V FIGURE A.8 Strong Product Demand (50%) Average Product Demand (20%) $2,000,000 · $1,200,000 Property is Leased (20%) Property Is Not $400,000 Weak Product Demand (30%) Lease New Facility Leased (80%) $100,000 2 Do not Lease New Facility $200,000 Property is Leased (20% ) Property Is Not $1,800,000 Lease New Facility Strong Product Demand (50%) Average Product Weak Product Demand (30%) Leased (80%) $1,200,000 3 Do not Lease New Facility $1,300,000 Demand (20%) $900,000 · $400,000 Do Not Expand Facility Facility puadx3

V FIGURE A.8 Strong Product Demand (50%) Average Product Demand (20%) $2,000,000 · $1,200,000 Property is Leased (20%) Property Is Not $400,000 Weak Product Demand (30%) Lease New Facility Leased (80%) $100,000 2 Do not Lease New Facility $200,000 Property is Leased (20% ) Property Is Not $1,800,000 Lease New Facility Strong Product Demand (50%) Average Product Weak Product Demand (30%) Leased (80%) $1,200,000 3 Do not Lease New Facility $1,300,000 Demand (20%) $900,000 · $400,000 Do Not Expand Facility Facility puadx3

Purchasing and Supply Chain Management

6th Edition

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

ChapterC: Cases

Section: Chapter Questions

Problem 5.3SD: Scenario 4 Sharon Gillespie, a new buyer at Visionex, Inc., was reviewing quotations for a tooling...

Related questions

Question

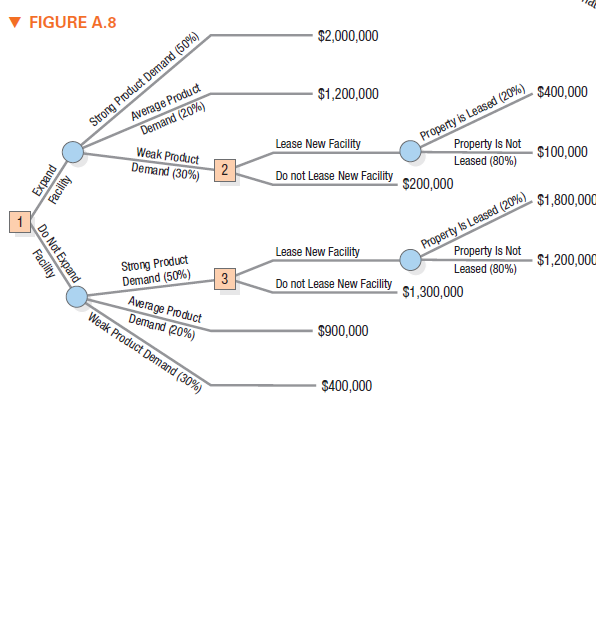

The owner of Pearl Automotive Dealers is trying to decide whether to expand his current facility. If he expands and customer demand turns weak, there is a chance he could lease part of his newly constructed facility to another dealer.

If he doesn’t expand and strong demand occurs, he could attempt to lease another facility across town. Analyze the decision tree in Figure A8. What is the best set of decisions and the expected payoff?

Transcribed Image Text:V FIGURE A.8

Strong Product Demand (50%)

Average Product

Demand (20%)

$2,000,000

· $1,200,000

Property is Leased (20%)

Property Is Not

$400,000

Weak Product

Demand (30%)

Lease New Facility

Leased (80%)

$100,000

2

Do not Lease New Facility

$200,000

Property is Leased (20% )

Property Is Not

$1,800,000

Lease New Facility

Strong Product

Demand (50%)

Average Product

Weak Product Demand (30%)

Leased (80%)

$1,200,000

3

Do not Lease New Facility $1,300,000

Demand (20%)

$900,000

· $400,000

Do Not Expand

Facility

Facility

puadx3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning