ussions Question 10 --/1 erences View Policies aborations Current Attempt in Progress eyPLUS Support Mussatto Corporation produces snowboards. The following per unit cost information is available: direct materials $18, direct labor $14, variable manufacturing overhead $9, fixed manufacturing overhead $11, variable selling and administrative expenses $6, and fixed selling and administrative expenses $12. Using a 35% markup percentage on total per unit cost, compute the target selling price. (Round answer to 2 decimal places, e g. 10.50.) Central ce 365 dges zza Target selling price $ 845 PM 11/18/2019 hp foll ins prt sc n2 home delete end 144 + num backspace lock P 7 home

ussions Question 10 --/1 erences View Policies aborations Current Attempt in Progress eyPLUS Support Mussatto Corporation produces snowboards. The following per unit cost information is available: direct materials $18, direct labor $14, variable manufacturing overhead $9, fixed manufacturing overhead $11, variable selling and administrative expenses $6, and fixed selling and administrative expenses $12. Using a 35% markup percentage on total per unit cost, compute the target selling price. (Round answer to 2 decimal places, e g. 10.50.) Central ce 365 dges zza Target selling price $ 845 PM 11/18/2019 hp foll ins prt sc n2 home delete end 144 + num backspace lock P 7 home

Chapter6: Activity-based, Variable, And Absorption Costing

Section: Chapter Questions

Problem 14EB: Crafts 4 All has these costs associated with production of 12,000 units of accessory products:...

Related questions

Question

Transcribed Image Text:ussions

Question 10

--/1

erences

View Policies

aborations

Current Attempt in Progress

eyPLUS Support

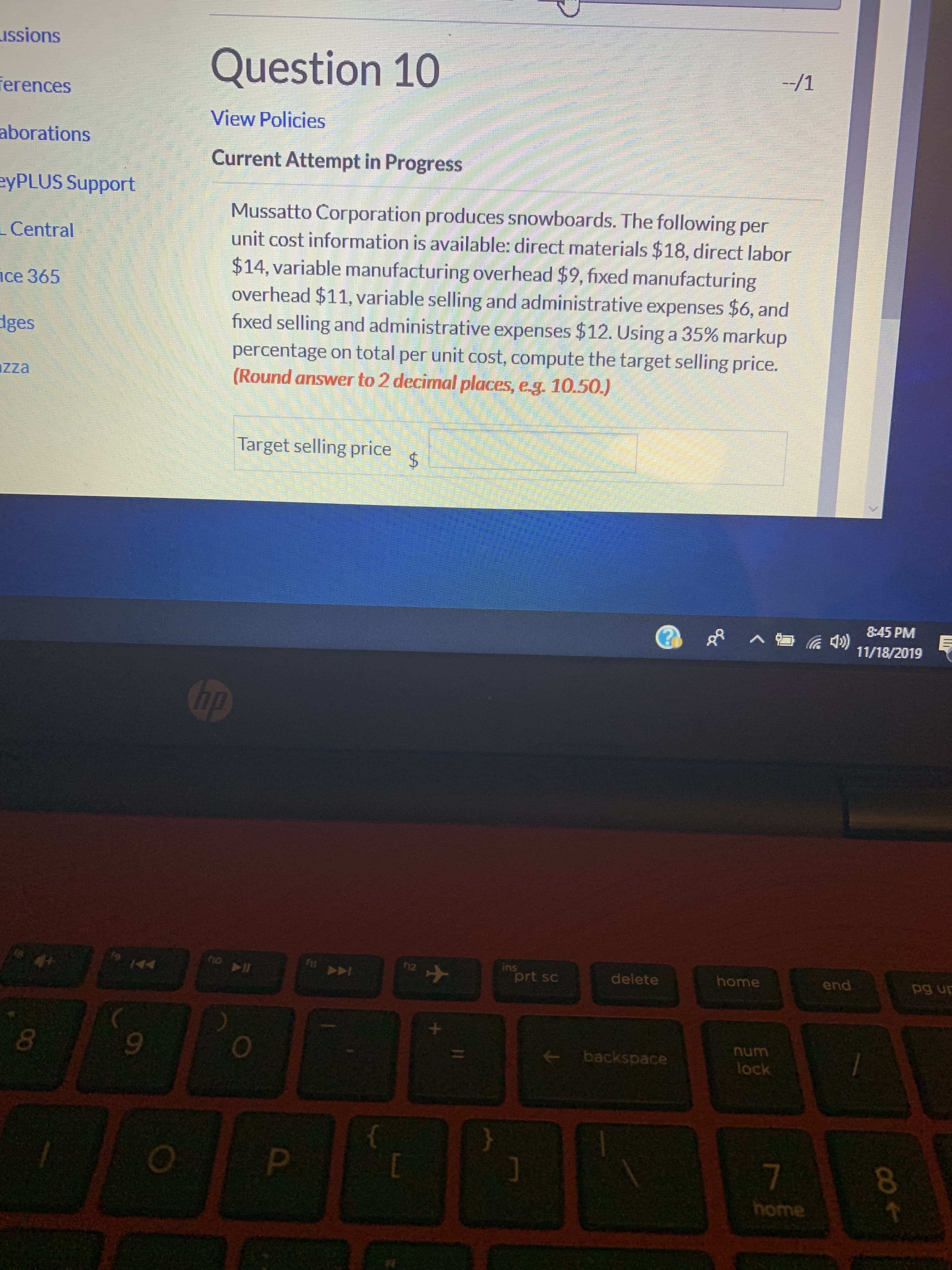

Mussatto Corporation produces snowboards. The following per

unit cost information is available: direct materials $18, direct labor

$14, variable manufacturing overhead $9, fixed manufacturing

overhead $11, variable selling and administrative expenses $6, and

fixed selling and administrative expenses $12. Using a 35% markup

percentage on total per unit cost, compute the target selling price.

(Round answer to 2 decimal places, e g. 10.50.)

Central

ce 365

dges

zza

Target selling price

$

845 PM

11/18/2019

hp

foll

ins

prt sc

n2

home

delete

end

144

+

num

backspace

lock

P

7

home

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning