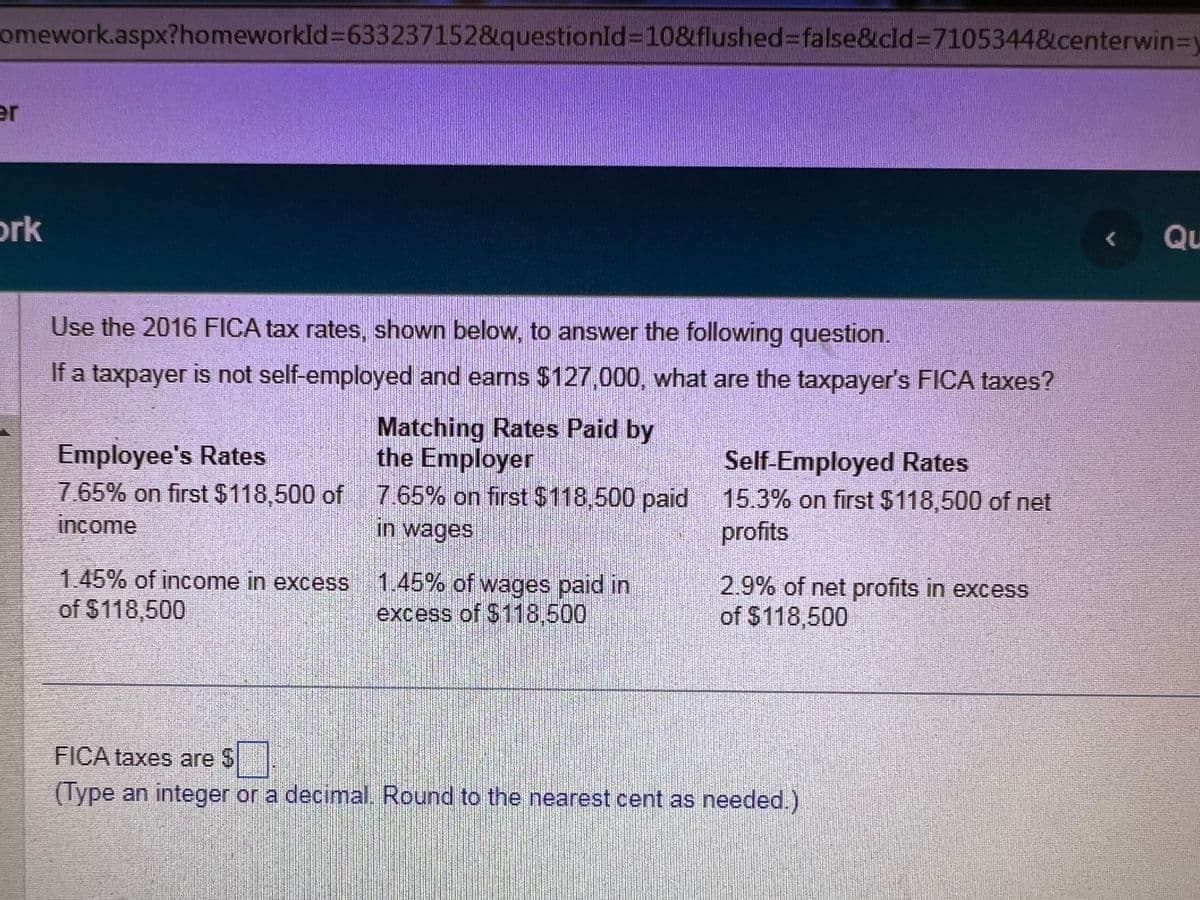

Use the 2016 FICA tax rates, shown below, to answer the following question. If a taxpayer is not self-employed and earns $127,000, what are the taxpayer's FICA taxes? Matching Rates Paid by the Employer 7.65% on first $118,500 paid in wages Employee's Rates 7.65% on first $118,500 of income 1.45% of income in excess of $118,500 1.45% of wages paid in excess of $118,500 Self-Employed Rates 15.3% on first $118,500 of net profits 2.9% of net profits in excess of $118,500 FICA taxes are $ (Type an integer or a decimal. Round to the nearest cent as needed.)

Use the 2016 FICA tax rates, shown below, to answer the following question. If a taxpayer is not self-employed and earns $127,000, what are the taxpayer's FICA taxes? Matching Rates Paid by the Employer 7.65% on first $118,500 paid in wages Employee's Rates 7.65% on first $118,500 of income 1.45% of income in excess of $118,500 1.45% of wages paid in excess of $118,500 Self-Employed Rates 15.3% on first $118,500 of net profits 2.9% of net profits in excess of $118,500 FICA taxes are $ (Type an integer or a decimal. Round to the nearest cent as needed.)

Chapter5: Unemployment Compensation Taxes

Section: Chapter Questions

Problem 11QR

Related questions

Question

Transcribed Image Text:omework.aspx?homeworkId=633237152&questionId=10&flushed=false&cld=7105344¢erwin-y

er

ork

Use the 2016 FICA tax rates, shown below, to answer the following question.

If a taxpayer is not self-employed and earns $127,000, what are the taxpayer's FICA taxes?

Matching Rates Paid by

the Employer

Employee's Rates

7.65% on first $118,500 of 7.65% on first $118,500 paid

income

in wages

1.45% of income in excess 1.45% of wages paid in

of $118,500

excess of $118,500

Self-Employed Rates

15.3% on first $118,500 of net

profits

2.9% of net profits in excess

of $118,500

FICA taxes are $

(Type an integer or a decimal. Round to the nearest cent as needed.)

Qu

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT