ula or a financial calculator to ra • not round intermediate cale for $80 a share (the stock pays 50 (current income on this secu ote has a $1,000 par value and

ula or a financial calculator to ra • not round intermediate cale for $80 a share (the stock pays 50 (current income on this secu ote has a $1,000 par value and

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter12: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 2FPE

Related questions

Question

Transcribed Image Text:***

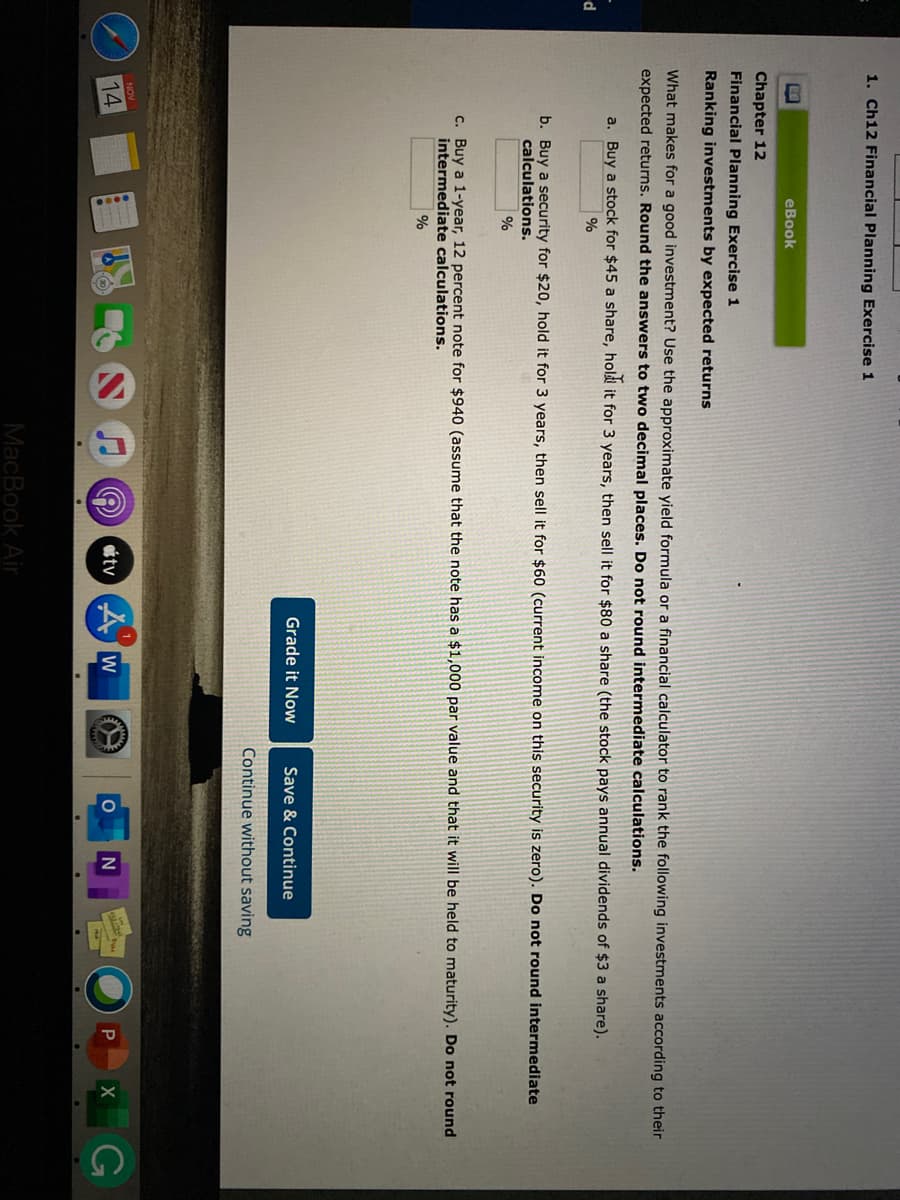

1. Ch12 Financial Planning Exercise 1

eBook

Chapter 12

Financial Planning Exercise 1

Ranking investments by expected returns

What makes for a good investment? Use the approximate yield formula or a financial calculator to rank the following investments according to their

expected returns. Round the answers to two decimal places. Do not round intermediate calculations.

a. Buy a stock for $45 a share, hold it for 3 years, then sell it for $80 a share (the stock pays annual dividends of $3 a share).

d

b. Buy a security for $20, hold it for 3 years, then sell it for $60 (current income on this security is zero). Do not round intermediate

calculations.

%

c. Buy a 1-year, 12 percent note for $940 (assume that the note has a $1,000 par value and that it will be held to maturity). Do not round

intermediate calculations.

Grade it Now

Save & Continue

Continue without saving

NOV

14

O Ctv A W

MacBook Air

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning