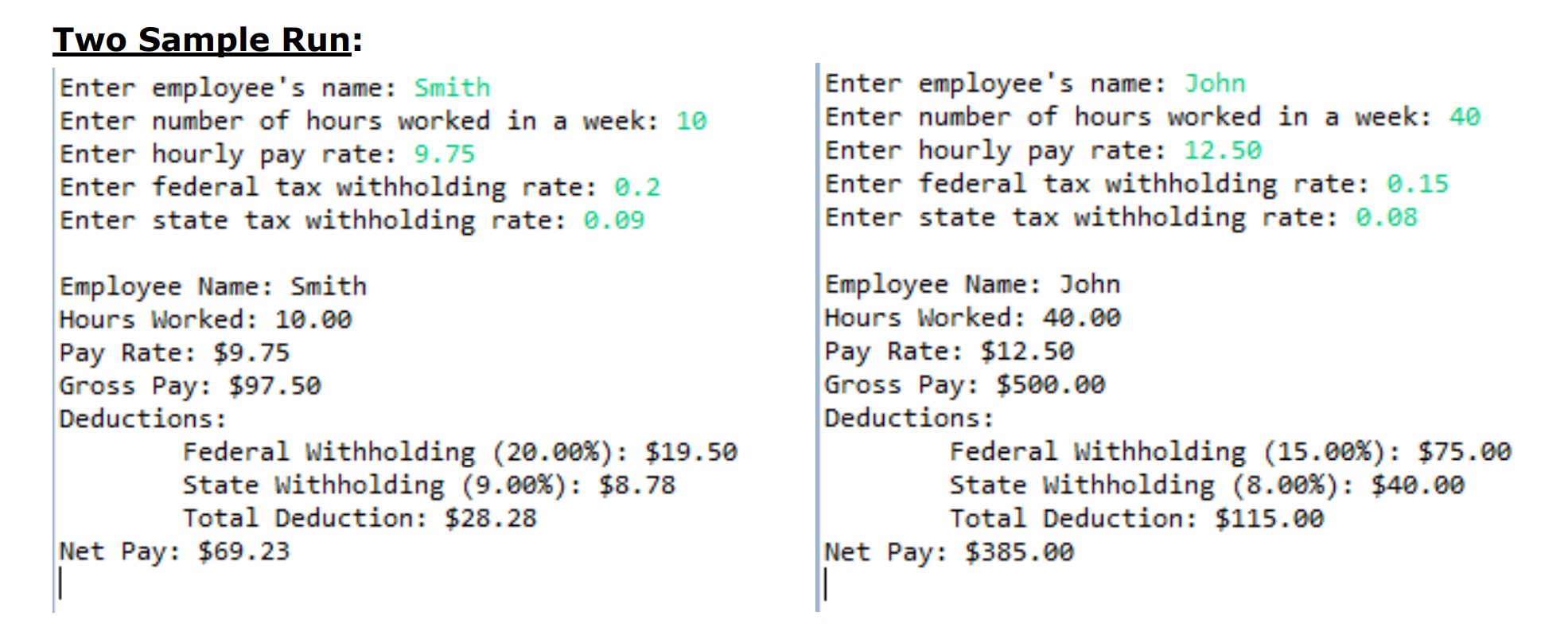

Two Sample Run: Enter emplovee's name: Smith Enter number of hours worked in a week: 10 Enter hourly pay rate: 9.75 Enter federal tax withholding rate: 0.2 Enter state tax withholding rate: 0.09 Enter employee's name: John Enter number of hours worked in a week: 40 Enter hourly pay rate: 12.50 Enter federal tax withholding rate: 0.15 Enter state tax withholding rate: 0.08 Employee Name: Smith Hours Worked 10.00 Pay Rate: $9.75 Gross Pay: $97.50 Deductions: Employee Name: John Hours Worked: 40.00 Pay Rate: $12.50 Gross Pay: $500.00 Deductions: Federal withholding (20.00%): $19.50 state withholding (9.00%): $8.78 Total Deduction: $28.28 Federal withholding (15.00%): $75.00 state withholding (8.00%); $48.00 Total Deduction: $115.00 Net Pay: $69.23 Net Pay: $385.00

For this

Carefully read the instructions and write a program that reads the following

information and prints a payroll statement.

Employee’s name (e.g., Smith)

Number of hours worked in a week (e.g., 10)

Hourly pay rate (e.g., 9.75)

Federal tax withholding rate (e.g., 20%)

State tax withholding rate (e.g., 9%)

design a program to

• Prompt user for 5 values and read the values using Scanner

o Use method .nextLine() to get the String for the name

o Use method .nextDouble() to get all other numeric values

• Calculating the Gross pay

o Gross pay = hours worked * hourly pay rate

• Calculating the Federal withholding

o Federal withholding = Gross pay * federal tax withholding rate

• Calculating the State withholding

o State withholding = Gross pay * state tax withholding rate

• Calculating the Total deduction

o Total deduction = Federal withholding + State withholding

• Calculating the Net Pay

o Net Pay = Gross pay – Total deduction

• Formatting the output same as the Sample run (Use ONLY printf)

o Correctly format 2 decimals and use $ (hint $%.2f)

o Indenting the under Deductions (hint \t)

o Printing % for state withholding and federal withholding rate (hint refer to

practice question below)

Include a comment at the start of the program with the following.

The computer must do all calculations.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images