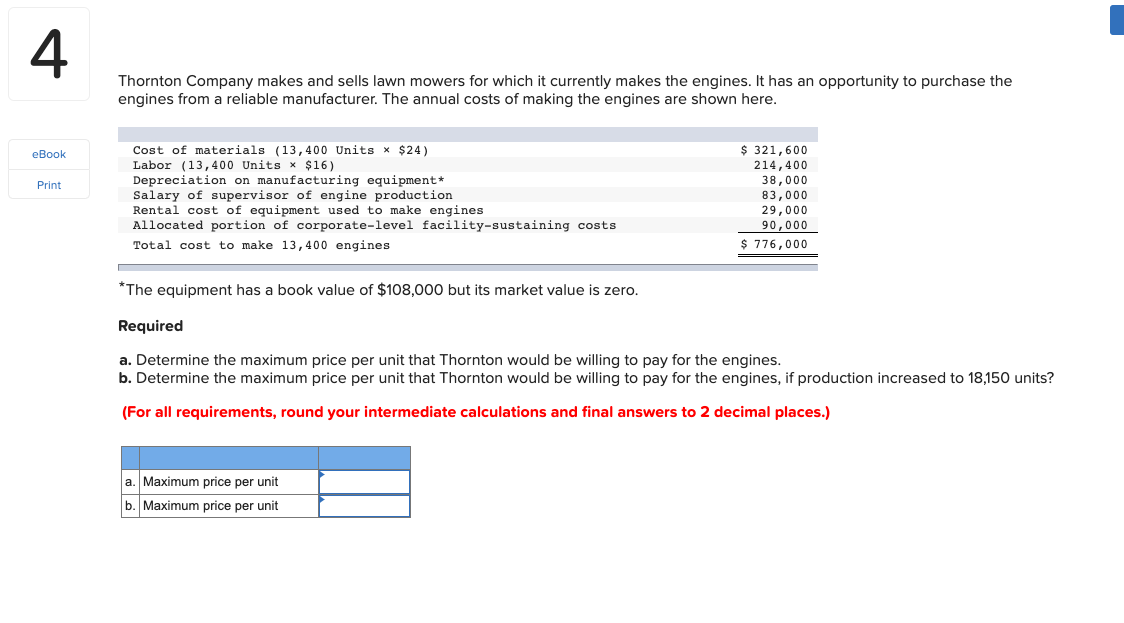

Thornton Company makes and sells lawn mowers for which it currently makes the engines. It has an opportunity to purchase the engines from a reliable manufacturer. The annual costs of making the engines are shown here. Cost of materials (13,400 Units x $24) Labor (13,400 Units x $16) Depreciation on manufacturing equipment* Salary of supervisor of engine production Rental cost Allocated portion of corporate-level facility-sustaining costs $ 321,600 214,400 38,000 83,000 29,000 equipment used to make engines 90,000 $ 776,000 Total cost to make 13,400 engines *The equipment has a book value of $108,000 but its market value is zero. Required a. Determine the maximum price per unit that Thornton would be willing to pay for the engines. b. Determine the maximum price per unit that Thornton would be willing to pay for the engines, if production increased to 18,150 units? (For all requirements, round your intermediate calculations and final answers to 2 decimal places.) a. Maximum price per unit b. Maximum price per unit

Thornton Company makes and sells lawn mowers for which it currently makes the engines. It has an opportunity to purchase the engines from a reliable manufacturer. The annual costs of making the engines are shown here. Cost of materials (13,400 Units x $24) Labor (13,400 Units x $16) Depreciation on manufacturing equipment* Salary of supervisor of engine production Rental cost Allocated portion of corporate-level facility-sustaining costs $ 321,600 214,400 38,000 83,000 29,000 equipment used to make engines 90,000 $ 776,000 Total cost to make 13,400 engines *The equipment has a book value of $108,000 but its market value is zero. Required a. Determine the maximum price per unit that Thornton would be willing to pay for the engines. b. Determine the maximum price per unit that Thornton would be willing to pay for the engines, if production increased to 18,150 units? (For all requirements, round your intermediate calculations and final answers to 2 decimal places.) a. Maximum price per unit b. Maximum price per unit

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter6: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 1PB: Classify costs Cromwell Furniture Company manufactures sofas for distribution to several major...

Related questions

Question

Having an issue with this problem.

Thank you

Transcribed Image Text:Thornton Company makes and sells lawn mowers for which it currently makes the engines. It has an opportunity to purchase the

engines from a reliable manufacturer. The annual costs of making the engines are shown here.

Cost of materials (13,400 Units x $24)

Labor (13,400 Units x $16)

Depreciation on manufacturing equipment*

Salary of supervisor of engine production

Rental cost

Allocated portion of corporate-level facility-sustaining costs

$ 321,600

214,400

38,000

83,000

29,000

equipment used to make engines

90,000

$ 776,000

Total cost to make 13,400 engines

*The equipment has a book value of $108,000 but its market value is zero.

Required

a. Determine the maximum price per unit that Thornton would be willing to pay for the engines.

b. Determine the maximum price per unit that Thornton would be willing to pay for the engines, if production increased to 18,150 units?

(For all requirements, round your intermediate calculations and final answers to 2 decimal places.)

a. Maximum price per unit

b. Maximum price per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning