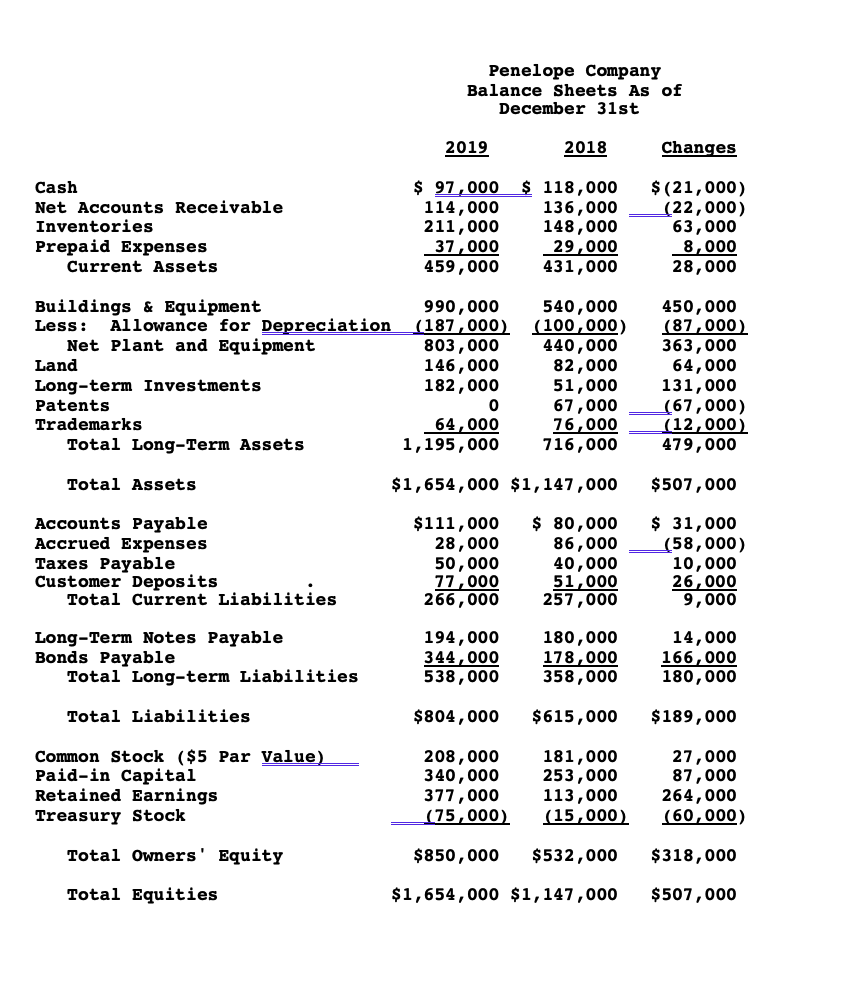

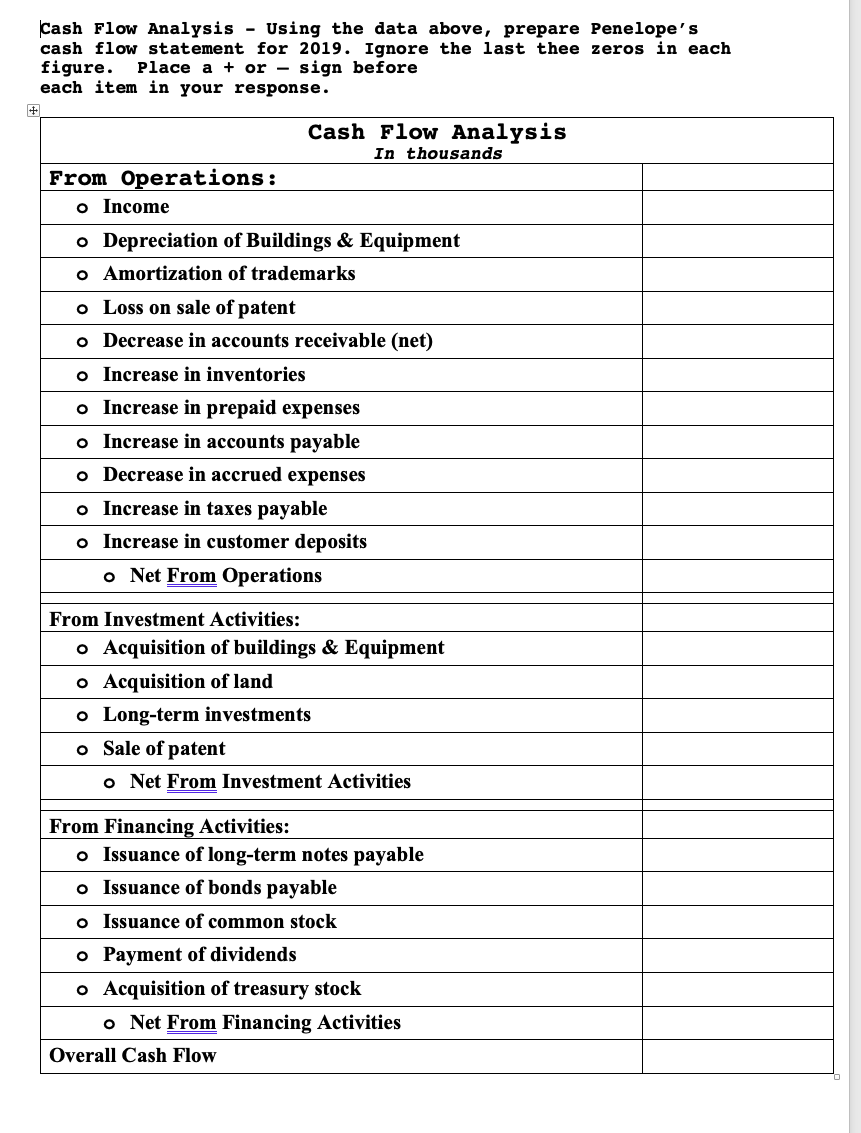

Using the financial statements and notes provided below, prepare a cash flow analysis for the Penelope Company for 2019. Penelope Company Income Statement For the Year Ended December 31, 2019 Revenues $2,467,000 Cost of Goods Sold 1,285,000 Gross Margin 1,182,000 Operating Expenses: Selling Expenses 230,000 Administrative Expenses 94,000 Depreciation 15,000 Total Operating Expenses 339,000 Operating Income 843,000 Other Items: Loss on Sale of Patent (11,000) Interest Expense (42,000) Other Items (53,000) Net Income Before Taxes 790,000 Taxes 316,000 Net Income After Taxes $474,000 A review of the notes to the financial statements revealed the following information: Dividends of $210,000 were declared and paid during the year. Selling Expenses include charges of $10,000 for the amortization of trademarks. During 2019 the company sold the only patent that had been reflected on its balance sheet at the beginning of the year. Hint: Consider the beginning balance in the Patent account and the loss on the sale in entering a figure on the cash flow statement. The total depreciation reflected on the income statement amounted to $87,000. Factory-related depreciation of $72,000 is included within cost of goods sold. Note Ignore the last three zeros at the end of each figure in completing this problem. For example, express the net income after taxes of $474,000 as simply +474 in your cash flow statement.

Using the financial statements and notes provided below,

prepare a cash flow analysis for the Penelope Company for 2019.

Penelope Company

Income Statement

For the Year Ended December 31, 2019

Revenues $2,467,000

Cost of Goods Sold 1,285,000

Gross Margin 1,182,000

Operating Expenses:

Selling Expenses 230,000

Administrative Expenses 94,000

Total Operating Expenses 339,000

Operating Income 843,000

Other Items:

Loss on Sale of Patent (11,000)

Interest Expense (42,000)

Other Items (53,000)

Net Income Before Taxes 790,000

Taxes 316,000

Net Income After Taxes $474,000

A review of the notes to the financial statements revealed the

following information:

- Dividends of $210,000 were declared and paid during the year.

- Selling Expenses include charges of $10,000 for the

amortization of trademarks.

- During 2019 the company sold the only patent that had been

reflected on its balance sheet at the beginning of the year.

Hint: Consider the beginning balance in the Patent account and the

loss on the sale in entering a figure on the cash flow statement.

The total depreciation reflected on the income statement

amounted to $87,000. Factory-related depreciation of

$72,000 is included within cost of goods sold.

Note

Ignore the last three zeros at the end of each figure in completing this problem. For example, express the net income after taxes of $474,000 as simply +474 in your cash flow statement.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images