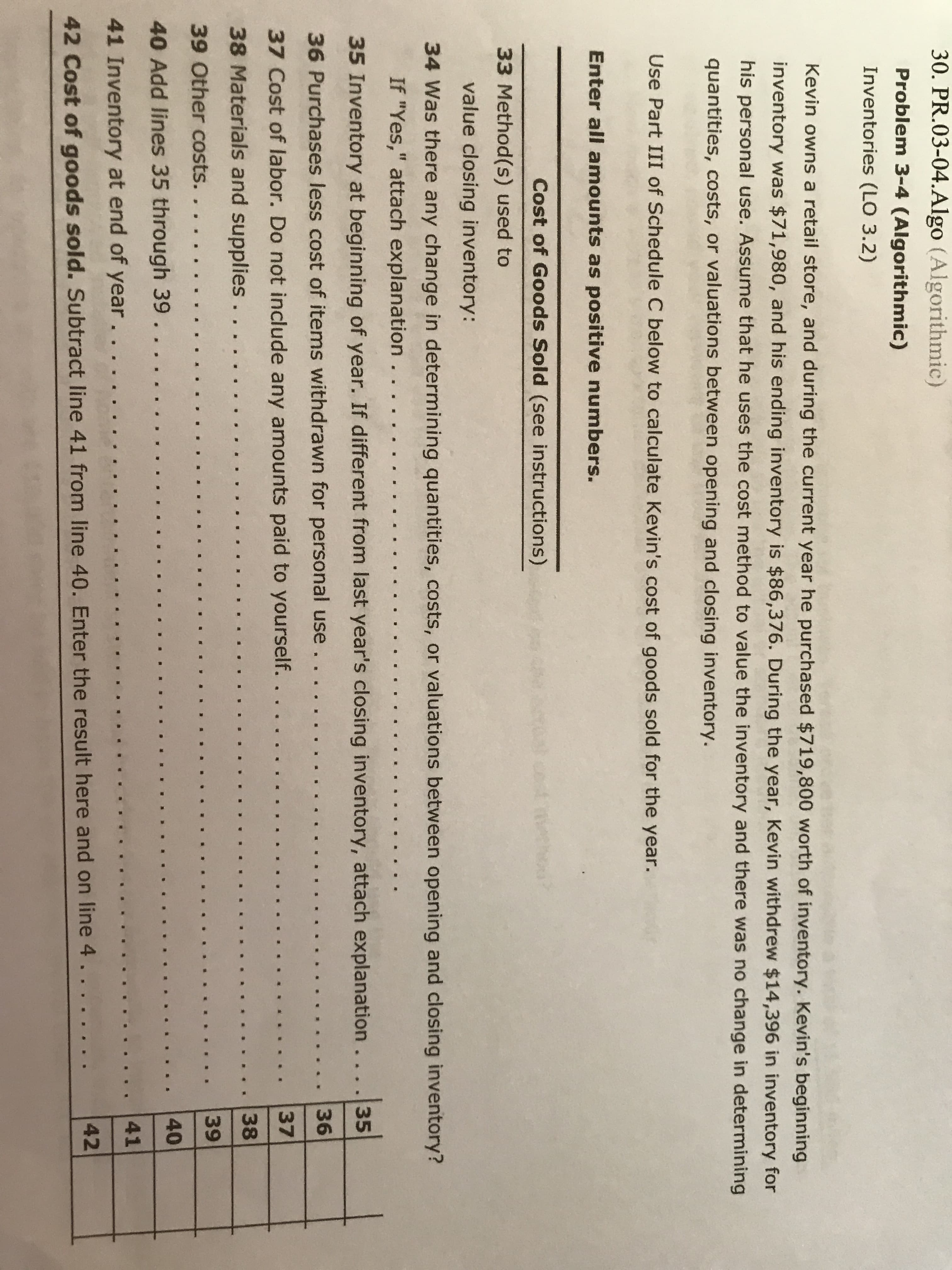

W 30. PR.03-04.Algo (Algorithmic) Problem 3-4 (Algorithmic) Inventories (LO 3.2) Kevin owns a retail store, and during the current year he purchased $719,800 worth of inventory. Kevin's beginning inventory was $71,980, and his ending inventory is $86,376. During the year, Kevin withdrew $14,396 in inventory for his personal use. Assume that he uses the cost method to value the inventory and there was no change in determining quantities, costs, or valuations between opening and closing inventory. Use Part III of Schedule C below to calculate Kevin's cost of goods sold for the year. Enter all amounts as positive numbers. Cost of Goods Sold (see instructions) 33 Method(s) used to value closing inventory: 34 Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If "Yes," attach explanation. .. 35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation... 36 35 36 Purchases less cost of items withdrawn for personal use. . . 37 37 Cost of labor. Do not include any amounts paid to yourself. . . . . 38 38 Materials and supplies . . . . . 39 39 Other costs. ... 40 40 Add lines 35 through 39. . . .. 41 41 Inventory at end of year. . . 42 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 . . . .

W 30. PR.03-04.Algo (Algorithmic) Problem 3-4 (Algorithmic) Inventories (LO 3.2) Kevin owns a retail store, and during the current year he purchased $719,800 worth of inventory. Kevin's beginning inventory was $71,980, and his ending inventory is $86,376. During the year, Kevin withdrew $14,396 in inventory for his personal use. Assume that he uses the cost method to value the inventory and there was no change in determining quantities, costs, or valuations between opening and closing inventory. Use Part III of Schedule C below to calculate Kevin's cost of goods sold for the year. Enter all amounts as positive numbers. Cost of Goods Sold (see instructions) 33 Method(s) used to value closing inventory: 34 Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If "Yes," attach explanation. .. 35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation... 36 35 36 Purchases less cost of items withdrawn for personal use. . . 37 37 Cost of labor. Do not include any amounts paid to yourself. . . . . 38 38 Materials and supplies . . . . . 39 39 Other costs. ... 40 40 Add lines 35 through 39. . . .. 41 41 Inventory at end of year. . . 42 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 . . . .

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 7RE: At the end of Year 1, Herkimer Co. sells two laptops for 1,800 each. Based on the information in...

Related questions

Question

Problem 3-4 (

Inventories (LO 3.2)

Kevin owns a retail store, and during the current year he purchased $719,800 worth of inventory. Kevin's beginning inventory was $71,980, and his ending inventory is $86,376. During the year, Kevin withdrew $14,396 in inventory for his personal use. Assume that he uses the cost method to value the inventory and there was no change in determining quantities, costs, or valuations between opening and closing inventory.

Use Part III of Schedule C below to calculate Kevin's cost of goods sold for the year.

Enter all amounts as positive numbers.

Transcribed Image Text:W

30. PR.03-04.Algo (Algorithmic)

Problem 3-4 (Algorithmic)

Inventories (LO 3.2)

Kevin owns a retail store, and during the current year he purchased $719,800 worth of inventory. Kevin's beginning

inventory was $71,980, and his ending inventory is $86,376. During the year, Kevin withdrew $14,396 in inventory for

his personal use. Assume that he uses the cost method to value the inventory and there was no change in determining

quantities, costs, or valuations between opening and closing inventory.

Use Part III of Schedule C below to calculate Kevin's cost of goods sold for the year.

Enter all amounts as positive numbers.

Cost of Goods Sold (see instructions)

33 Method(s) used to

value closing inventory:

34 Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

If "Yes," attach explanation. ..

35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation...

36

35

36 Purchases less cost of items withdrawn for personal use. . .

37

37 Cost of labor. Do not include any amounts paid to yourself. . . . .

38

38 Materials and supplies . . . . .

39

39 Other costs. ...

40

40 Add lines 35 through 39. . . ..

41

41 Inventory at end of year. . .

42

42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 . . . .

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning