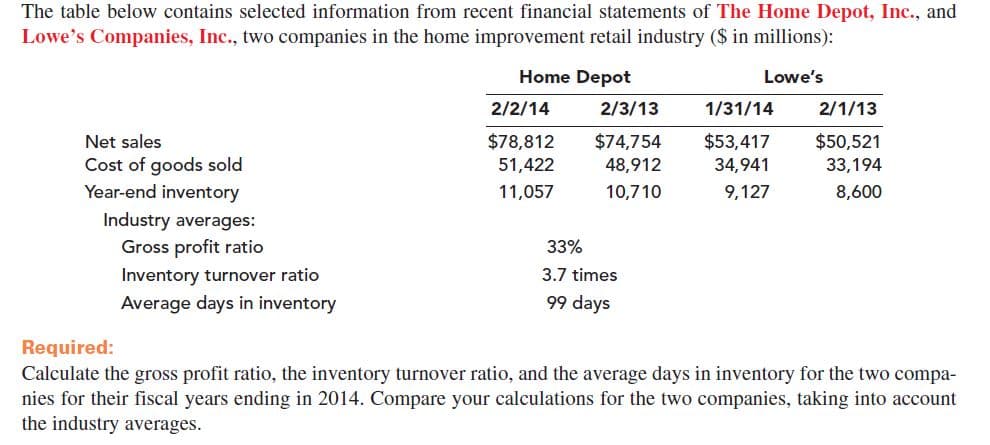

The table below contains selected information from recent financial statements of The Home Depot, Inc., and Lowe's Companies, Inc., two companies in the home improvement retail industry ($ in millions): Home Depot Lowe's 2/2/14 2/3/13 1/31/14 2/1/13 $78,812 $74,754 $53,417 $50,521 33,194 Net sales Cost of goods sold Year-end inventory 51,422 48,912 34,941 11,057 10,710 9,127 8,600 Industry averages: Gross profit ratio 33% Inventory turnover ratio 3.7 times 99 days Average days in inventory Required: Calculate the gross profit ratio, the inventory turnover ratio, and the average days in inventory for the two compa- nies for their fiscal years ending in 2014. Compare your calculations for the two companies, taking into account the industry averages.

The table below contains selected information from recent financial statements of The Home Depot, Inc., and Lowe's Companies, Inc., two companies in the home improvement retail industry ($ in millions): Home Depot Lowe's 2/2/14 2/3/13 1/31/14 2/1/13 $78,812 $74,754 $53,417 $50,521 33,194 Net sales Cost of goods sold Year-end inventory 51,422 48,912 34,941 11,057 10,710 9,127 8,600 Industry averages: Gross profit ratio 33% Inventory turnover ratio 3.7 times 99 days Average days in inventory Required: Calculate the gross profit ratio, the inventory turnover ratio, and the average days in inventory for the two compa- nies for their fiscal years ending in 2014. Compare your calculations for the two companies, taking into account the industry averages.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 56P: The following selected information is taken from the financial statements of Arnn Company for its...

Related questions

Question

Transcribed Image Text:The table below contains selected information from recent financial statements of The Home Depot, Inc., and

Lowe's Companies, Inc., two companies in the home improvement retail industry ($ in millions):

Home Depot

Lowe's

2/2/14

2/3/13

1/31/14

2/1/13

$78,812

$74,754

$53,417

$50,521

33,194

Net sales

Cost of goods sold

Year-end inventory

51,422

48,912

34,941

11,057

10,710

9,127

8,600

Industry averages:

Gross profit ratio

33%

Inventory turnover ratio

3.7 times

99 days

Average days in inventory

Required:

Calculate the gross profit ratio, the inventory turnover ratio, and the average days in inventory for the two compa-

nies for their fiscal years ending in 2014. Compare your calculations for the two companies, taking into account

the industry averages.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning