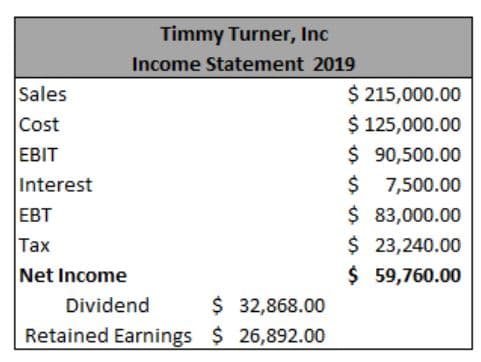

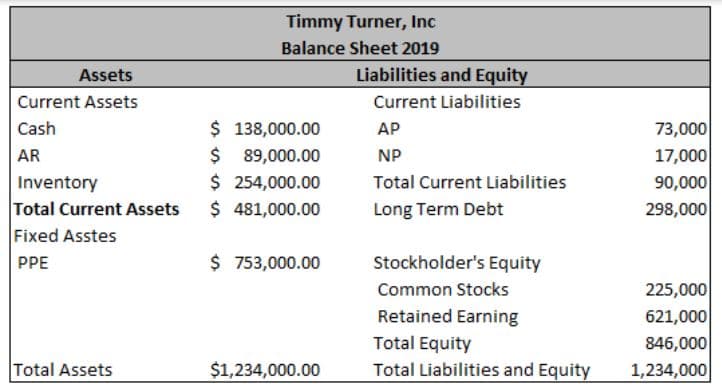

Timmy Turner, Inc. is a company that produces toys about fairies. The company has a wide range of products, the most famous of which are the characters Wanda and Cosmo. They have one large plant in Dimmsdale, California, which operates at 89% capacity rates. Since the outbreak of the COVID-19 pandemic, companies need to revise their financial projections. Below, the companies are attaching their income statement and balance sheet in 2019. They reduce the company’s sales growth from 50% to 25%. In projecting its financial statements, the company assumes that all expenses, current assets, and current liabilities that do not have interest will increase following sales growth. Interest expense will remain constant; the tax rate and dividend payout rate will also remain constant. As a financial manager, you need to: a. Prepare Projected Income Statement and Projected Balance Sheet using the percentage of sales approach. b. Calculate the external financing needed!

3. Timmy Turner, Inc. is a company that produces toys about fairies. The company has a wide range of products, the most famous of which are the characters Wanda and Cosmo. They have one large plant in Dimmsdale, California, which operates at 89% capacity rates. Since the outbreak of the COVID-19 pandemic, companies need to revise their financial projections. Below, the companies are attaching their income statement and balance sheet in 2019. They reduce the company’s sales growth from 50% to 25%. In projecting its financial statements, the company assumes that all expenses, current assets, and current liabilities that do not have interest will increase following sales growth. Interest expense will remain constant; the tax

a. Prepare

b. Calculate the external financing needed!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images