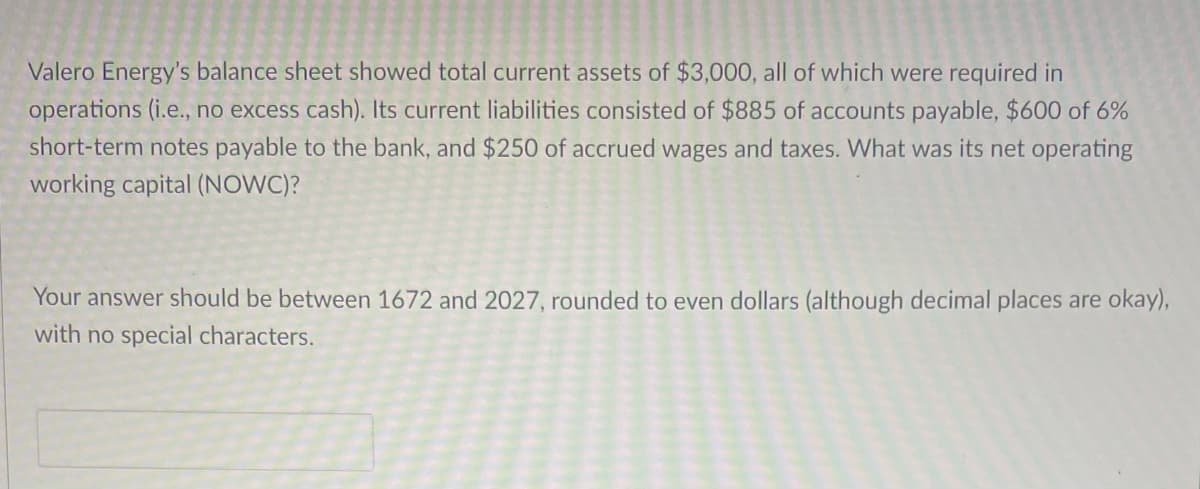

Valero Energy's balance sheet showed total current assets of $3,000, all of which were required in operations (i.e., no excess cash). Its current liabilities consisted of $885 of accounts payable, $600 of 6% short-term notes payable to the bank, and $250 of accrued wages and taxes. What was its net operating working capital (NOWC)?

Q: What rate compounded monthly will yield the effective rate 19.75%?

A: The effective annual rate (u) is 19.75%. The compounding period (m) is 12.

Q: Francis wants to start a foundation that will pay its beneficiaries $64,000 per year forever, with…

A: The concept of money's time worth states that any sum today is worth more than its worth in the…

Q: The book value for year 2, (in $) Round to the nearest two (2) decimal places Add your answer

A: In a double declining balance depreciation, the depreciation rate will be accelerated and be applied…

Q: Read the article. The question is Remy is trying to decide if he should rent or buy. He is…

A: In this case we need to guide the Remy regarding housing decision whether he should opt to buy the…

Q: Find the payment that should be used for the annuity due whose future value is given. Assume that…

A: The annuity is a set of payments made in exchange for a lump sum payment. It is widely used in…

Q: A 182-day, $110,000 face value treasury bill was issued 88 days ago when yields were 0.75%. If the…

A: The government issues Treasury bills, which are short-term money market instruments with guaranteed…

Q: Find the monthly house payments necessary to amortize a 7.2% loan of $222,000 over 15 years. The…

A: An example of debt is a loan. Borrowers agree to repay the lender with interest over a predetermined…

Q: a b) Create a replicate portfolio using bonds A, B, and C to replicate cashflows from bond D. Is…

A: The replicating portfolio using Bonds A, B and C that give the same cash flow as bond D is as…

Q: BULLOCK GOLD MINING Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine…

A: The act of analyzing and evaluating an investment/project's feasibility and profitability is…

Q: Given that company’s cost of capital is 30% and that the amount

A: The payback period of the project is the period within which initial investments is generally…

Q: ( ² ), ^² = ( ² ). 12 3 respectively, does the price of an asset with returns Consider two assets:…

A: The no-arbitrage property states that the price of an asset must be equal to the expected value of…

Q: You want to have $51,000 in your savings account 9 years from now, and you're prepared to make equal…

A: Payment per period is the regular payments made or received of an investment, while future value is…

Q: Dimi regrets that he didn’t buy stocks. He thinks it would be better to buy a stock of Air…

A: We have to create a portfolio of long stock and short call. We need to find the payoff for a range…

Q: How much federal tax will a single person who earns $435,000 pay? $126,794 $47,843 $225,575 $209,425

A: Taxable income is income on which tax is determined and levied on the basis of the tax rate. This…

Q: 3. Deontay Jenkins LLC Engineering firm borrowed $100,000 to purchase a new AC unit the building.…

A: Loans are paid by the annual payments and these annual payments carry the payment for interest and…

Q: 3. A company needs to decide if it will move forward with 2 new products that it is evaluating. The…

A: STEP 1 NPV NPV stands for Net Present Value. According to the NPV rule, all projects should be…

Q: Suppose an investor shorts a straddle (a call option + a put option with the same strike price) with…

A: We can use the Black-Scholes formula to calculate the theoretical values of the call and put options…

Q: Ajinkya Electronic Systems, a company in India that manufacturers many different electronic…

A: A firm has several suppliers. Purchases from each supplier is subjected to VAT, however VAT rates…

Q: Sonova Corporation has an operating income (EBIT) of $215,000 and a 40% tax rate. The firm has…

A: The operating profit (EBIT) is $215,000. The tax rate is 40%. The short term is $115,000 and…

Q: A new employee charged $6740 on his credit card to relocate for his first job. After noticing that…

A: Monthly payments refer to the amount that is paid every month for the repayment of the loan amount…

Q: Morgan Weatherspoon, a super salesman contemplating retirement on his fifty-fifth birthday, decides…

A: Formula = Marginal contribution to the fund = Balance of fund / cumulative FV value The balance…

Q: Jack Frat Burger Shack reported 2022 net income of $11 million and depreciation of $3,500,000. The…

A: STEP 1 The portion of a company's cash flow statement titled "cash flow from operations" shows how…

Q: You bought a stock for $76.81 and sold it after 4 years for $100.37. What is the average compound…

A: Compound annual growth rate (CAGR) is the average return on the investment which is there for more…

Q: The existence of a bank is argued by her transformation functions. One typical bank product is a…

A: Banks and financial institutions are pillars of the financial system. They are intermediaries that…

Q: The Gecko Company and the Gordon Company are two firms that have the same business risk but…

A: Dividend is the part or share of profits which is being distributed to shareholders. Several models…

Q: 1. Mr. Santos would like to have P6,500,000 in his account by the end of 6 years. How much should he…

A:

Q: The financial information below is for Mat Moery, who works as an administrative assistant in a law…

A: Networth is calculated as Assets - Liabilities. Revenue and expenses do not form part of the…

Q: Suppose you have just purchased your first home for $550,000. At the time of purchase you could only…

A: Mortgage amortization is the process of paying off a mortgage loan in regular installments over a…

Q: 5. You are a fixed income trader at Goldman Sachs. You purchase $1,000,000 in face value of a bond…

A: The amount of face value of the Treasury security to be sold to hedge the interest rate risk of the…

Q: An insurance company is offering a new policy to its customers. Typically the policy is bought by a…

A:

Q: Yosemite Corporation has an outstanding debt of $10.19 million on which it pays a 6 percent fixed…

A: Interest rate swaps are forward arrangements that involve the trade-off of one future flow of…

Q: a) You purchase 516 shares of ABC Co. stock on margin at a price of $37. Your broker requires you to…

A: STEP 1 MARGIN CALL A margin call is a notification from the brokerage business that the amount of…

Q: You are interested in buying a piece of real estate property that could be worth $490,000 in four…

A: Present Value refers to a concept that states the discounted value or say value at today's time of…

Q: b. Jamie wants to have $2,000,000 for her retirement in 25 years. How much should she save annually…

A: An annuity is a set of equal payments made at a set rate over a predetermined amount of time.…

Q: Reuben has the option of receiving a loan of $13,625 for 8 years at an interest rate of either 4.73%…

A: Future value, FV = P(1+r/k)^n*k Where P is the loan value. r= rate. k = compounding n= number of…

Q: This question is about futures risk premia. Consider a two period economy.You can buy stocks in…

A: The expected return on this trading strategy would be equal to the risk-free rate, as the investment…

Q: What is the present value of the asset being leased? Recommendation: Your Answer: Answer draw a…

A: Let us calculate the present value as given. Present Value =$30000×1-1(1+7%)57%×(1+7%) +…

Q: Can you please write out the equations

A: Present value of annuity is the current value of the future payments that are calculated using the…

Q: What are the sources of gains for bondholders Interest payments Dividends Stock split Capital gains

A: Bondholders An investor or the owner of debt instruments, which are frequently issued by…

Q: Assuming an inflationary economy, the future value interest factor is O always greater than 1.0. O…

A: Time Value of Money states that a dollar earned today is more valuable than any time in the future,…

Q: Answer No. 2

A: a. For an investment to reach Php1,000,000 to Php1,001,000 at a 2% simple interest rate, the formula…

Q: Hamad Corporation's total sales for 2022 were AED 800 million, and gross profit was AED 100 million,…

A: Ratio analysis is a method of evaluating a company's financial performance by comparing different…

Q: publishing company delivered textbooks worth $43,000 to a college bookstore. The invoice is dated…

A: Companies gives discount to the customers so that they pay cash payment and they pay early and this…

Q: A transportation company is considering adding new busses for its transit system. The total cost of…

A: Fair price per trip depends on the cost of purchase of Bus and cost of finance of Bus and also other…

Q: Assume that $500 million of Power’s long-term debt is due and the board of directors are meeting to…

A: Altman Z-score is a numerical value that determines the likelihood of a company getting bankrupt.…

Q: Banks are regulated by e.g. Basel-II or -III-rules. a) Please name the reason why the Basel accords…

A: The Basel II Accord, the second of the three Basel Accords, was established to establish global…

Q: If a company's required rate of return is 8%, and in using the profitability index method, a…

A: The profitability index (PI) is a financial metric used to evaluate investment opportunities by…

Q: A firm is expected to have free cash flows of $50 million this year (FCF1=$50m). Free cash flows are…

A: The free cash flow valuation method is one of the techniques that entities employ to value their…

Q: The company with the common equity accounts shown here has declared a 4-for-1 stock split. The…

A: STEP 1 The total of a company's declared dividends issued for each outstanding share of its common…

Q: (i) (ii) (iii) Calculate the annual rates of return for the five years ending in 2018. Calculate the…

A: To determine the annual rates of return we need to use the formula below for each year. Annual…

Net operating working capital is the difference between a company's current assets (excluding cash and cash equivalents) and its current liabilities and represents the funds that are tied up in the company's daily operations. It measures a company's ability to meet its short-term obligations and is an important indicator of financial health and stability. A positive net operating working capital means the company has enough liquid assets to pay off its short-term debts, while a negative value signals a potential risk of default.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Vigo Vacations has $200 million in total assets, $5 million in notes payable, and $25 million in long-term debt. What is the debt ratio?BB Incorporated had the following balances of assets and liabilities in 2022: Beginning balances: Cash and cash equivalents P250,000 Accounts payable P120,000 Trade and other receivables 150,000 Notes payable 80,000 Inventories 210,000 Bonds payable 200,000 Prepaid expenses 50,000 Mortgage payable 240,000 Property, plant and equipment - net 350,000 Ending balances: Cash and cash equivalents P230,000 Accounts payable P100,000 Trade and other receivables 250,000 Notes payable 60,000 Inventories 300,000 Bonds payable 170,000 Prepaid expenses 40,000 Mortgage payable 240,000 Property, plant and equipment - net 300,000 How much is the net income in 2022?The net changes in the balance sheet accounts of Linda, Inc. for the year 2021 are shown below: Account Debit Credit Cash $ 217,900 Accounts receivable $ 63,100 Allowance for doubtful accounts 11,700 Inventory 195,900 Prepaid expenses 22,300 Long-term investments 147,000 Land 410,000 Buildings 655,000 Machinery 92,000 Office Equipment 30,000 Accumulated depreciation: Buildings 24,500 Machinery 18,100 Office Equipment 15,000 Accounts payable 183,900 Accrued liabilities 75,000 Dividends payable 128,500 Premium on bonds 37,600 Bonds payable 940,000 Preferred stock ($50 par) 74,400 Common stock ($10 par) 160,000 Additional paid-in capital—common 298,400 Retained earnings 67,500 $1,933,900 $1,933,900 Additional information: 1. Net income $165,500 2.…

- The following December 31, 2021, fiscal year-end account balance information is available for the Stonebridge Corporation: Cash and cash equivalents $ 5,000Accounts receivable (net) 20,000Inventory 60,000Property, plant, and equipment (net) 120,000Accounts payable 44,000Salaries payable 15,000Paid-in capital 100,000 The only asset not listed is short-term investments. The only liabilities not listed are $30,000 notes payable due in two years and related accrued interest of $1,000 due in four months. The current ratio at year-end is 1.5:1.Required:Determine the following…The following December 31, 2021, fiscal year-end account balance information is available for the Stonebridge Corporation: Cash and cash equivalents $ 6,400 Accounts receivable (net) 34,000 Inventory 74,000 Property, plant, and equipment (net) 190,000 Accounts payable 53,000 Salaries payable 14,000 Paid-in capital 170,000 The only asset not listed is short-term investments. The only liabilities not listed are $44,000 notes payable due in two years and related accrued interest of $1,000 due in four months. The current ratio at year-end is 1.8:1. Required:Determine the following at December 31, 2021: Total Current Asset? Short Term Investment? Retained Earnings?Positivity Company provided the following information on December 31, 2020 ( in their normal balances): Accounts Receivable- 350,000; Accounts payable - 200,000; Accrued Expenses - 150,000; Building in progress - 500,000; Cash in bank - 200,000; Cash surrender value - 150,000; Merchandise Inventory - 580,000; Office equipment - 200,000; Share Capital - 1,500,000; Accummulated profits - 400,000. Revaluation Surplus - 50,000. What is the total current assets? * 1,780,000 1,280,000 1,130,000 answer not given

- 1.Positivity Company provided the following information on December 31, 2020 ( in their normal balances): Accounts Receivable- 350,000; Accounts payable - 200,000; Accrued Expenses - 150,000; Building in progress - 500,000; Cash in bank - 200,000; Cash surrender value - 150,000; Merchandise Inventory - 580,000; Office equipment - 200,000; Share Capital - 1,500,000; Accummulated profits - 400,000. Revaluation Surplus - 50,000. What is the total current assets? a. 1,780,000 b. 1,280,000 c. 1,130,000 d. answer not given 2. Selected data for ABC Co. for 2020 are as follows: Decrease in merchandise inventory: P20,000 increase in accounts payable: P50,000 Disbursements for purchases of merchandise: P580,000. How much is the 2020 Cost of goods sold? a. P510,000 b. P550,000 c. P610,000 d. P650,000 e. answer not given 3. On May 1, 2020, GAL Co. purchased a short-term P2,000,000 face value, 9% debt instruments for P1,860,000…Valero’s energy’s balance sheet showed total current assets of $3000 all of which were required in operations. It’s current liabilities consists of $905 of accounts payable $600 of 6% short term notes payable to the bank and $250 of acute wages and taxes. What was its net operating working capital?NNR Inc.'s balance sheet showed total current assets of $1,875,000 plus $4,225,000 of net fixed assets. All of these assets were required in operations. The firm's current liabilities consisted of $475,000 of accounts payable, $375,000 of 6% short-term notes payable to the bank, and $150,000 of accrued wages and taxes. Its remaining capital consisted of long-term debt and common equity. What was NNR's total operating capital?

- Carmela Company, as of December 31, 2021 provided the following balances: Cash, net of a P7,000 overdraft 80,000 Receivable, net of customer credit balances totaling P6,000 30,000 Inventory (P20,000 of which are held on consignment) 60,000 Prepayments 10,000 Property, plant and equipment, net of accumulated depreciation of P15,000 90,000 Accounts payable net of debit balances in suppliers’ accounts of P3,000 45,000 Notes payable – bank, due on July 2022 25,000 Income tax payable 15,000 Total current assets reported in the December 31, 2021 balance sheet isSwinnerton Clothing Company's balance sheet showed total current assets of $2,450, all of which were required in operations. Its current liabilities consisted of $550 of accounts payable, $300 of 5% short-term notes payable to the bank, and $165 of accrued wages and taxes. What was its net operating working capital that was financed by investors? Group of answer choices $1,892 $1,659 $1,812 $1,976 $1,735Presented below is the trial balance of Scott Butler Corporation at December 31, 2020. Debit Credit Cash $ 197,000 Sales Revenue $ 8,100,000 Debt Investments (trading) (at cost, $145,000) 153,000 Cost of Goods Sold 4,800,000 Debt Investments (long-term) 299,000 Equity Investments (long-term) 277,000 Notes Payable (short-term) 90,000 Accounts Payable 455,000 Selling Expenses 2,000,000 Investment Revenue 63,000 Land 260,000 Buildings 1,040,000 Dividends Payable 136,000 Accrued Liabilities 96,000 Accounts Receivable 435,000 Accumulated Depreciation—Buildings 152,000 Allowance for Doubtful Accounts 25,000 Administrative Expenses 900,000 Interest Expense 211,000 Inventory 597,000 Gain 80,000 Notes Payable (long-term) 900,000 Equipment 600,000 Bonds Payable 1,000,000 Accumulated Depreciation—Equipment 60,000 Franchises 160,000 Common Stock ($5 par) 1,000,000 Treasury…