The total income since incorporation is P420,000. The total cash dividends paid is P130,000. The total value of property dividends distributed is P30,000. The excess of proceeds over cost of treasury shares sold is P110,000. In its December 31, 2021 statement of changes in equity, what amount should the f as accumulated profits (retained earnings)?

Q: Miami Heat Inc. began operations in January2017, and reported the following results for each of its…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: The following information was taken from the accounting records of Sa Gyung Joon Inc. for 2020.…

A: Cash flow from investing activities: It is a section of the cash flow statement that shows the cash…

Q: During the current year, XYZ Corporation had the following activities related to financial…

A: Cash flow from Financing activities includes the transactions relating to the loan/debt,…

Q: 1. Compute the change in Tucker’s shareholders’ equity during 2020. Change in Tucker’s shareholders’…

A: Shareholder's Equity + Liabilities = Total Assets

Q: Listed below are the transactions that affected the shareholders’ equity of Branch-Rickie…

A: Journal Entries for 2018: Date Account title and explanation Debit Credit Nov. 1, 2018 Dividend…

Q: AUBURN Corporation had 120,000 of ordinary shares issued and outstanding at January 1, 2021. On…

A: Formula: Basic earnings per share = Net income available to Ordinary shareholders / No. of Ordinary…

Q: The balance in the retained earnings of HAWKEYE Corporation on December 31, 2020 and 2021…

A: Ending retained earnings = Beginning retained earnings + Net income during the year - Stock dividend…

Q: On December 31, 2020, Loving Company showed shareholder’s equity of P5,000,000. The share capital of…

A: Retained Earnings is the left out earnings of the company that is not distributed among…

Q: The condensed balance sheet of C Company as of December 31, 2020 is shown below: On January 1,…

A: Business combination refers to the combination of transaction or event under which the investor…

Q: The balance in the retained earnings at December 31, 2019 and 2020 respectively are ₱720,000 and…

A: Cash dividends are the excess of profit that is distributed to the shareholders (owners) in the form…

Q: Listed below are the transactions that affected the shareholders’ equity of Branch-Rickie…

A: A stock dividend is the payment of dividend which is done in the form of shares rather than cash.…

Q: Listed below are the transactions that affected the shareholders’ equity of Branch-Rickie…

A: Stockholders’ equity is the measure of assets staying in a business after the sum total of the…

Q: At the beginning of 2020, Tucker Corporation had assets of $350,000 and liabilities of $175,000. At…

A: Assets = Liabilities + Shareholders' Equity

Q: Pineapple Co. reported total assets of P2,100,000 and total liabilities of P1,360,000 in its…

A: Stockholder's equity: It implies to the remaining value of net assets that are owned by the…

Q: At year end, National Corporation balance sheet showed total assets of P70,000,000, total…

A: Here, Total assets = P70,000,000 Total liabilities = P35,000,000 Total preferred share capital =…

Q: At the beginning of 2021, Sunland Company had retained earnings of $402000. During the year Sunland…

A: Retained earnings, ending balance = Retained earnings, beginning balance + Net Income - Cash…

Q: The shareholders' equity of McCoy Corp. revealed the following on June 30, 2017: · Preference…

A: Legal capital of the business par value of ordinary shares capital and preference share capital. It…

Q: 5. On January 1, 2021, MNO Company acquired 12,500 of the outstanding common shares of Esther…

A: The question is related Business Combination. The details are as under Stake of MNO Comapny in…

Q: On January 1, 2021, Wildhorse Corporation had 980,000 shares of common stock outstanding. On March…

A: Note: Assume that the accounting period of Company starts in January and ends in December of every…

Q: Miami Heat Inc. began operations in January2017, and reported the following results for each of its…

A: Cumulative preference shares have all of the perks of regular preference shares, including increased…

Q: The record of ABAKA Corporation, a closely-held corporation shows the following calendar years:…

A: The federal government imposes an accumulated earnings tax on businesses that have maintained…

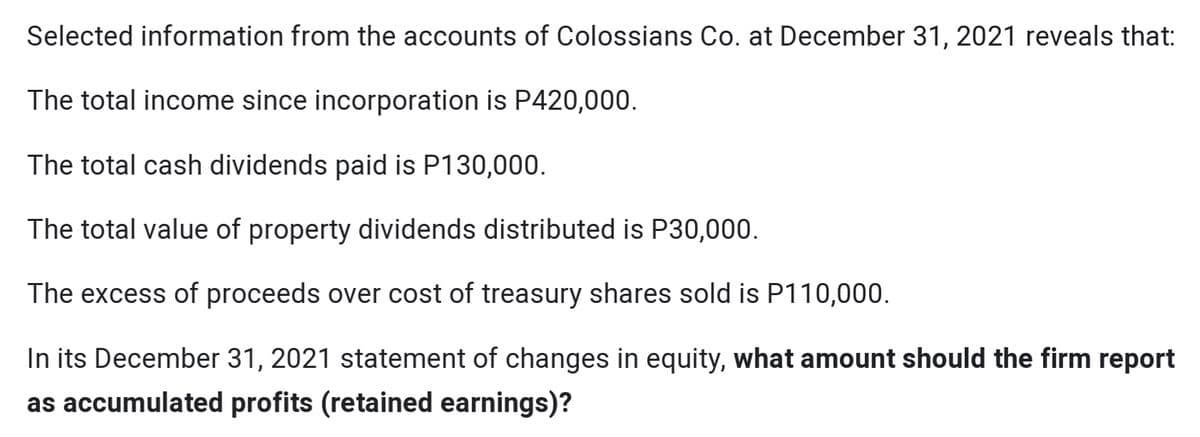

Q: Selected information from the accounts of Colossians Co. at December 31, 2021 reveals that the…

A: Statement of Changes in Equity: Equity is one of the elements of the accounting equation, where,…

Q: ST Corporation has a total shareholders' equity of P1,000,000, including retained earnings of…

A: Given, Balance in retained earnings = 175,000 Cash balance = 350,000

Q: On January 1, 2021, had 2, 000, 0000 ordinary shares outstanding. On July 1, 2021, the entity issued…

A: Diluted earnings per share refers to a company’s per-share profit based on the number of common…

Q: On January 1, 2020, Pangarap Nalang Company showed total assets of P5,000,000, total liabilities of…

A: Answer - Working Note : Calculation of Retained Earnings: Particulars Amount Amount Total…

Q: On January 1, 2021, Oriole Corporation had 1,020,000 shares of common stock outstanding. On March 1,…

A: Earnings per share (EPS) is calculated by dividing the net income earned by the Company by the…

Q: he retained earnings balance of the Corporation as of the end of the year shows:…

A: Answer: The retained earnings balance of the Corporation as of the end of the year shows:…

Q: On January 1, 2020, Blue Company’s board of directors declared a cash dividend of P6,000,000 to…

A: The regular dividend can be defined as the distribution of profits to the shareholders of the…

Q: Kiwi Company was incorporated on July 1, 2021, with P8,000,000 from the issuance of shares and…

A: This question deals with the calculation of total asset that company should report. As per balance…

Q: The JHONG Corporation had the following balances in its Shareholders’ Equity accounts as of December…

A: The treasury stock has debit balance in normal. It is recorded in balance sheet as deduction from…

Q: On January 1, 2020, Volume Company had the following account balance carried over from the previous…

A: Treasury Stock The purpose of issue of treasury stock which describes as the repurchase of own stock…

Q: Riley Company paid cash dividends of P840,000 and reported net income of P2,170,000. The ordinary…

A: Book value of ordinary share is the the total ordinary shareholders equity plus net income less cash…

Q: Prince Corporation's accounts provided the following information at December 31, 2019: Total…

A: Retained earning means the amount of profit that has not been distributed to shareholder as divided.…

Q: The balance in the retained earnings account of Indigo Corporation was P450,000 at December 31,…

A: Treasury stock: Shares which are bought back by the company from the open market but not retired…

Q: The following data were taken from the accounts of Miami Heat Corporation as at December 31, 2019:…

A: Out of the profit earned by the business entities, some of the profit is distributed by them to…

Q: The JHONG Corporation had the following balances in its Shareholders' Equity accounts as of December…

A: The treasury shares include the own shares of company purchased from the shareholders of…

Q: Sunland Rental Corporation had the following balances in its shareholders' equity accounts at…

A: Golden Rules of Accounting : Account Debit Credit Personal Accounts the receiver the giver…

Q: The following balances/data was extracted from the accounting records of Benta Ltd on 28 February…

A: 1. Market to book ratio = Market capitalisation/ Net book value = 243,000,000/1,750,000 = 138.85…

Q: On December 31, 2020, Loving Company showed shareholder’s equity of P5,000,000. The share capital of…

A: Retained Earnings is the part of profit which is not distributed to shareholders as dividend but…

Q: Selected infomation from the accounts of Colossians Co. at December 31, 2021 reveals that the total…

A: Retained Earnings:- Retained earnings are a part of firm’s profit that is not distributed to the…

Q: At the beginning of the current year , Flash Company had retained earnings of P4,000,000 . During…

A: Retained earnings are surplus left after paying all operating Expenses, taxes and dividends. It is…

Q: The Retained Earnings for Blanka Corporation at January 1, 2021 were $250,000. The corporation had…

A: Retained earnings is the term that represents the profits accumulated by the entity that are not…

Q: Junior Berhad is a company that, during the year ended 31 December2020, paid RM25,000 debenture…

A: Profit of the business can be calculated by subtracting all the costs from the total sales revenue…

Q: Party Company reported total assets of P1,050,000 and total liabilities of P680,000 in it December…

A: Statement of owner equity states the changes in the equity(Capital stock) of the company over a…

Q: Malit Corporation has a total shareholders' equity of P1,000,000, including retained earnings of…

A: >The stockholders are the owner of the corporation who invest their money in the common stock of…

Q: AUBURN Corporation had 120,000 of ordinary shares issued and outstanding at January 1, 2021. On On…

A: Earnings per share indicate the profits per share of common stockholders. It can be calculated by…

Q: The company reported total assets of P2,100,000 and total liabilities of P1,360,000 in its December…

A: Stockholders’ Equity on December 31, 2020 = total assets- total liabilities = P2,100,000 -…

Q: On January 1, 2021, Blossom Corporation had 950,000 shares of common stock outstanding. On March 1,…

A: In order to calculate weighted average shares, shares outstanding have to be multiplied with the…

Q: On January 1, 2021, Eugene Co. had retained earnings of P1,240,000. During 2021, the co. earned net…

A: Retained earnings balances are adjusted for many reasons. This is the summary of retained earnings.…

Q: Colossians Co. at December 31, 2021 reveals that the total income since incorporation is P420,000;…

A: Retained earnings or accumulated profit is the shareholder's equity component which states the…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.

- Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.Assume that as of January 1, 20Y8, Sylvester Con- suiting has total assets of $500,000 and total assets of $150,000. As of December 31, 20Y8, Sylvester has total liabilities of $200,000 and total stockholders’ equity of $400,000. (a) What was Sylvester’s stockholders’ equity as of January 1, 20Y8? (b) Assume that Sylvester did not pay any dividends during 20Y8. What was the amount of net income for 20Y8?For the current year, Vidalia Company reported revenues of 250,000 and expenses of 225,000. At the beginning of the year, its retained earnings had a balance of 95,000. During the year, Vidalia paid 11,000 dividends to shareholders. Its contributed capital was 56,000 at the beginning of the year, and it did not issue any new stock during the year. Vidalias assets total 237,500 on December 31 of the current year. What are Vidalias total liabilities on December 31 of the current year?

- The controller of Red Lake Corporation has requested assistance in determining income, basic earnings per share, and diluted earnings per share for presentation on the companys income statement for the year ended September 30, 2020. As currently calculated, Red Lakes net income is 540,000 for fiscal year 2019-2020. Your working papers disclose the following opening balances and transactions in the companys capital stock accounts during the year: 1. Common stock (at October 1, 2019, stated value 10, authorized 300,000 shares; effective December 1, 2019, stated value 5, authorized 600,000 shares): Balance, October 1, 2019issued and outstanding 60,000 shares December 1, 201960,000 shares issued in a 2-for-l stock split December 1, 2019280,000 shares (stated value 5) issued at 39 per share 2. Treasury stockcommon: March 3, 2020purchased 40,000 shares at 38 per share April 1, 2020sold 40,000 shares at 40 per share 3. Noncompensatory stock purchase warrants, Series A (initially, each warrant was exchangeable with 60 for 1 common share; effective December 1, 2019, each warrant became exchangeable for 2 common shares at 30 per share): October 1, 201925,000 warrants issued at 6 each 4. Noncompensatory stock purchase warrants, Series B (each warrant is exchangeable with 40 for 1 common share): April 1, 202020,000 warrants authorized and issued at 10 each 5. First mortgage bonds, 5%, due 2029 (nonconvertible; priced to yield 5% when issued): Balance October 1, 2019authorized, issued, and outstandingthe face value of 1,400,000 6. Convertible debentures, 7%, due 2036 (initially, each 1,000 bond was convertible at any time until maturity into 20 common shares; effective December 1, 2019, the conversion rate became 40 shares for each bond): October 1, 2019authorized and issued at their face value (no premium or discount) of 2,400,000 The following table shows the average market prices for the companys securities during 2019-2020: Adjusted for stock split Required: Prepare a schedule computing: 1. the basic earnings per share 2. the diluted earnings per share that should be presented on Red Lakes income statement for the year ended September 30, 2020 A supporting schedule computing the numbers of shares to be used in these computations should also be prepared. Assume an income tax rate of 30%.Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.

- Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.Errol Corporation earned net income of $200,000 this year. The company began the year with 10,000 shares of common stock and issued 5,000 more on April 1. They issued $7,500 in preferred dividends for the year. What is the numerator of the EPS calculation for Errol?