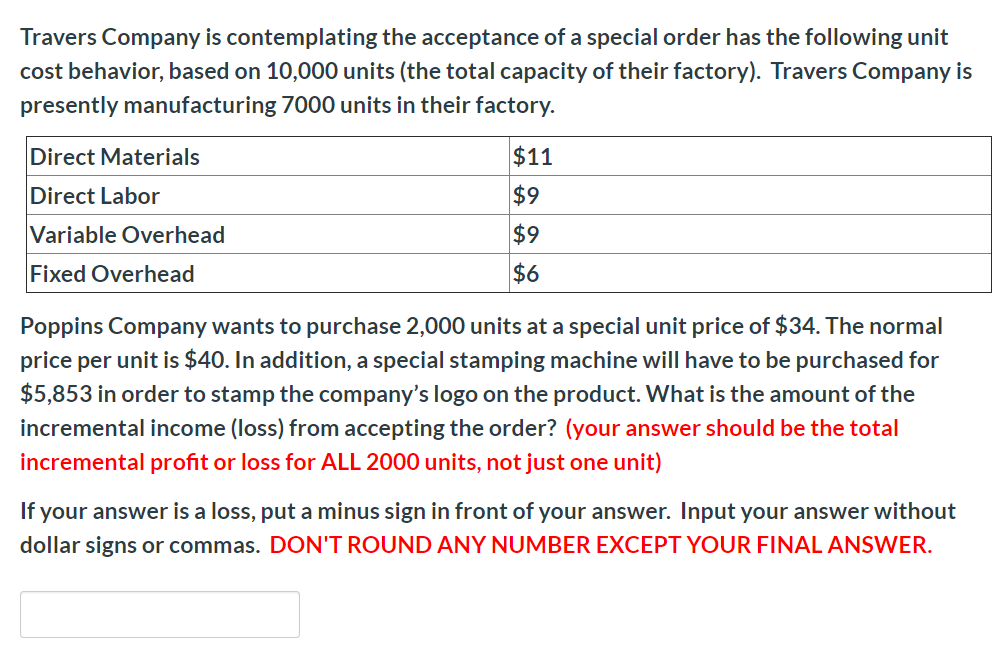

Travers Company is contemplating the acceptance of a special order has the following unit cost behavior, based on 10,000 units (the total capacity of their factory). Travers Company is presently manufacturing 7000 units in their factory. Direct Materials $11 Direct Labor $9 Variable Overhead $9 Fixed Overhead $6 Poppins Company wants to purchase 2,000 units at a special unit price of $34. The normal price per unit is $40. In addition, a special stamping machine will have to be purchased for $5,853 in order to stamp the company's logo on the product. What is the amount of the incremental income (loss) from accepting the order? (your answer should be the total loss for ALL 2000 units incremental profit it) just one If your answer is a loss, puta minus sign in front of your answer. Input your answer without dollar signs or commas. DON'T ROUND ANY NUMBER EXCEPT YOUR FINAL ANSWER.

Travers Company is contemplating the acceptance of a special order has the following unit cost behavior, based on 10,000 units (the total capacity of their factory). Travers Company is presently manufacturing 7000 units in their factory. Direct Materials $11 Direct Labor $9 Variable Overhead $9 Fixed Overhead $6 Poppins Company wants to purchase 2,000 units at a special unit price of $34. The normal price per unit is $40. In addition, a special stamping machine will have to be purchased for $5,853 in order to stamp the company's logo on the product. What is the amount of the incremental income (loss) from accepting the order? (your answer should be the total loss for ALL 2000 units incremental profit it) just one If your answer is a loss, puta minus sign in front of your answer. Input your answer without dollar signs or commas. DON'T ROUND ANY NUMBER EXCEPT YOUR FINAL ANSWER.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter17: Activity Resource Usage Model And Tactical Decision Making

Section: Chapter Questions

Problem 18E: A company is considering a special order for 1,000 units to be priced at 8.90 (the normal price...

Related questions

Question

Transcribed Image Text:Travers Company is contemplating the acceptance of a special order has the following unit

cost behavior, based on 10,000 units (the total capacity of their factory). Travers Company is

presently manufacturing 7000 units in their factory.

Direct Materials

$11

Direct Labor

$9

Variable Overhead

$9

Fixed Overhead

$6

Poppins Company wants to purchase 2,000 units at a special unit price of $34. The normal

price per unit is $40. In addition, a special stamping machine will have to be purchased for

$5,853 in order to stamp the company's logo on the product. What is the amount of the

incremental income (loss) from accepting the order? (your answer should be the total

loss for ALL 2000 units

incremental profit

it)

just one

If your answer is a loss, puta minus sign in front of your answer. Input your answer without

dollar signs or commas. DON'T ROUND ANY NUMBER EXCEPT YOUR FINAL ANSWER.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub