Wade (49) and Colleen (50) are married. They have two children, Jacob (20) and Lucella (15), who both lived with their parents all year. Jacob is not a student, but he has a part-time job. Lucella is stil in high school. Wade and Colleen provide more than 50% support for both children. Wade's wages were $27,500; Colleen's wages were $17,900, Jac gross income was $5,100, Lucella's was $0 Question 25 of 50. What is Wade's correct and most favorable 2019 filing status? O single O Married filing jointly O Married filing separately O Head of household O Qualitying widow(er). OMark for follow up Question 26 of 50. Does Wade meet the qualifications for claiming the Child Tax CreditiAdditional Child Tax Credit or the Other Dependent Credit? Choose the best answer. O Wade is eligible to claim the Child Tax Credt/Additional Chid Tax Credit. O Wade is eligible to claim the Other Dependent Credt O Wade is not eligible to claim the Child Tax Credit/Addtional Child Tax Credt or the Other Dependent Credit. OMark for follow up Question 27 of 50. Is Wade eligible to claim and receive the Earned Income Tax Credit? O Yes. O No.

Wade (49) and Colleen (50) are married. They have two children, Jacob (20) and Lucella (15), who both lived with their parents all year. Jacob is not a student, but he has a part-time job. Lucella is stil in high school. Wade and Colleen provide more than 50% support for both children. Wade's wages were $27,500; Colleen's wages were $17,900, Jac gross income was $5,100, Lucella's was $0 Question 25 of 50. What is Wade's correct and most favorable 2019 filing status? O single O Married filing jointly O Married filing separately O Head of household O Qualitying widow(er). OMark for follow up Question 26 of 50. Does Wade meet the qualifications for claiming the Child Tax CreditiAdditional Child Tax Credit or the Other Dependent Credit? Choose the best answer. O Wade is eligible to claim the Child Tax Credt/Additional Chid Tax Credit. O Wade is eligible to claim the Other Dependent Credt O Wade is not eligible to claim the Child Tax Credit/Addtional Child Tax Credt or the Other Dependent Credit. OMark for follow up Question 27 of 50. Is Wade eligible to claim and receive the Earned Income Tax Credit? O Yes. O No.

Chapter3: Tax Formula And Tax Determination; An Overview Of property Transactions

Section: Chapter Questions

Problem 9BCRQ

Related questions

Question

100%

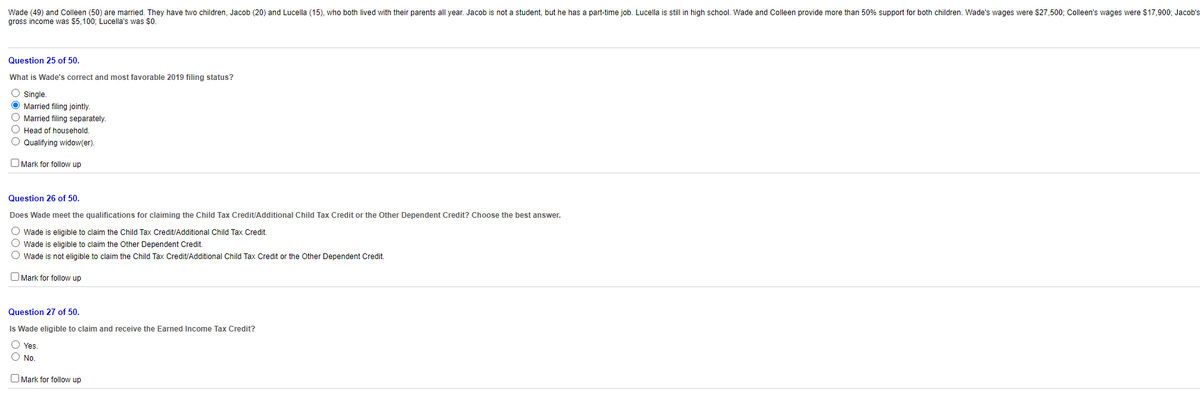

Transcribed Image Text:Wade (49) and Colleen (50) are married. They have two children, Jacob (20) and Lucella (15), who both lived with their parents all year. Jacob is not a student, but he has a part-time job. Lucella is still in high school. Wade and Colleen provide more than 50% support for both children. Wade's wages were $27,500; Colleen's wages were $17,900; Jacob's

gross income was $5,100; Lucella's was $0.

Question 25 of 50.

What is Wade's correct and most favorable 2019 filing status?

O single.

Married filing jointly.

O Married filing separately.

O Head of household.

O Qualifying widow(er).

O Mark for follow up

Question 26 of 50.

Does Wade meet the qualifications for claiming the Child Tax Credit/Additional Child Tax Credit or the Other Dependent Credit? Choose the best answer.

O Wade is eligible to claim the Child Tax Credit/Additional Child Tax Credit.

O Wade is eligible to claim the Other Dependent Credit.

O wade is not eligible to claim the Child Tax Credit/Additional Child Tax Credit or the Other Dependent Credit.

O Mark for follow up

Question 27 of 50.

Is Wade eligible to claim and receive the Earned Income Tax Credit?

O Yes.

O No.

O Mark for follow up

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT