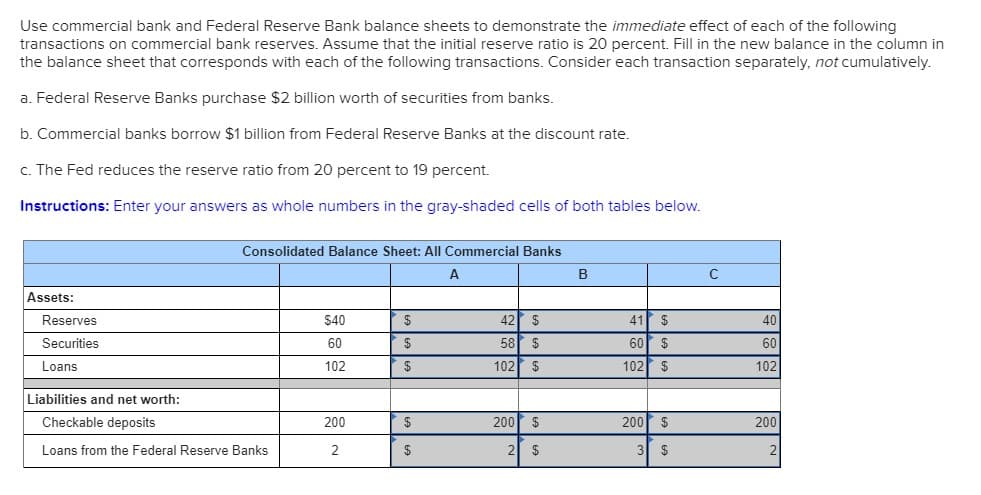

Use commercial bank and Federal Reserve Bank balance sheets to demonstrate the immediate effect of each of the following transactions on commercial bank reserves. Assume that the initial reserve ratio is 20 percent. Fill in the new balance in the column in the balance sheet that corresponds with each of the following transactions. Consider each transaction separately, not cumulatively. a. Federal Reserve Banks purchase $2 billion worth of securities from banks b. Commercial banks borrow $1 billion from Federal Reserve Banks at the discount rate. c. The Fed reduces the reserve ratio from 20 percent to 19 percent. Instructions: Enter your answers as whole numbers in the gray-shaded cells of both tables below. Consolidated Balance Sheet: All Commercial Banks A B C Assets 42 $ 41 $ Reserves $40 40 58 $ Securities 60 $ 60 $ 60 102 $ 102 $ Loans 102 $ 102 Liabilities and net worth: Checkable deposits 200 $ 200 $ 200 $ 200 3 $ Loans from the Federal Reserve Banks 2 2 $ 2 Consolidated Balance Sheet: 12 Federal Reserve Banks Assets: 285$ 283 $ Securities $283 $ 283 2 S Loans to commercial banks 21 2 $ Liabilities and net worth: Reserves of commercial banks 40 42 41 40 5 $ 5 $ Treasury deposits $ 5 225 S 225 $ Federal Reserve Notes 225 225 15 S 15 $ Other liabilities and net worth 15 $ 15 d. Commercial banks increase their reserves after the Fed increases the interest rate it pays on reserves. Which of the columns above could represent this action?

Use commercial bank and Federal Reserve Bank balance sheets to demonstrate the immediate effect of each of the following transactions on commercial bank reserves. Assume that the initial reserve ratio is 20 percent. Fill in the new balance in the column in the balance sheet that corresponds with each of the following transactions. Consider each transaction separately, not cumulatively. a. Federal Reserve Banks purchase $2 billion worth of securities from banks b. Commercial banks borrow $1 billion from Federal Reserve Banks at the discount rate. c. The Fed reduces the reserve ratio from 20 percent to 19 percent. Instructions: Enter your answers as whole numbers in the gray-shaded cells of both tables below. Consolidated Balance Sheet: All Commercial Banks A B C Assets 42 $ 41 $ Reserves $40 40 58 $ Securities 60 $ 60 $ 60 102 $ 102 $ Loans 102 $ 102 Liabilities and net worth: Checkable deposits 200 $ 200 $ 200 $ 200 3 $ Loans from the Federal Reserve Banks 2 2 $ 2 Consolidated Balance Sheet: 12 Federal Reserve Banks Assets: 285$ 283 $ Securities $283 $ 283 2 S Loans to commercial banks 21 2 $ Liabilities and net worth: Reserves of commercial banks 40 42 41 40 5 $ 5 $ Treasury deposits $ 5 225 S 225 $ Federal Reserve Notes 225 225 15 S 15 $ Other liabilities and net worth 15 $ 15 d. Commercial banks increase their reserves after the Fed increases the interest rate it pays on reserves. Which of the columns above could represent this action?

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter11: The Monetary System

Section: Chapter Questions

Problem 2PA

Related questions

Question

Commercial banks increase their reserves after the Fed increases the interest rate it pays on reserves. Which of the columns above could represent this action?

Transcribed Image Text:Use commercial bank and Federal Reserve Bank balance sheets to demonstrate the immediate effect of each of the following

transactions on commercial bank reserves. Assume that the initial reserve ratio is 20 percent. Fill in the new balance in the column in

the balance sheet that corresponds with each of the following transactions. Consider each transaction separately, not cumulatively.

a. Federal Reserve Banks purchase $2 billion worth of securities from banks

b. Commercial banks borrow $1 billion from Federal Reserve Banks at the discount rate.

c. The Fed reduces the reserve ratio from 20 percent to 19 percent.

Instructions: Enter your answers as whole numbers in the gray-shaded cells of both tables below.

Consolidated Balance Sheet: All Commercial Banks

A

B

C

Assets

42 $

41 $

Reserves

$40

40

58 $

Securities

60

$

60

$

60

102 $

102 $

Loans

102

$

102

Liabilities and net worth:

Checkable deposits

200 $

200 $

200

$

200

3 $

Loans from the Federal Reserve Banks

2

2

$

2

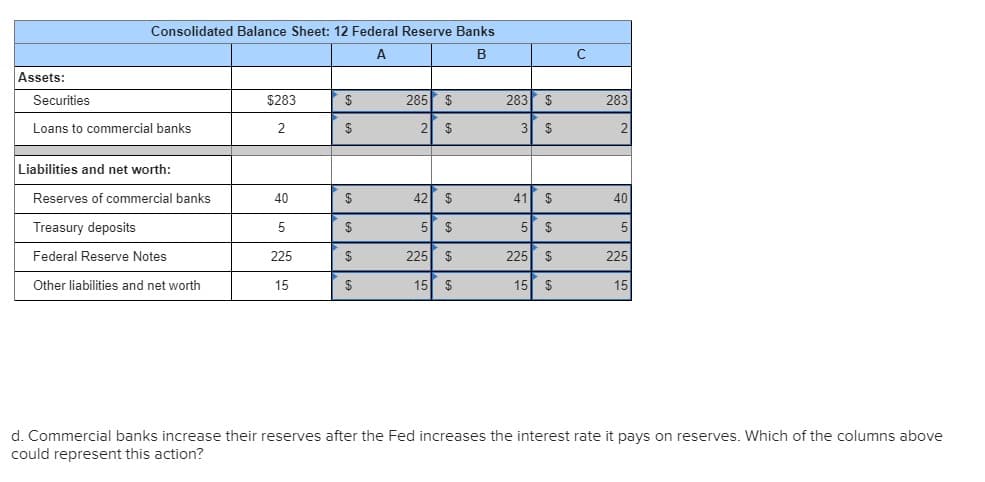

Transcribed Image Text:Consolidated Balance Sheet: 12 Federal Reserve Banks

Assets:

285$

283 $

Securities

$283

$

283

2 S

Loans to commercial banks

21

2

$

Liabilities and net worth:

Reserves of commercial banks

40

42

41

40

5 $

5 $

Treasury deposits

$

5

225 S

225 $

Federal Reserve Notes

225

225

15 S

15 $

Other liabilities and net worth

15

$

15

d. Commercial banks increase their reserves after the Fed increases the interest rate it pays on reserves. Which of the columns above

could represent this action?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning