Trial Balance September 30, 2020 Unadjusted Adjusted Dr. Cr. Dr. Cr. sh $8,800 $8,800 counts Receivable oplies 10,300 11,400 1,450 600 spaid Rent uipment 2,150 1,250 18,000 18,000 cumulated Depreciation-Equipment $ 0 $ 650 tes Payable counts Payable 9,300 9,300 2,550 2,550 aries and Wages Payable 730 erest Payable 93 earned Rent Revenue mmon Stock 1,900 1,100 22,000 22,000 -idends 1,650 1,650 vice Revenue 16,890 17,990 nt Revenue 1,380 2,180 aries and Wages Expense 8,200 8,930

Trial Balance September 30, 2020 Unadjusted Adjusted Dr. Cr. Dr. Cr. sh $8,800 $8,800 counts Receivable oplies 10,300 11,400 1,450 600 spaid Rent uipment 2,150 1,250 18,000 18,000 cumulated Depreciation-Equipment $ 0 $ 650 tes Payable counts Payable 9,300 9,300 2,550 2,550 aries and Wages Payable 730 erest Payable 93 earned Rent Revenue mmon Stock 1,900 1,100 22,000 22,000 -idends 1,650 1,650 vice Revenue 16,890 17,990 nt Revenue 1,380 2,180 aries and Wages Expense 8,200 8,930

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 13PA: Prepare adjusting journal entries, as needed, considering the account balances excerpted from the...

Related questions

Question

Please help experts

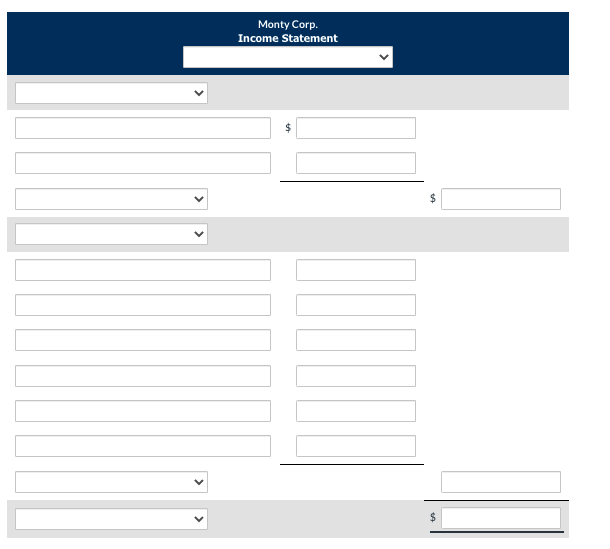

Transcribed Image Text:Monty Corp.

Income Statement

2$

%24

2$

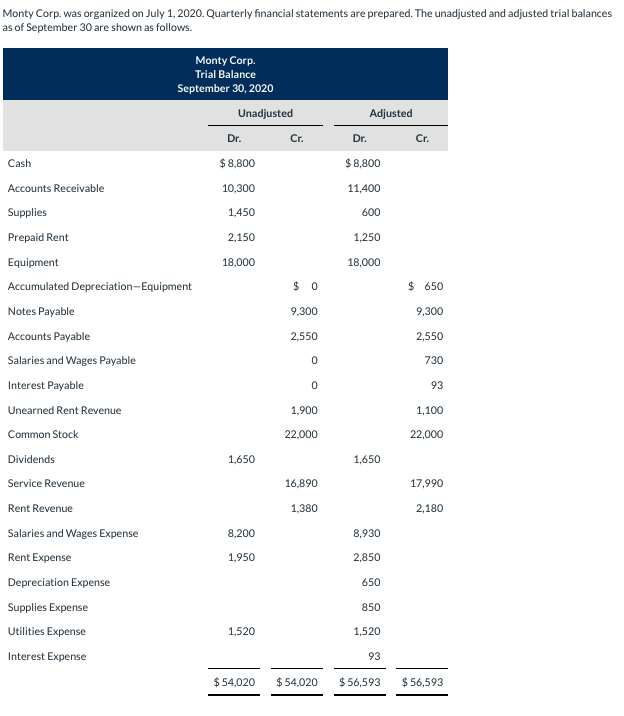

Transcribed Image Text:Monty Corp. was organized on July 1, 2020. Quarterly financial statements are prepared. The unadjusted and adjusted trial balances

as of September 30 are shown as follows.

Monty Corp.

Trial Balance

September 30, 2020

Unadjusted

Adjusted

Dr.

Cr.

Dr.

Cr.

Cash

$8,800

$8,800

Accounts Receivable

10,300

11,400

Supplies

1,450

600

Prepaid Rent

2,150

1,250

Equipment

18,000

18,000

Accumulated Depreciation-Equipment

$ 0

$ 650

Notes Payable

9,300

9,300

Accounts Payable

2,550

2,550

Salaries and Wages Payable

730

Interest Payable

93

Unearned Rent Revenue

1,900

1,100

Common Stock

22,000

22,000

Dividends

1,650

1,650

Service Revenue

16,890

17,990

Rent Revenue

1,380

2,180

Salaries and Wages Expense

8,200

8,930

Rent Expense

1,950

2,850

Depreciation Expense

650

Supplies Expense

850

Utilities Expense

1,520

1,520

Interest Expense

93

$ 54,020

$ 54,020

$ 56,593

$ 56,593

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning