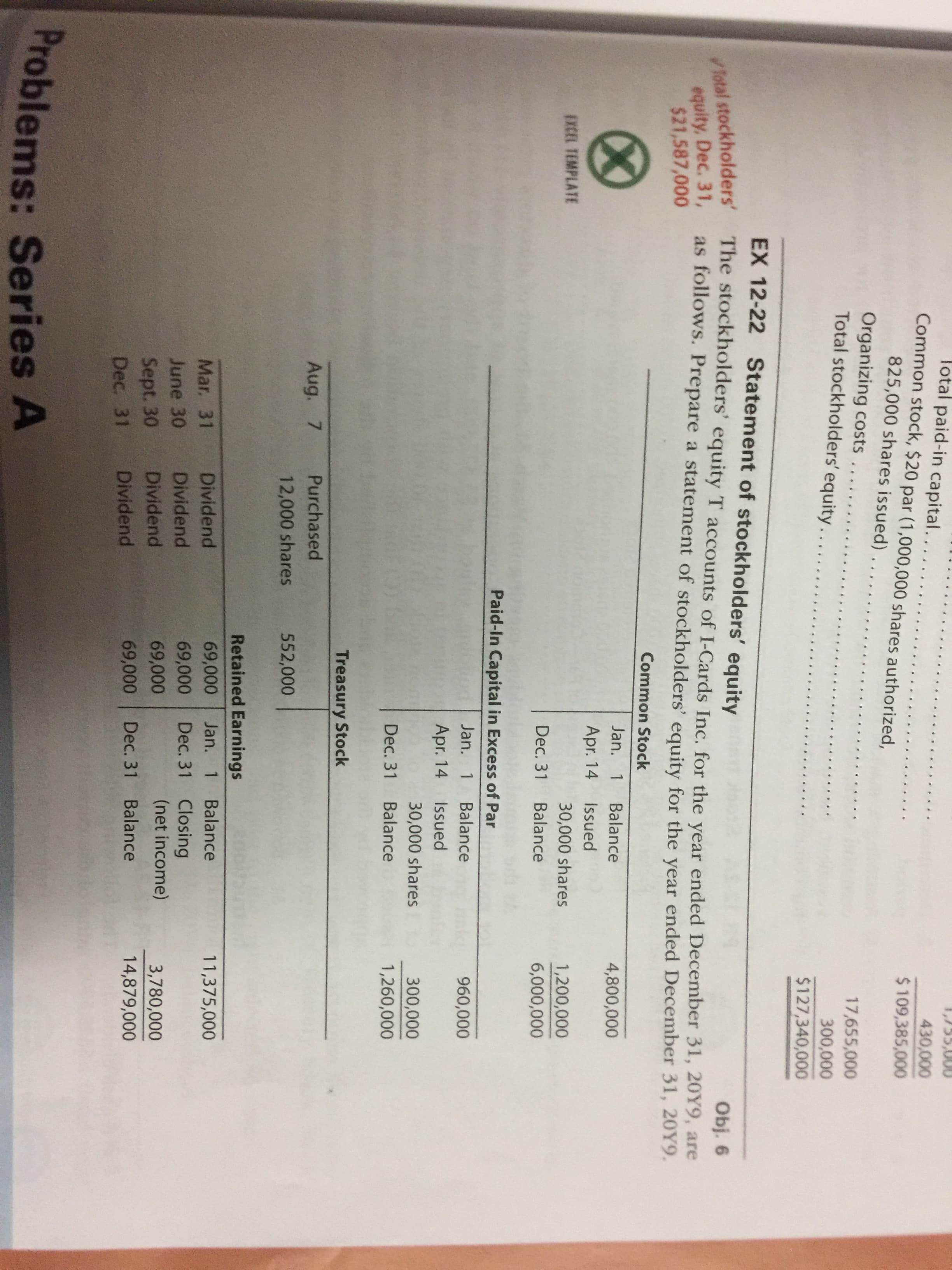

UBJ. 6 tOCknolders' equity T accounts of I-Cards Inc. for the year ended December 31, 20Y9, are as follows. Prepare a statement of stockholders' equity for the year ended December 31, 20Y9. Common Stock Jan. 1 Balance 4,800,000 Apr. 14 Issued 30,000 shares 1,200,000 Dec. 31 Balance 6,000,000 Paid-In Capital in Excess of Par Jan. 1 Balance 960,000 Apr. 14 Issued 30,000 shares 300,000 Dec. 31 Balance 1,260,000 Treasury Stock Aug. 7 Purchased 12,000 shares 552,000 Retained Earnings Mar. 31 Dividend 69,000 Jan. 1 Balance 11,375,000 Dec. 31 Closing (net income) June 30 Dividend 69,000 Sept. 30 Dividend 69,000 3,780,000 Dec. 31 Dividend 69,000 Dec. 31 Balance 14,879,000

UBJ. 6 tOCknolders' equity T accounts of I-Cards Inc. for the year ended December 31, 20Y9, are as follows. Prepare a statement of stockholders' equity for the year ended December 31, 20Y9. Common Stock Jan. 1 Balance 4,800,000 Apr. 14 Issued 30,000 shares 1,200,000 Dec. 31 Balance 6,000,000 Paid-In Capital in Excess of Par Jan. 1 Balance 960,000 Apr. 14 Issued 30,000 shares 300,000 Dec. 31 Balance 1,260,000 Treasury Stock Aug. 7 Purchased 12,000 shares 552,000 Retained Earnings Mar. 31 Dividend 69,000 Jan. 1 Balance 11,375,000 Dec. 31 Closing (net income) June 30 Dividend 69,000 Sept. 30 Dividend 69,000 3,780,000 Dec. 31 Dividend 69,000 Dec. 31 Balance 14,879,000

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 22E: Statement of stockholders equity The stockholders equity T accounts of I-Cards Inc. for the year...

Related questions

Question

How do i do EX 12-22?

Transcribed Image Text:UBJ. 6

tOCknolders' equity T accounts of I-Cards Inc. for the year ended December 31, 20Y9, are

as follows. Prepare a statement of stockholders' equity for the year ended December 31, 20Y9.

Common Stock

Jan. 1

Balance

4,800,000

Apr. 14

Issued

30,000 shares

1,200,000

Dec. 31 Balance

6,000,000

Paid-In Capital in Excess of Par

Jan. 1

Balance

960,000

Apr. 14

Issued

30,000 shares

300,000

Dec. 31 Balance

1,260,000

Treasury Stock

Aug. 7

Purchased

12,000 shares

552,000

Retained Earnings

Mar. 31

Dividend

69,000

Jan. 1 Balance

11,375,000

Dec. 31 Closing

(net income)

June 30

Dividend

69,000

Sept. 30

Dividend

69,000

3,780,000

Dec. 31

Dividend

69,000

Dec. 31 Balance

14,879,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning