ts & Short Investments 6.75% 6.4 5.97% 6.76% unts Receivable 6.2 ntories r Current Assets AL CURRENT ASSETS Property, Plant & Equipment 5.9 2.29% 2.2 21.77% 20.8 1.20% 11.7 Investments and Advances 5.67% 56.1 -Term Note Receivable 2.70% 4.2 gible Assets 2.22% 2.0 r Assets 4.61% 4.9 AL LONG-TERM ASSETS 78.23% 79.1 AL ASSETS 100.00% 100.0 lities 4.32% 7.54% ebt &Current Portion LT Debt 7.0 unts Payable me Tax Payable 6.7 0.27% 0.2

ts & Short Investments 6.75% 6.4 5.97% 6.76% unts Receivable 6.2 ntories r Current Assets AL CURRENT ASSETS Property, Plant & Equipment 5.9 2.29% 2.2 21.77% 20.8 1.20% 11.7 Investments and Advances 5.67% 56.1 -Term Note Receivable 2.70% 4.2 gible Assets 2.22% 2.0 r Assets 4.61% 4.9 AL LONG-TERM ASSETS 78.23% 79.1 AL ASSETS 100.00% 100.0 lities 4.32% 7.54% ebt &Current Portion LT Debt 7.0 unts Payable me Tax Payable 6.7 0.27% 0.2

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 14E: Future Values and Long-Term Investments Portman Corporation engaged in the following transactions...

Related questions

Question

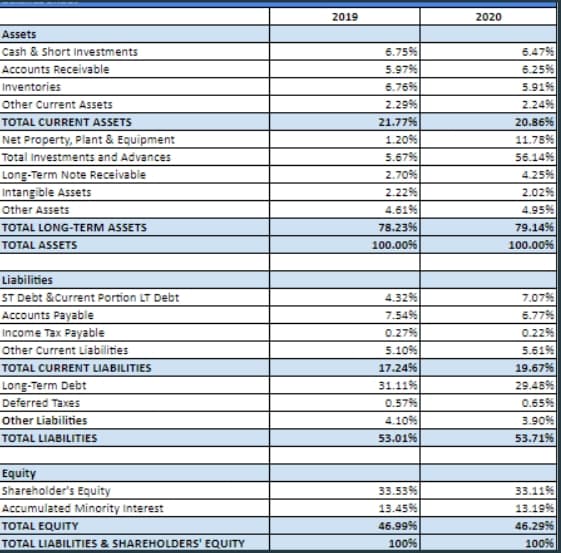

What accounting concepts are used in the balance sheet (mainly on assets) based on the data provided below?

Transcribed Image Text:2019

2020

Assets

Cash & Short Investments

6.75%

6.479%

Accounts Receivable

5.97%

6.25%

Inventories

6.76%

5.91%

2.29%

21.77%

1.20%

Other Current Assets

2.24%

TOTAL CURRENT ASSETS

20.86%

Net Property, Plant & Equipment

11.78%

Total Investments and Advances

5.6795

56.14%

Long-Term Note Receivable

Intangible Assets

2.70%

4.25%

2.229%

2.02%

Other Assets

4.61%

4.95%

TOTAL LONG-TERM ASSETS

78.23%

79.14%

TOTAL ASSETS

100.00%

100.00%

Liabilities

ST Debt &Current Portion LT Debt

4.32%

7.07%

Accounts Payable

7.54%

6.77%

Income Tax Payable

0.279%

0.22%

Other Current Liabilities

5.10%

5.61%

TOTAL CURRENT LIABILITIES

17.24%

19.67%

31.11%

0.57%

Long-Term Debt

29.48%

Deferred Taxes

0.65%

Other Liabilities

4.10%

3.90%

TOTAL LIABILITIES

53.01%

53.71%

Equity

Shareholder's Equity

33.53%

13.45%

33.11%

Accumulated Minority Interest

13.19%

TOTAL EQUITY

46.99%

46.29%

TOTAL LIABILITIES & SHAREHOLDERS' EQUITY

100%

100%

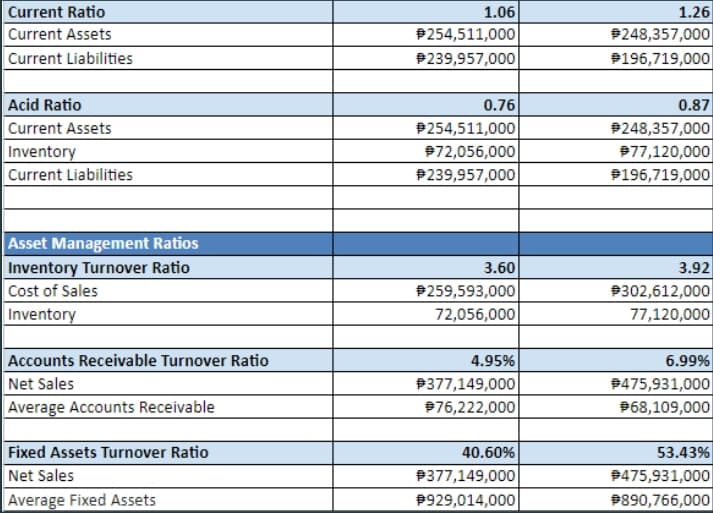

Transcribed Image Text:1.26

$248,357,000

P196,719,000

Current Ratio

1.06

254,511,000

P239,957,000

Current Assets

Current Liabilities

0.87

9248,357,000

977,120,000

$196,719,000

Acid Ratio

0.76

Current Assets

P254,511,000

972,056,000

P239,957,000

Inventory

Current Liabilities

Asset Management Ratios

Inventory Turnover Ratio

3.60

3.92

P259,593,000

$302,612,000

77,120,000

Cost of Sales

Inventory

72,056,000

Accounts Receivable Turnover Ratio

4.95%

P377,149,000

976,222,000

6.99%

9475,931,000

968,109,000

Net Sales

Average Accounts Receivable

40.60%

P377,149,000

53.43%

9475,931,000

P890,766,000

Fixed Assets Turnover Ratio

Net Sales

Average Fixed Assets

9929,014,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning