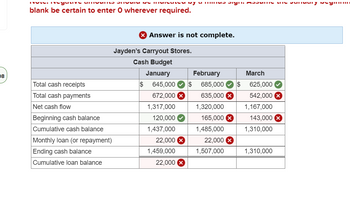

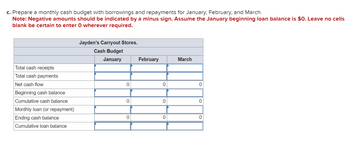

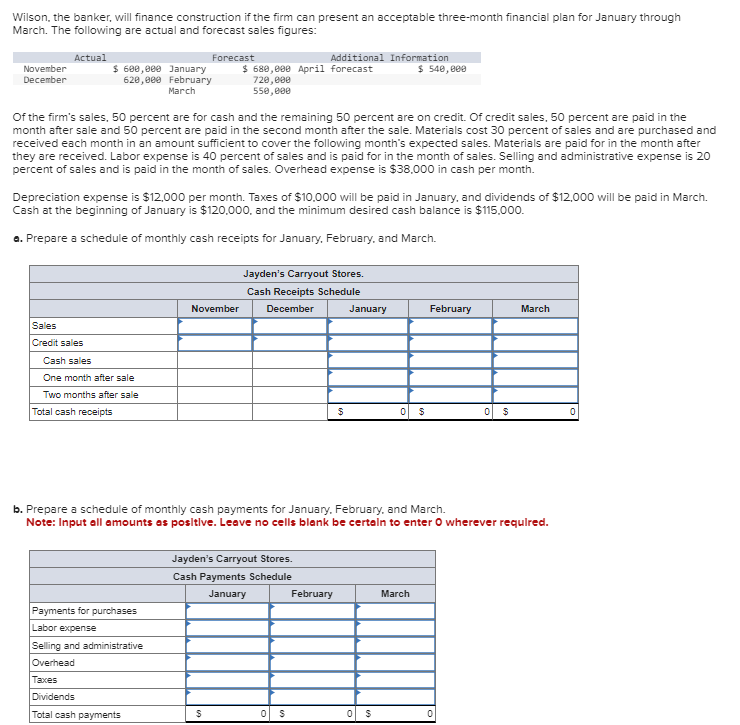

Wilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and forecast sales figures: November December Actual $ 600,000 January 620,000 February March Sales Credit sales Forecast Of the firm's sales, 50 percent are for cash and the remaining 50 percent are on credit. Of credit sales, 50 percent are paid in the month after sale and 50 percent are paid in the second month after the sale. Materials cost 30 percent of sales and are purchased and received each month in an amount sufficient to cover the following month's expected sales. Materials are paid for in the month after they are received. Labor expense is 40 percent of sales and is paid for in the month of sales. Selling and administrative expense is 20 percent of sales and is paid in the month of sales. Overhead expense is $38,000 in cash per month. Cash sales One month after sale Two months after sale Depreciation expense is $12,000 per month. Taxes of $10,000 will be paid in January, and dividends of $12,000 will be paid in March. Cash at the beginning of January is $120,000, and the minimum desired cash balance is $115,000. a. Prepare a schedule of monthly cash receipts for January, February, and March. Total cash receipts Payments for purchases Labor expense Selling and administrative Overhead Taxes Dividends Additional Information $ 540,000 $ 680,000 April forecast 720,000 550,000 November Jayden's Carryout Stores. Cash Receipts Schedule December Jayden's Carryout Stores. Cash Payments Schedule January $ February January $ b. Prepare a schedule of monthly cash payments for January, February, and March. Note: Input all amounts as positive. Leave no cells blank be certain to enter O wherever required. March February $ March 0

Cost of Debt, Cost of Preferred Stock

This article deals with the estimation of the value of capital and its components. we'll find out how to estimate the value of debt, the value of preferred shares , and therefore the cost of common shares . we will also determine the way to compute the load of every cost of the capital component then they're going to estimate the general cost of capital. The cost of capital refers to the return rate that an organization gives to its investors. If an organization doesn’t provide enough return, economic process will decrease the costs of their stock and bonds to revive the balance. A firm’s long-run and short-run financial decisions are linked to every other by the assistance of the firm’s cost of capital.

Cost of Common Stock

Common stock is a type of security/instrument issued to Equity shareholders of the Company. These are commonly known as equity shares in India. It is also called ‘Common equity

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

I put them in as negatives and it was still wrong.