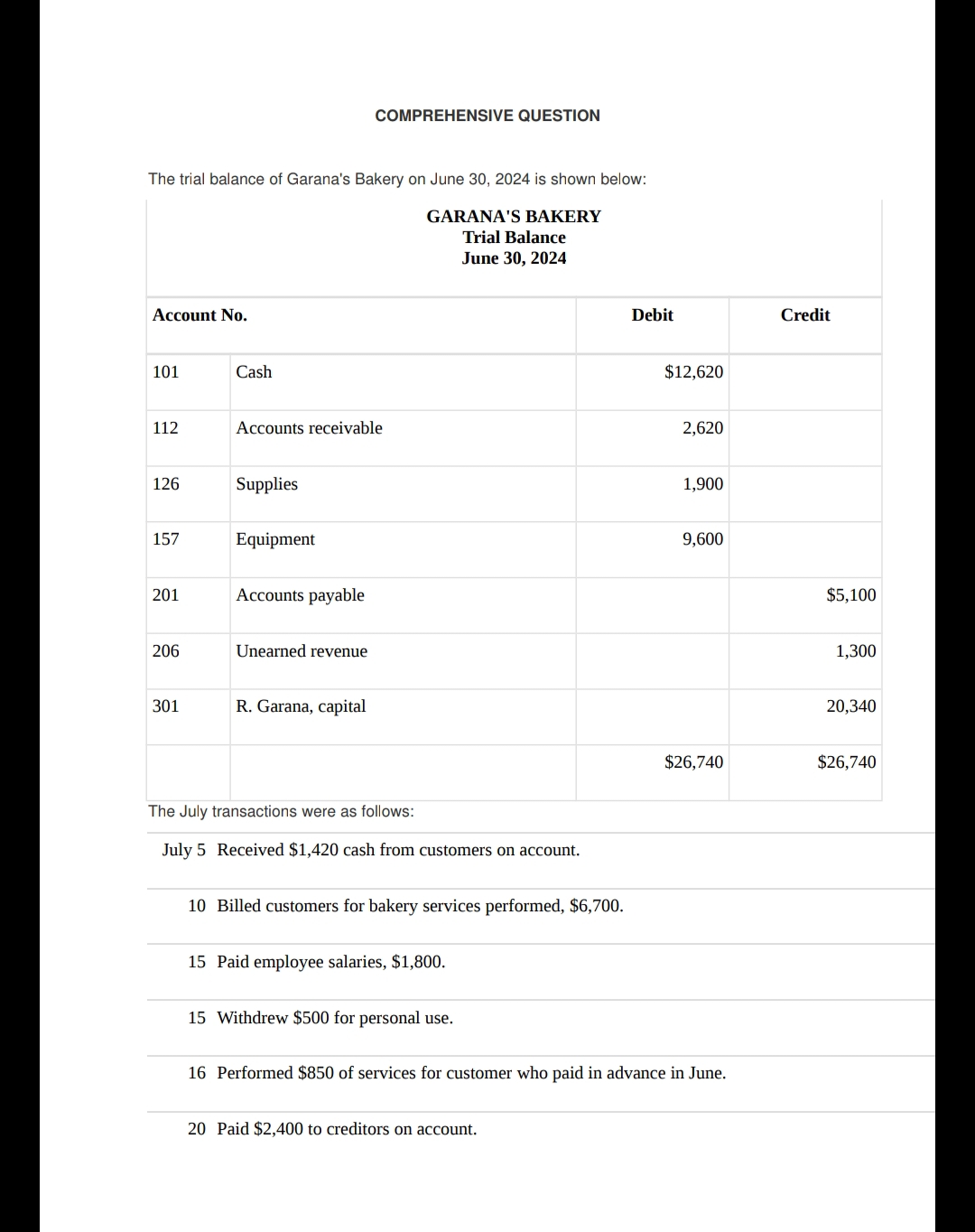

The trial balance of Garana's Bakery on June 30, 2024 is shown below: GARANA'S BAKERY Trial Balance June 30, 2024 Account No. 101 112 126 157 201 206 301 Cash Accounts receivable Supplies Equipment Accounts payable COMPREHENSIVE QUESTION Unearned revenue R. Garana, capital The July transactions were as follows: Debit $12,620 2,620 1,900 9,600 $26,740 Credit $5,100 1,300 20,340 $26,740

The trial balance of Garana's Bakery on June 30, 2024 is shown below: GARANA'S BAKERY Trial Balance June 30, 2024 Account No. 101 112 126 157 201 206 301 Cash Accounts receivable Supplies Equipment Accounts payable COMPREHENSIVE QUESTION Unearned revenue R. Garana, capital The July transactions were as follows: Debit $12,620 2,620 1,900 9,600 $26,740 Credit $5,100 1,300 20,340 $26,740

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 11PB: Prepare journal entries to record the following transactions. Create a T-account for Unearned...

Related questions

Question

Transcribed Image Text:●

●

●

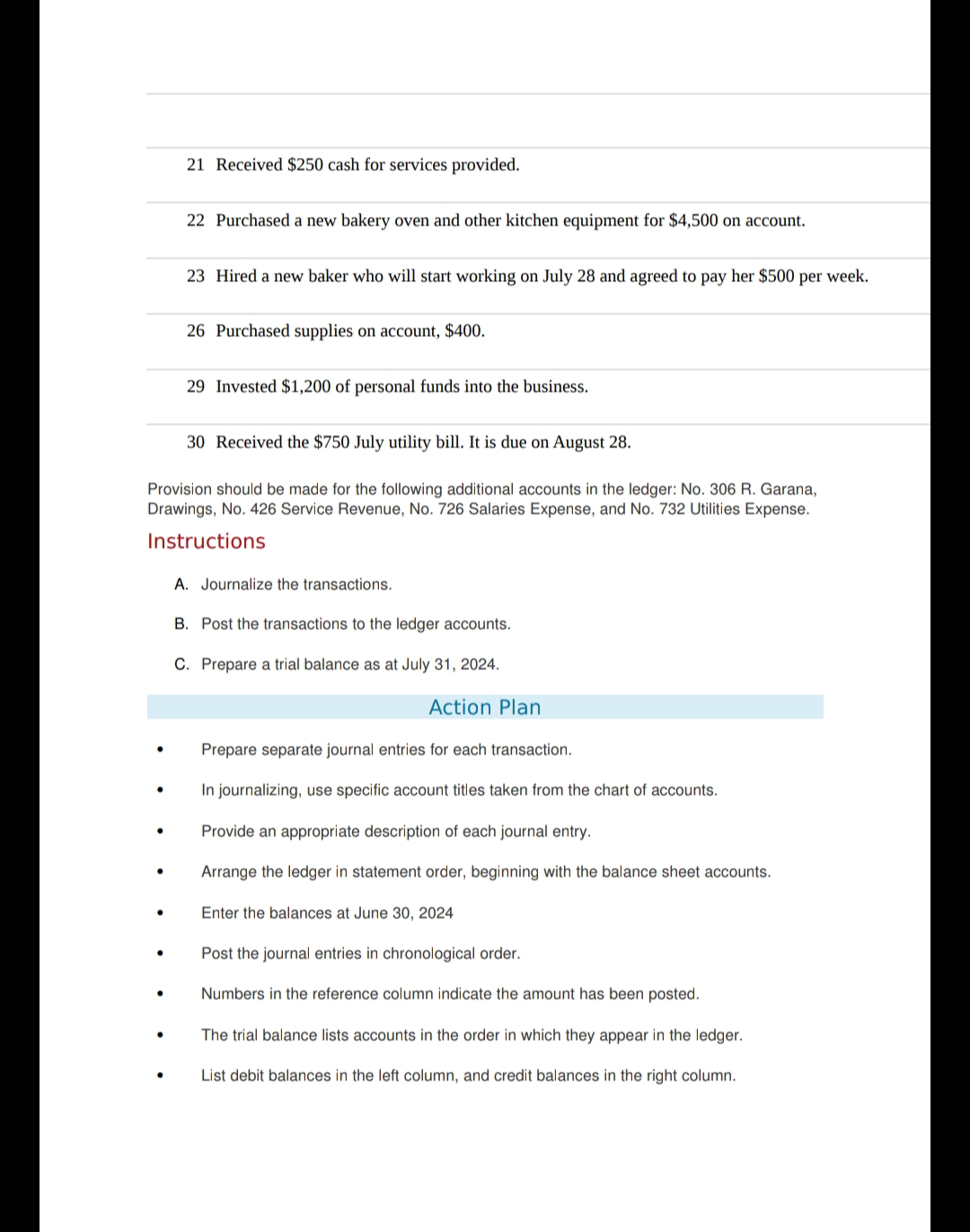

21 Received $250 cash for services provided.

●

22 Purchased a new bakery oven and other kitchen equipment for $4,500 on account.

30 Received the $750 July utility bill. It is due on August 28.

Provision should be made for the following additional accounts in the ledger: No. 306 R. Garana,

Drawings, No. 426 Service Revenue, No. 726 Salaries Expense, and No. 732 Utilities Expense.

Instructions

23 Hired a new baker who will start working on July 28 and agreed to pay her $500 per week.

26 Purchased supplies on account, $400.

29 Invested $1,200 of personal funds into the business.

A. Journalize the transactions.

B. Post the transactions to the ledger accounts.

C. Prepare a trial balance as at July 31, 2024.

Action Plan

Prepare separate journal entries for each transaction.

In journalizing, use specific account titles taken from the chart of accounts.

Provide an appropriate description of each journal entry.

Arrange the ledger in statement order, beginning with the balance sheet accounts.

Enter the balances at June 30, 2024

Post the journal entries in chronological order.

Numbers in the reference column indicate the amount has been posted.

The trial balance lists accounts in the order in which they appear in the ledger.

List debit balances in the left column, and credit balances in the right column.

Transcribed Image Text:The trial balance of Garana's Bakery on June 30, 2024 is shown below:

GARANA'S BAKERY

Trial Balance

June 30, 2024

Account No.

101

112

126

157

201

206

301

Cash

Accounts receivable

Supplies

Equipment

Accounts payable

COMPREHENSIVE QUESTION

Unearned revenue

R. Garana, capital

The July transactions were as follows:

July 5 Received $1,420 cash from customers on account.

10 Billed customers for bakery services performed, $6,700.

15 Paid employee salaries, $1,800.

15 Withdrew $500 for personal use.

Debit

20 Paid $2,400 to creditors on account.

$12,620

2,620

1,900

9,600

$26,740

16 Performed $850 of services for customer who paid in advance in June.

Credit

$5,100

1,300

20,340

$26,740

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage