classified in any of the preceding sections,

indicate with an X and explain.

1. Cash

2. Bonds payable (due in 8 years)

3. Machinery

4. Deficit

5. Unexpired insurance

6. Franchise (net)

7. Fund to retire preference shares

8. Current portion of mortgage payable

9. Accumulated depreciation

10.

(net)

11. Investment in held-to-maturity bonds

12. Allowance for doubtful accounts

13. Notes receivable (due in 3 years)

_14. Property taxes payable

15. Deferred taxes payable

16. Premium on preference shares

17. Premium on bonds payable (due in 8 years)

18. Goods in process

19. Shares capital, P1 par

20. Land

21. Treasury stock (at cost)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub