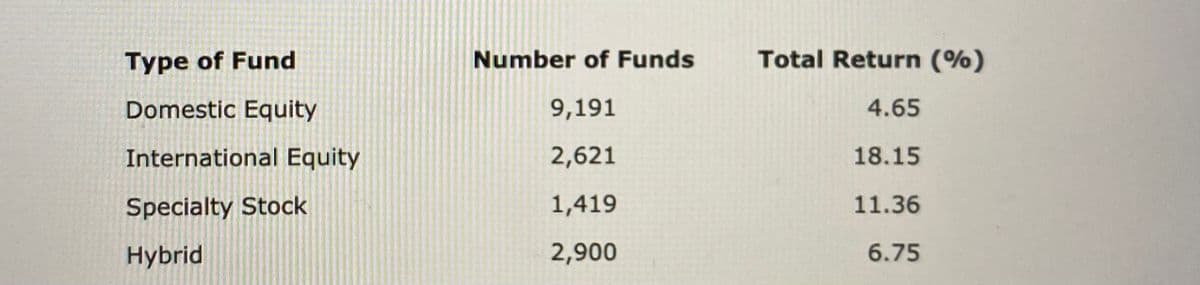

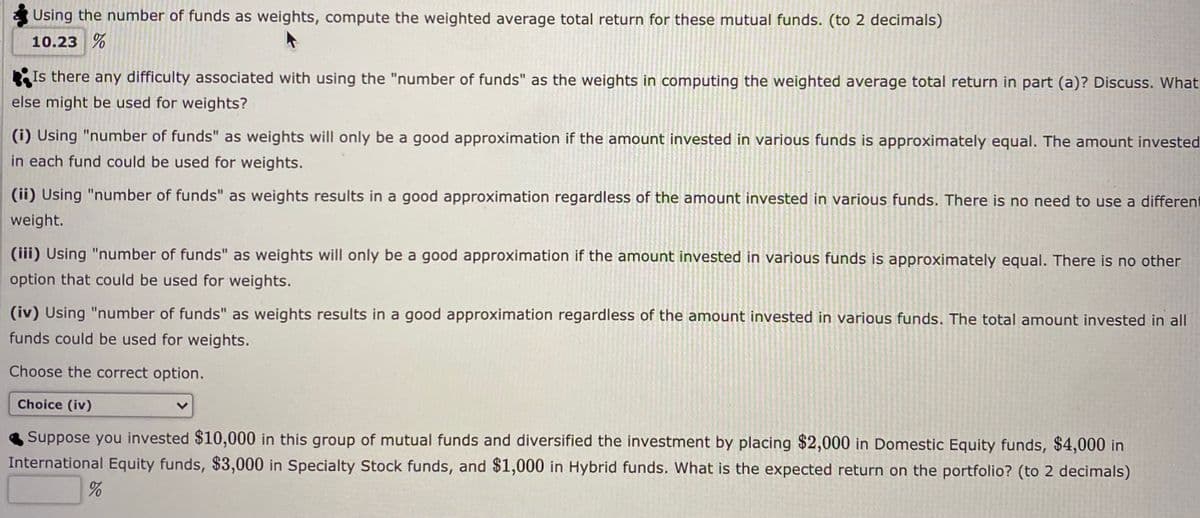

Using the number of funds as weights, compute the weighted average total return for these mutual funds. (to 2 decimals) 10.23 % Is there any difficulty associated with using the "number of funds" as the weights in computing the weighted average total return in part (a)? Discuss. What else might be used for weights? (i) Using "number of funds" as weights will only be a good approximation if the amount invested in various funds is approximately equal. The amount investec in each fund could be used for weights. (ii) Using "number of funds" as weights results in a good approximation regardless of the amount invested in various funds. There is no need to use a differen veight. (iii) Using "number of funds" as weights will only be a good approximation if the amount invested in various funds is approximately equal. There is no other ption that could be used for weights. (iv) Using "number of funds" as weights results in a good approximation regardless of the amount invested in various funds. The total amount invested in all Funds could be used for weights. Choose the correct option. Choice (iv) A Suppose you invested $10,000 in this group of mutual funds and diversified the investment by placing $2,000 in Domestic Equity funds, $4,000 in Enternational Equity funds, $3,000 in Specialty Stock funds, and $1,000 in Hybrid funds. What is the expected return on the portfolio? (to 2 decimals)

Correlation

Correlation defines a relationship between two independent variables. It tells the degree to which variables move in relation to each other. When two sets of data are related to each other, there is a correlation between them.

Linear Correlation

A correlation is used to determine the relationships between numerical and categorical variables. In other words, it is an indicator of how things are connected to one another. The correlation analysis is the study of how variables are related.

Regression Analysis

Regression analysis is a statistical method in which it estimates the relationship between a dependent variable and one or more independent variable. In simple terms dependent variable is called as outcome variable and independent variable is called as predictors. Regression analysis is one of the methods to find the trends in data. The independent variable used in Regression analysis is named Predictor variable. It offers data of an associated dependent variable regarding a particular outcome.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps