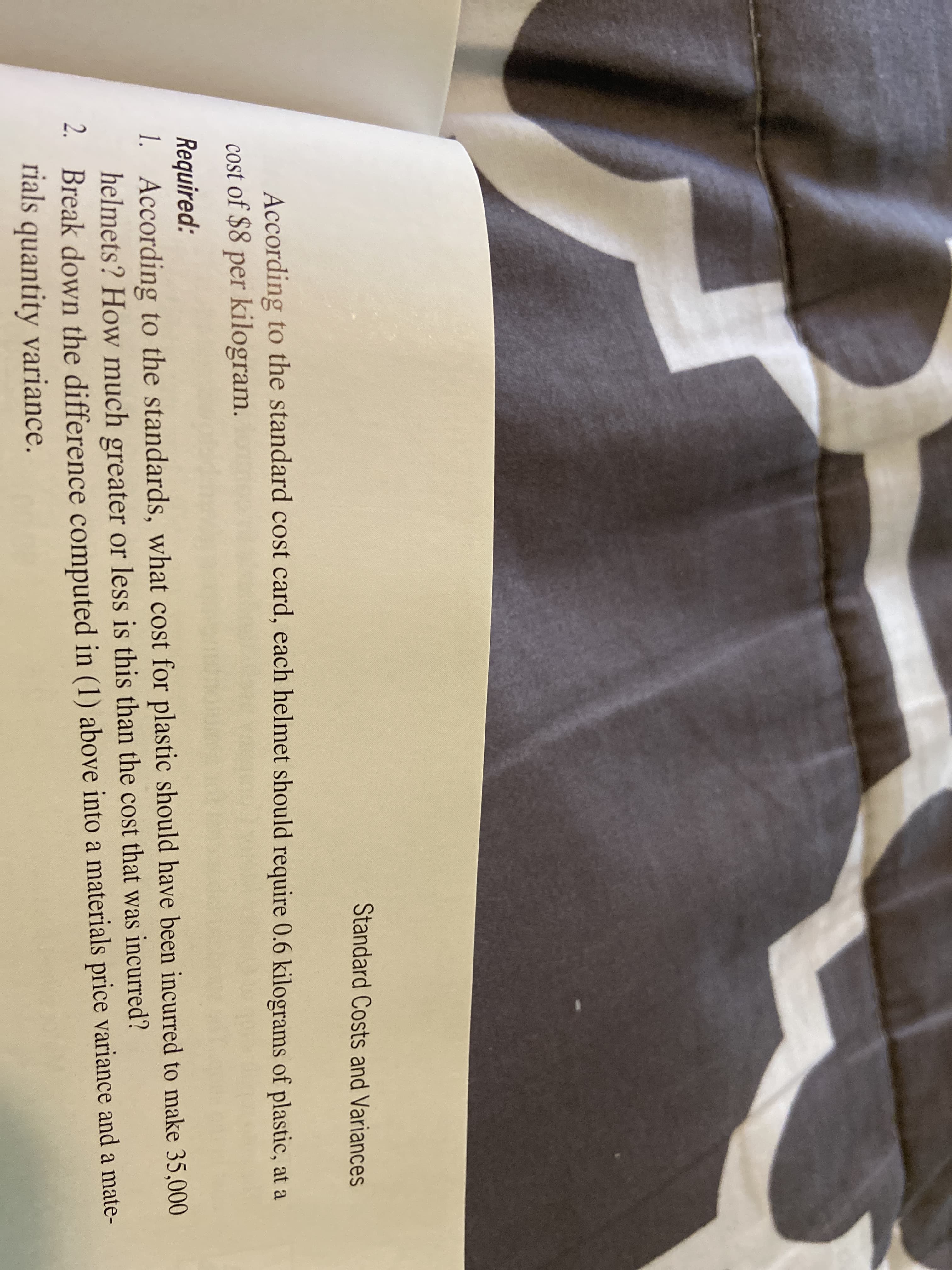

Tunable manufacturing overhead cost would be included in the company's planning budget for March? What variable manufacturing overhead cost would be included in the company's flexible 13. budget for March? What is the variable overhead rate variance for March? What is the variable overhead efficiency variance for March? 14. 15. connect |ACCOUNTING All applicable exercises are available with McGraw-Hill's Connect® Accounting. EXERCISE 10-1 Direct Materials Variances [LO10-1] Bandar Industries Berhad of Malaysia manufactures sporting equipment. One of the company's products, a football helmet for the North American market, requires a special plastic. During the quarter ending June 30, the company manufactured 35,000 helmets, using 22,500 kilograms of plastic. The plastic cost the company $171,000. Standard Costs and Variances According to the standard cost card, each helmet should require 0.6 kilograms of plastic, at a cost of $8 per kilogram. Required: 1. According to the standards, what cost for plastic should have been incurred to make 35,000 helmets? How much greater or less is this than the cost that was incurred? 2. Break down the difference computed in (1) above into a materials price variance and a mate- rials quantity variance.

Tunable manufacturing overhead cost would be included in the company's planning budget for March? What variable manufacturing overhead cost would be included in the company's flexible 13. budget for March? What is the variable overhead rate variance for March? What is the variable overhead efficiency variance for March? 14. 15. connect |ACCOUNTING All applicable exercises are available with McGraw-Hill's Connect® Accounting. EXERCISE 10-1 Direct Materials Variances [LO10-1] Bandar Industries Berhad of Malaysia manufactures sporting equipment. One of the company's products, a football helmet for the North American market, requires a special plastic. During the quarter ending June 30, the company manufactured 35,000 helmets, using 22,500 kilograms of plastic. The plastic cost the company $171,000. Standard Costs and Variances According to the standard cost card, each helmet should require 0.6 kilograms of plastic, at a cost of $8 per kilogram. Required: 1. According to the standards, what cost for plastic should have been incurred to make 35,000 helmets? How much greater or less is this than the cost that was incurred? 2. Break down the difference computed in (1) above into a materials price variance and a mate- rials quantity variance.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter9: Standard Costing: A Functional-based Control Approach

Section: Chapter Questions

Problem 7CE: Variances Refer to Cornerstone Exercise 9.6. Required: 1. Calculate the variable overhead spending...

Related questions

Question

100%

10-1

![Tunable manufacturing overhead cost would be included in the company's planning

budget for March?

What variable manufacturing overhead cost would be included in the company's flexible

13.

budget for March?

What is the variable overhead rate variance for March?

What is the variable overhead efficiency variance for March?

14.

15.

connect

|ACCOUNTING

All applicable exercises are available with McGraw-Hill's Connect® Accounting.

EXERCISE 10-1 Direct Materials Variances [LO10-1]

Bandar Industries Berhad of Malaysia manufactures sporting equipment. One of the company's

products, a football helmet for the North American market, requires a special plastic. During the

quarter ending June 30, the company manufactured 35,000 helmets, using 22,500 kilograms of

plastic. The plastic cost the company $171,000.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F85e39e9b-3b6a-4fb6-8406-b63a567ff03b%2Fb75607e1-7215-49be-9b36-0e84e3ccda10%2F5ey9cdi.jpeg&w=3840&q=75)

Transcribed Image Text:Tunable manufacturing overhead cost would be included in the company's planning

budget for March?

What variable manufacturing overhead cost would be included in the company's flexible

13.

budget for March?

What is the variable overhead rate variance for March?

What is the variable overhead efficiency variance for March?

14.

15.

connect

|ACCOUNTING

All applicable exercises are available with McGraw-Hill's Connect® Accounting.

EXERCISE 10-1 Direct Materials Variances [LO10-1]

Bandar Industries Berhad of Malaysia manufactures sporting equipment. One of the company's

products, a football helmet for the North American market, requires a special plastic. During the

quarter ending June 30, the company manufactured 35,000 helmets, using 22,500 kilograms of

plastic. The plastic cost the company $171,000.

Transcribed Image Text:Standard Costs and Variances

According to the standard cost card, each helmet should require 0.6 kilograms of plastic, at a

cost of $8 per kilogram.

Required:

1. According to the standards, what cost for plastic should have been incurred to make 35,000

helmets? How much greater or less is this than the cost that was incurred?

2. Break down the difference computed in (1) above into a materials price variance and a mate-

rials quantity variance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,