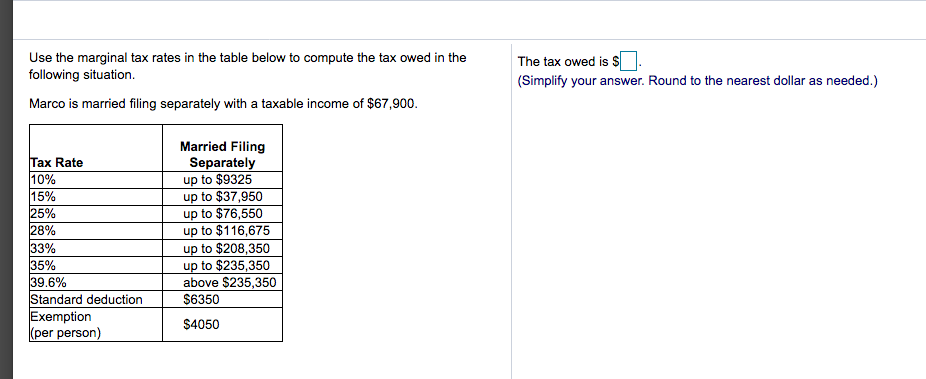

Use the marginal tax rates in the table below to compute the tax owed in the following situation. The tax owed is S (Simplify your answer. Round to the nearest dollar as needed.) Marco is married filing separately with a taxable income of $67,900. Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Married Filing Separately up to $9325 up to $37,950 up to $76,550 up to $116,675 up to $208,350 up to $235,350 above $235,350 $6350 $4050

Use the marginal tax rates in the table below to compute the tax owed in the following situation. The tax owed is S (Simplify your answer. Round to the nearest dollar as needed.) Marco is married filing separately with a taxable income of $67,900. Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Married Filing Separately up to $9325 up to $37,950 up to $76,550 up to $116,675 up to $208,350 up to $235,350 above $235,350 $6350 $4050

Chapter2: Gross Income And Exclusions

Section: Chapter Questions

Problem 34MCQ: Dana and Larry are married and live in Texas. Dana earns a salary of $45,000 and Larry has $25,000...

Related questions

Question

Transcribed Image Text:Use the marginal tax rates in the table below to compute the tax owed in the

following situation.

The tax owed is S

(Simplify your answer. Round to the nearest dollar as needed.)

Marco is married filing separately with a taxable income of $67,900.

Tax Rate

10%

15%

25%

28%

33%

35%

39.6%

Standard deduction

Exemption

(per person)

Married Filing

Separately

up to $9325

up to $37,950

up to $76,550

up to $116,675

up to $208,350

up to $235,350

above $235,350

$6350

$4050

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT