Use the attached information to complete the ratio analysis. The Ratio Analysis is for Profitability.

Use the attached information to complete the ratio analysis. The Ratio Analysis is for Profitability.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter7: Analysis Of Financial Statements

Section: Chapter Questions

Problem 1Q: Define each of the following terms:

Liquidity ratios: current ratio; quick, or acid test,...

Related questions

Question

Use the attached information to complete the ratio analysis. The Ratio Analysis is for Profitability.

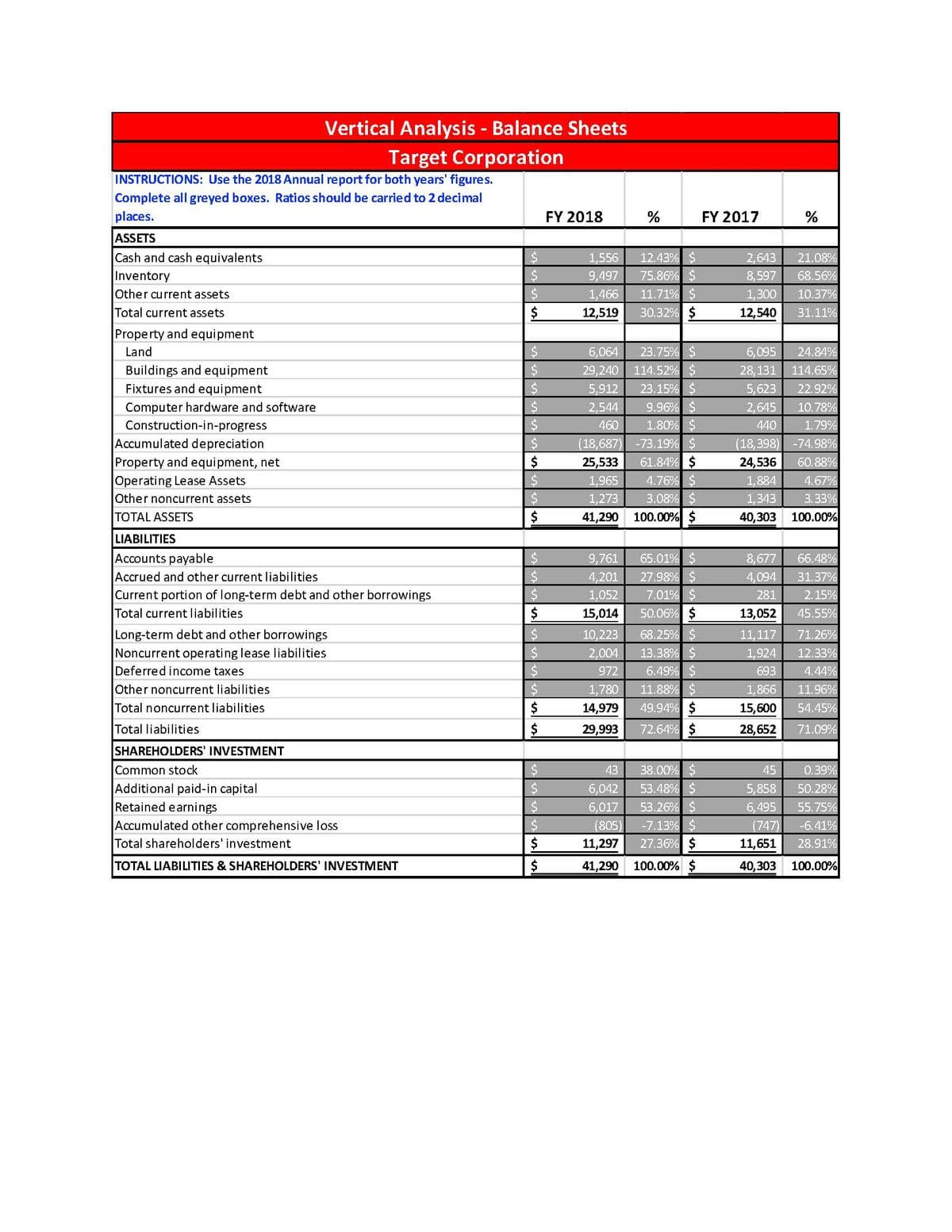

Transcribed Image Text:Vertical Analysis - Balance Sheets

Target Corporation

INSTRUCTIONS: Use the 2018 Annual report for both years' figures.

Complete all greyed boxes. Ratios should be carried to 2 decimal

places.

FY 2018

FY 2017

ASSETS

Cash and cash equivalents

12.43% $

75.86% $

1,556

2,643

21.08%

8,597

68.56%

Inventory

Other current assets

9,497

11.71% $

30.32% $

1,466

1,300

10.37%

Total current assets

12,519

12,540

31.11%

Property and equipment

Land

6,064

23.75% $

6,095

24.84%

29,240 114.52% $

23.15% $

9.96% $

1.80% $

-73.19% $

61.84% $

4.76% $

3.08% $

Buildings and equipment

28,131

114.65%

Fixtures and equipment

5,912

5,623

22.92%

Computer hardware and software

2,544

2,645

10.78%

Construction-in-progress

460

440

1.79%

Accumulated depreciation

Property and equipment, net

Operating Lease Assets

Other noncurrent assets

(18,687)

(18,398)

-74.98%

25,533

60.88%

24,536

1,884

1,965

4.67%

1,273

1,343

3.33%

TOTAL ASSETS

41,290

100.00% $

40,303 100.00%

LIABILITIES

Accounts payable

Accrued and other current liabilities

Current portion of long-term debt and other borrowings

Total current liabilities

65.01% $

27.98% $

7.01% $

50.06% $

8,677

66.48%

9,761

4,201

4,094

31.37%

1,052

281

2.15%

15,014

13,052

45.55%

Long-term debt and other borrowings

Noncurrent operating lease liabilities

Deferred income taxes

68.25% $

13.38% $

6.49% $

11.88% $

10,223

11,117

71.26%

2,004

1,924

12.33%

972

693

4.44%

Other noncurrent liabilities

1,780

1,866

11.96%

Total noncurrent liabilities

$4

14,979

49.94% $

15,600

54.45%

Total liabilities

29,993

72.64% $

28,652

71.09%

SHAREHOLDERS' INVESTMENT

38.00% $

53.48% $

53.26% $

Common stock

43

45

0.39%

Additional paid-in capital

Retained earnings

Accumulated other comprehensive loss

Total shareholders' investment

6,042

5,858

50.28%

6,017

6,495

55.75%

-7.13% $

27.36% $

(805)

(747)

-6.41%

11,297

11,651

28.91%

TOTAL LIABILITIES & SHAREHOLDERS' INVESTMENT

$

41,290

100.00% $

40,303

100.00%

%24

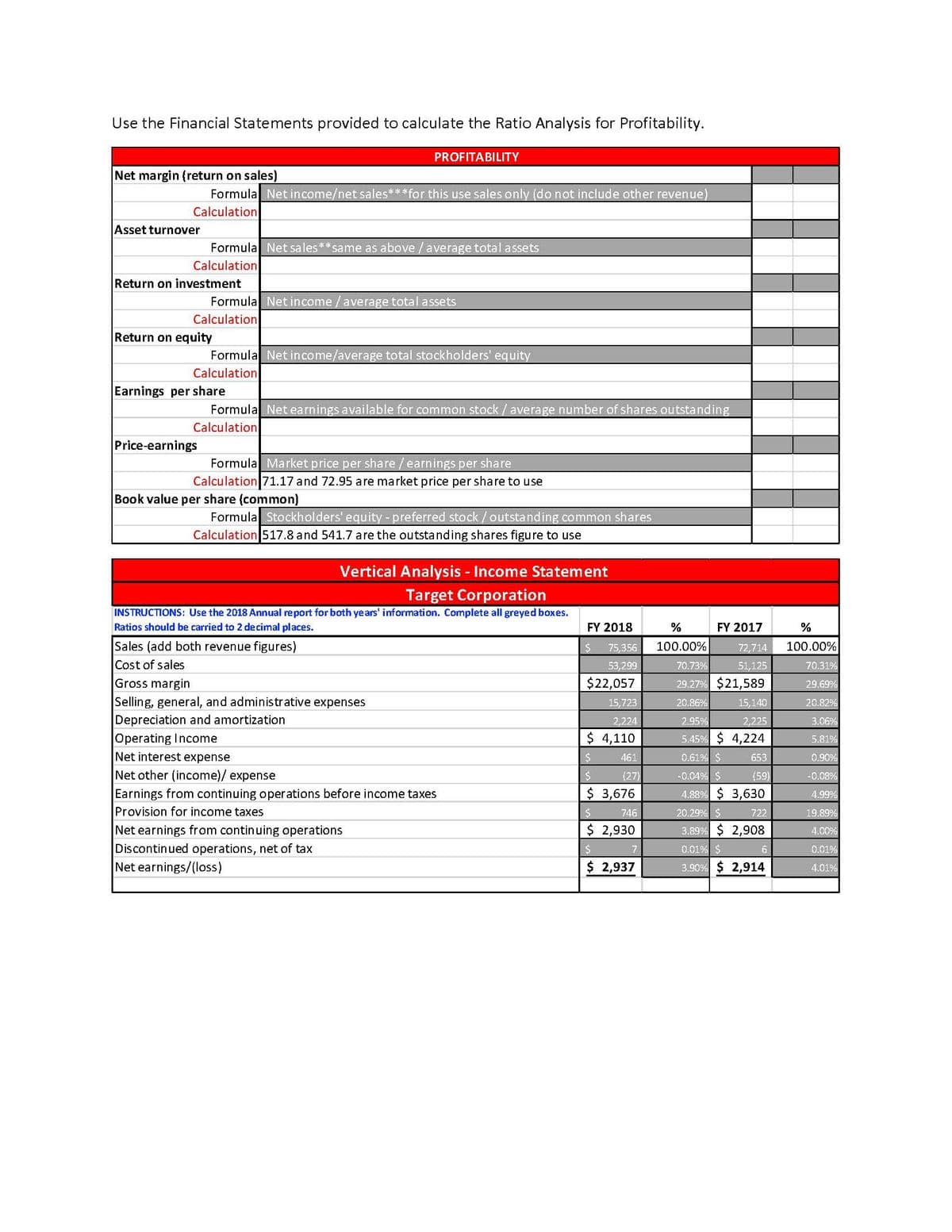

Transcribed Image Text:Use the Financial Statements provided to calculate the Ratio Analysis for Profitability.

PROFITABILITY

Net margin (return on sales)

Formula Net income/net sales***for this use sales only (do not include other revenue)

Calculation

Asset turnover

Formula Net sales**same as above /average total assets

Calculation

Return on investment

Formula Net income /average total assets

Calculation

Return on equity

Formula Net income/average total stockholders' equity

Calculation

Earnings per share

Formula Net earnings available for common stock /average number of shares outstanding

Calculation

Price-earnings

Formula Market price per share /earnings per share

Calculation 71.17 and 72.95 are market price per share to use

Book value per share (common)

Formula Stockholders' equity - preferred stock/outstanding common shares

Calculation 517.8 and 541.7 are the outstanding shares figure to use

Vertical Analysis - Income Statement

Target Corporation

INSTRUCTIONS: Use the 2018 Annual report for both years' information. Complete all greyed boxes.

Ratios should be carried to 2 de cimal places.

FY 2018

%

FY 2017

%

Sales (add both revenue figures)

24

75,356

100.00%

72,714

100.00%

Cost of sales

Gross margin

Selling, general, and administrative expenses

Depreciation and amortization

Operating Income

Net interest expense

Net other (income)/ expense

Earnings from continuing operations before income taxes

Provision for income taxes

53,299

70.73%

51,125

70.31%

$22,057

29.27% $21,589

29.69%

15,723

20.86%

20.82%

15,140

2,224

2.95%

2,225

3.06%

$ 4,110

5.45% $ 4,224

5.81%

461

0.61% $

653

0.90%

(27)

-0.04% $

(59)

-0.08%

$ 3,676

4.88% $ 3,630

4.99%

746

20.29% $

722

19.89%

$ 2,930

Net earnings from continuing operations

Discontinued operations, net of tax

Net earnings/(loss)

3.89%

2,908

4.00%

0.01% $

6

0.01%

$ 2,937

3.90% $ 2,914

4.01%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage