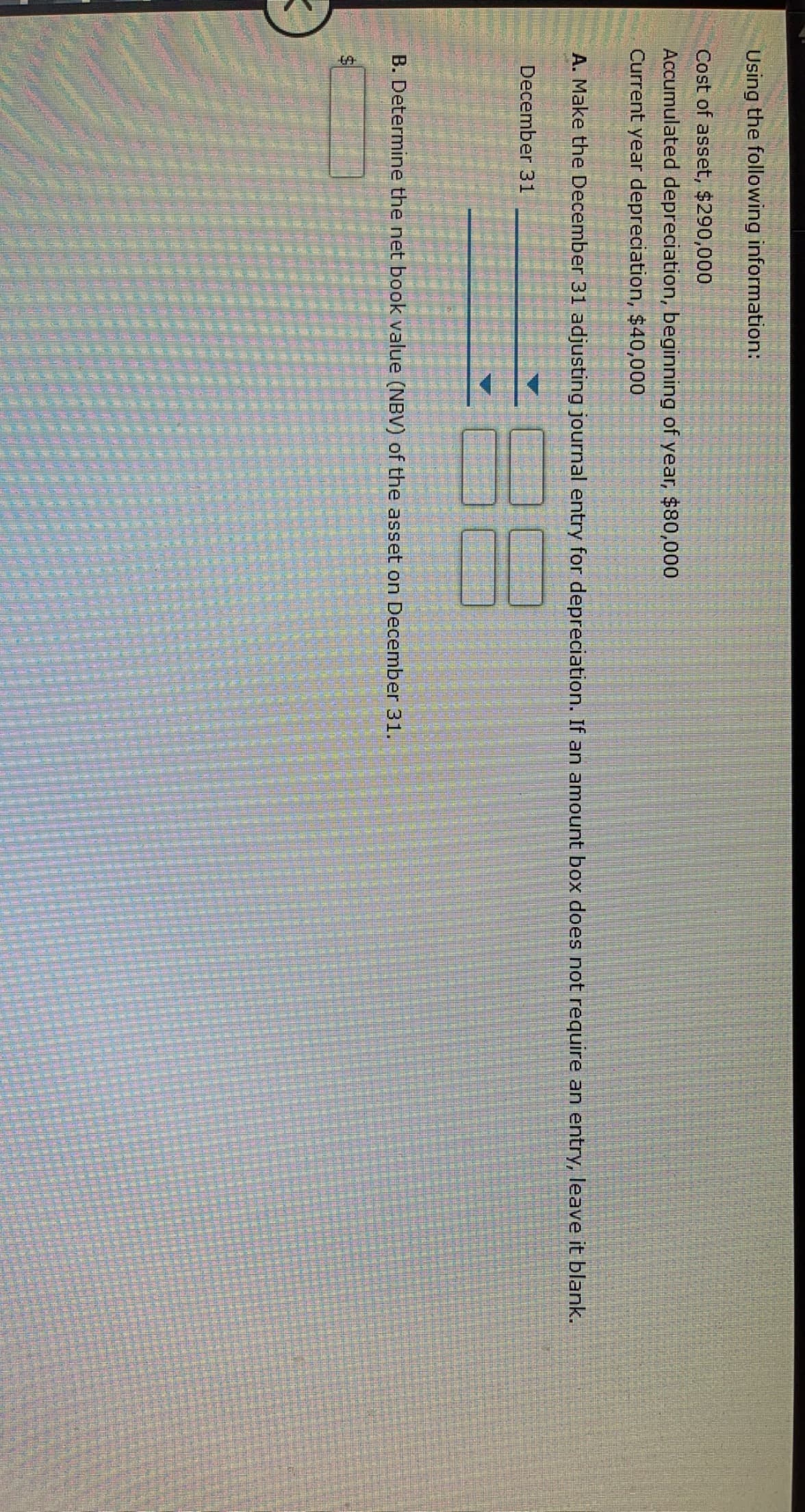

Using the following information: Cost of asset, $290,000 Accumulated depreciation, beginning of year, $80,000 Current year depreciation, $40,000 A. Make the December 31 adjusting journal entry for depreciation. If an amount box does not require an entry, leave it blank. December 31 B. Determine the net book value (NBV) of the asset on December 31.

Using the following information: Cost of asset, $290,000 Accumulated depreciation, beginning of year, $80,000 Current year depreciation, $40,000 A. Make the December 31 adjusting journal entry for depreciation. If an amount box does not require an entry, leave it blank. December 31 B. Determine the net book value (NBV) of the asset on December 31.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 2CE

Related questions

Question

Transcribed Image Text:Using the following information:

Cost of asset, $290,000

Accumulated depreciation, beginning of year, $80,000

Current year depreciation, $40,000

A. Make the December 31 adjusting journal entry for depreciation. If an amount box does not require an entry, leave it blank.

December 31

B. Determine the net book value (NBV) of the asset on December 31.

Expert Solution

Introduction

Depreciation expense is an expense which is charged on fixed assets like machinery, building and equipment over the useful years and different depreciation methods are there to calculate depreciation like straight line method, double declining balance method and units of production.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT