Use the information provided below to calculate the following. Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. 5.1.1 Payback Period (expressed in years, months and days) 5.1.2 Accounting Rate of Return, on average investment (expressed to two decimal places) 5.1.3 Internal Rate of Return (expressed to two decimal places) INFORMATION Redd Ltd intends purchasing a machine. The following details relate to this machine: Purchase price R1 200 000 Expected useful life 4 years Minimum required rate of return 12% Scrap value RO Depreciation Straight-line method Net profit per year. 1 year R40 000 2nd year R100 000 3rd vear R130 000

Use the information provided below to calculate the following. Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. 5.1.1 Payback Period (expressed in years, months and days) 5.1.2 Accounting Rate of Return, on average investment (expressed to two decimal places) 5.1.3 Internal Rate of Return (expressed to two decimal places) INFORMATION Redd Ltd intends purchasing a machine. The following details relate to this machine: Purchase price R1 200 000 Expected useful life 4 years Minimum required rate of return 12% Scrap value RO Depreciation Straight-line method Net profit per year. 1 year R40 000 2nd year R100 000 3rd vear R130 000

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter14: Valuation: Market-based Approach

Section: Chapter Questions

Problem 20PC

Related questions

Question

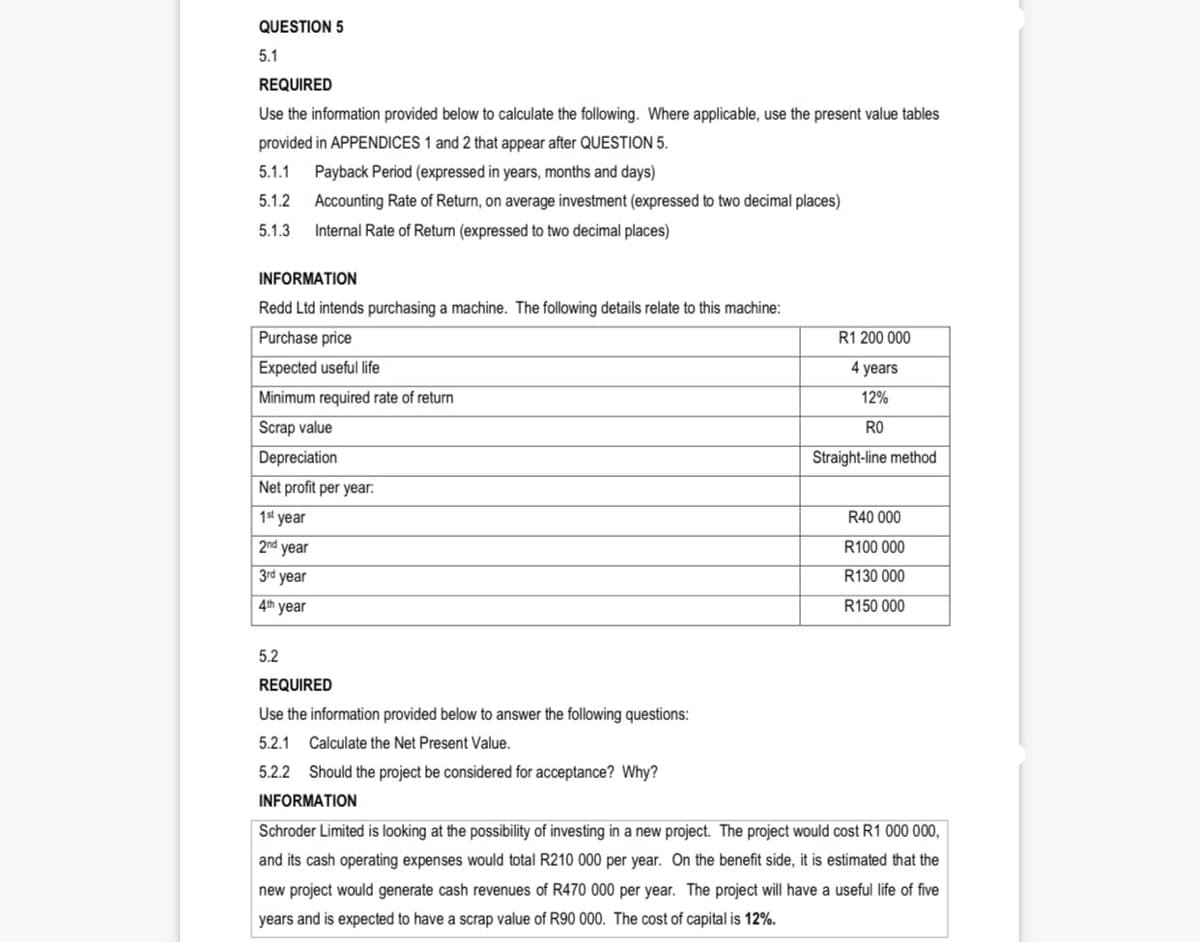

Transcribed Image Text:QUESTION 5

5.1

REQUIRED

Use the information provided below to calculate the following. Where applicable, use the present value tables

provided in APPENDICES 1 and 2 that appear after QUESTION 5.

5.1.1

Payback Period (expressed in years, months and days)

5.1.2

Accounting Rate of Return, on average investment (expressed to two decimal places)

5.1.3

Internal Rate of Return (expressed to two decimal places)

INFORMATION

Redd Ltd intends purchasing a machine. The following details relate to this machine:

Purchase price

R1 200 000

Expected useful life

4 years

Minimum required rate of return

12%

Scrap value

RO

Depreciation

Straight-line method

Net profit per year:

1st year

R40 000

2nd year

R100 000

3rd year

R130 000

4th year

R150 000

5.2

REQUIRED

Use the information provided below to answer the following questions:

5.2.1

Calculate the Net Present Value.

5.2.2 Should the project be considered for acceptance? Why?

INFORMATION

Schroder Limited is looking at the possibility of investing in a new project. The project would cost R1 000 000,

and its cash operating expenses would total R210 000 per year. On the benefit side, it is estimated that the

new project would generate cash revenues of R470 000 per year. The project will have a useful life of five

years and is expected to have a scrap value of R90 000. The cost of capital is 12%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning