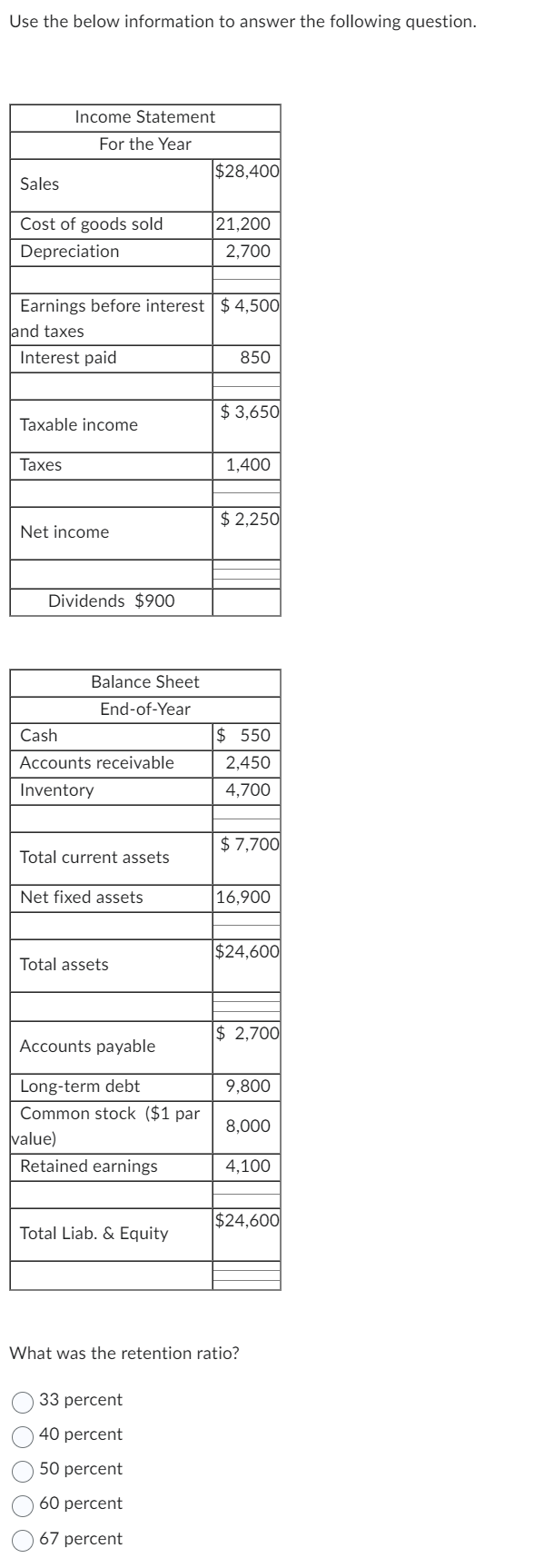

Use the below information to answer the following question. Sales Cost of goods sold Depreciation Income Statement For the Year Taxable income Taxes Earnings before interest $4,500 and taxes Interest paid Net income Dividends $900 Balance Sheet End-of-Year Cash Accounts receivable Inventory Total current assets Net fixed assets Total assets Accounts payable Long-term debt Common stock ($1 par value) Retained earnings O O O O Total Liab. & Equity 33 percent 40 percent $28,400 50 percent 21,200 2,700 60 percent 67 percent 850 $3,650 1,400 $2,250 $ 550 2,450 4,700 $7,700 16,900 $24,600 $ 2,700 What was the retention ratio? 9,800 8,000 4,100 $24,600

Use the below information to answer the following question. Sales Cost of goods sold Depreciation Income Statement For the Year Taxable income Taxes Earnings before interest $4,500 and taxes Interest paid Net income Dividends $900 Balance Sheet End-of-Year Cash Accounts receivable Inventory Total current assets Net fixed assets Total assets Accounts payable Long-term debt Common stock ($1 par value) Retained earnings O O O O Total Liab. & Equity 33 percent 40 percent $28,400 50 percent 21,200 2,700 60 percent 67 percent 850 $3,650 1,400 $2,250 $ 550 2,450 4,700 $7,700 16,900 $24,600 $ 2,700 What was the retention ratio? 9,800 8,000 4,100 $24,600

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.4.2MBA: Return on assets The following data (in millions) were adapted from recent financial statements of...

Related questions

Question

Transcribed Image Text:Use the below information to answer the following question.

Sales

Cost of goods sold

Depreciation

Income Statement

For the Year

Taxable income

Taxes

Earnings before interest $4,500

and taxes

Interest paid

Net income

Dividends $900

Balance Sheet

End-of-Year

Cash

Accounts receivable

Inventory

Total current assets

Net fixed assets

Total assets

Accounts payable

Long-term debt

Common stock ($1 par

value)

Retained earnings

O O O O

Total Liab. & Equity

33 percent

40 percent

50 percent

$28,400

60 percent

21,200

2,700

67 percent

850

$3,650

1,400

$2,250

$550

2,450

4,700

$7,700

What was the retention ratio?

16,900

$24,600

$ 2,700

9,800

8,000

4,100

$24,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT