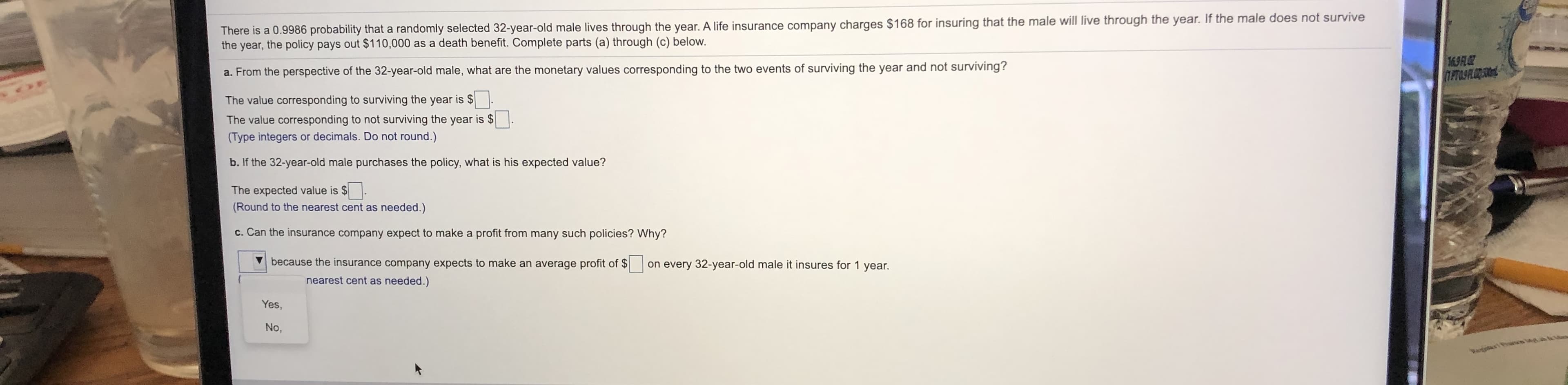

There is a 0.9986 probability that a randomly selected 32-year-old male lives through the year. A life insurance company charges $168 for insuring that the male will live through the year. If the male does not survive the year, the policy pays out $110,000 as a death benefit. Complete parts (a) through (c) below. a. From the perspective of the 32-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving? 16JFLOZ TPTUSROO The value corresponding to surviving the year is $ The value corresponding to not surviving the year is $ (Type integers or decimals. Do not round.) b. If the 32-year-old male purchases the policy, what is his expected value? The expected value is $ (Round to the nearest cent as needed.) c. Can the insurance company expect to make a profit from many such policies? Why? because the insurance company expects to make an average profit of $ nearest cent as needed.) on every 32-year-old male it insures for 1 year. Yes, No,

There is a 0.9986 probability that a randomly selected 32-year-old male lives through the year. A life insurance company charges $168 for insuring that the male will live through the year. If the male does not survive the year, the policy pays out $110,000 as a death benefit. Complete parts (a) through (c) below. a. From the perspective of the 32-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving? 16JFLOZ TPTUSROO The value corresponding to surviving the year is $ The value corresponding to not surviving the year is $ (Type integers or decimals. Do not round.) b. If the 32-year-old male purchases the policy, what is his expected value? The expected value is $ (Round to the nearest cent as needed.) c. Can the insurance company expect to make a profit from many such policies? Why? because the insurance company expects to make an average profit of $ nearest cent as needed.) on every 32-year-old male it insures for 1 year. Yes, No,

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter7: Percents

Section7.7: Simple And Compound Interest

Problem 1E

Related questions

Question

Can you assist me, please?

(not graded, concept solely for acquisition).

Transcribed Image Text:There is a 0.9986 probability that a randomly selected 32-year-old male lives through the year. A life insurance company charges $168 for insuring that the male will live through the year. If the male does not survive

the year, the policy pays out $110,000 as a death benefit. Complete parts (a) through (c) below.

a. From the perspective of the 32-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving?

16JFLOZ

TPTUSROO

The value corresponding to surviving the year is $

The value corresponding to not surviving the year is $

(Type integers or decimals. Do not round.)

b. If the 32-year-old male purchases the policy, what is his expected value?

The expected value is $

(Round to the nearest cent as needed.)

c. Can the insurance company expect to make a profit from many such policies? Why?

because the insurance company expects to make an average profit of $

nearest cent as needed.)

on every 32-year-old male it insures for 1 year.

Yes,

No,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL