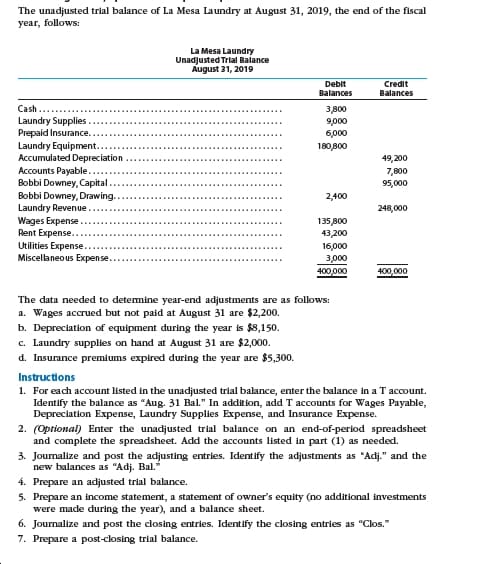

The unadjusted trial balance of La Mesa Laundry at August 31, 2019, the end of the fiscal year, follows: La Mesa Laundry Unadjusted Trial Balance August 31, 2019 Debit Balances Credit Balances Cash.... Laundry Supplies Prepaid Insurance. Laundry Equipment.. Accumulated Depreciation Accounts Payable.. Bobbi Downey, Capital. Bobbi Downey, Drawing. Laundry Revenue 3в00 9,000 6,000 180,800 49,200 7,800 95,000 2,400 248,000 Wages Expense... Rent Expense.. Utilities Expense... Miscellaneous Expense... 135,800 43,200 16,000 з000 400,000 400,000 The data needed to detemine year-end adjustments are as follows: a. Wages accrued but not paid at August 31 are $2,200. b. Depreciation of equipment during the year is $8,150. c. Laundry supplies on hand at August 31 are $2,000. d. Insurance premiums expired during the year are $5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as "Aug. 31 Bal." In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, and Insurance Expense. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments as "Adj." and the new balances as "Adj. Bal." 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owner's equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Identify the closing entries as "Clos." 7. Prepare a post-closing trial balance.

The unadjusted trial balance of La Mesa Laundry at August 31, 2019, the end of the fiscal year, follows: La Mesa Laundry Unadjusted Trial Balance August 31, 2019 Debit Balances Credit Balances Cash.... Laundry Supplies Prepaid Insurance. Laundry Equipment.. Accumulated Depreciation Accounts Payable.. Bobbi Downey, Capital. Bobbi Downey, Drawing. Laundry Revenue 3в00 9,000 6,000 180,800 49,200 7,800 95,000 2,400 248,000 Wages Expense... Rent Expense.. Utilities Expense... Miscellaneous Expense... 135,800 43,200 16,000 з000 400,000 400,000 The data needed to detemine year-end adjustments are as follows: a. Wages accrued but not paid at August 31 are $2,200. b. Depreciation of equipment during the year is $8,150. c. Laundry supplies on hand at August 31 are $2,000. d. Insurance premiums expired during the year are $5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as "Aug. 31 Bal." In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, and Insurance Expense. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments as "Adj." and the new balances as "Adj. Bal." 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owner's equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Identify the closing entries as "Clos." 7. Prepare a post-closing trial balance.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter4: Completing The Accounting Cycle

Section: Chapter Questions

Problem 4PB: The unadjusted trial balance of Recessive Interiors at January 31, 2019, the end of the year,...

Related questions

Question

100%

Transcribed Image Text:The unadjusted trial balance of La Mesa Laundry at August 31, 2019, the end of the fiscal

year, follows:

La Mesa Laundry

Unadjusted Trial Balance

August 31, 2019

Debit

Balances

Credit

Balances

Cash....

Laundry Supplies

Prepaid Insurance.

Laundry Equipment..

Accumulated Depreciation

Accounts Payable..

Bobbi Downey, Capital.

Bobbi Downey, Drawing.

Laundry Revenue

3в00

9,000

6,000

180,800

49,200

7,800

95,000

2,400

248,000

Wages Expense...

Rent Expense..

Utilities Expense...

Miscellaneous Expense...

135,800

43,200

16,000

з000

400,000

400,000

The data needed to detemine year-end adjustments are as follows:

a. Wages accrued but not paid at August 31 are $2,200.

b. Depreciation of equipment during the year is $8,150.

c. Laundry supplies on hand at August 31 are $2,000.

d. Insurance premiums expired during the year are $5,300.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in a T account.

Identify the balance as "Aug. 31 Bal." In addition, add T accounts for Wages Payable,

Depreciation Expense, Laundry Supplies Expense, and Insurance Expense.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet

and complete the spreadsheet. Add the accounts listed in part (1) as needed.

3. Journalize and post the adjusting entries. Identify the adjustments as "Adj." and the

new balances as "Adj. Bal."

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a statement of owner's equity (no additional investments

were made during the year), and a balance sheet.

6. Journalize and post the closing entries. Identify the closing entries as "Clos."

7. Prepare a post-closing trial balance.

Expert Solution

Trending now

This is a popular solution!

Step by step

Solved in 9 steps with 9 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning