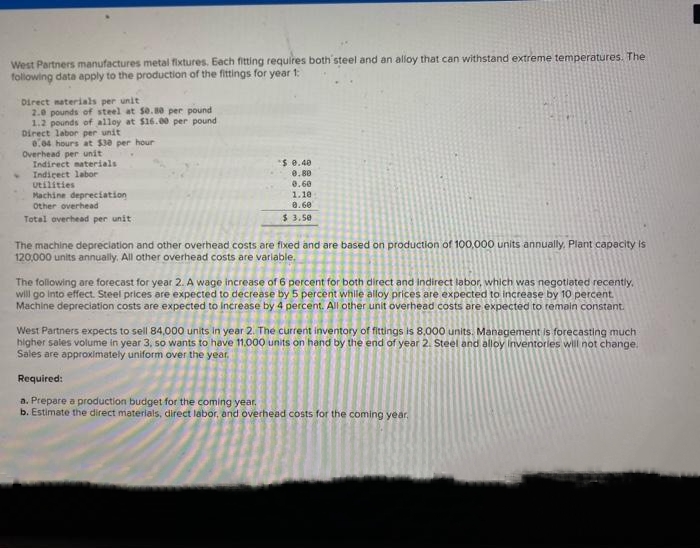

West Partners manufactures metal fixtures. Each fitting requires both steel and an alloy that can withstand extreme temperatures. The following data apply to the production of the fittings for year 1: Direct materials per unit 2.0 pounds of steel at 50.80 per pound 1.2 pounds of alloy at $16.00 per pound Direct labor per unit 0.04 hours at $30 per hour Overhead per unit Indirect materials Indirect labor Utilities Machine depreciation Other overhead Total overhead per unit $ 0.40 0.80 0.60 1.10 0.60 $ 3.50 The machine depreciation and other overhead costs are fixed and are based on production of 100,000 units annually, Plant capacity is 120,000 units annually. All other overhead costs are variable, The following are forecast for year 2. A wage increase of 6 percent for both direct and indirect labor, which was negotiated recently. will go into effect. Steel prices are expected to decrease by 5 percent while alloy prices are expected to increase by 10 percent. Machine depreciation costs are expected to increase by 4 percent. All other unit overhead costs are expected to remain constant. West Partners expects to sell 84,000 units in year 2. The current inventory of fittings is 8,000 units. Management is forecasting much higher sales volume in year 3, so wants to have 11.000 units on hand by the end of year 2. Steel and alloy inventories will not change. Sales are approximately uniform over the year. Required: a. Prepare a production budget for the coming year. b. Estimate the direct materials, direct labor, and overhead costs for the coming year.

West Partners manufactures metal fixtures. Each fitting requires both steel and an alloy that can withstand extreme temperatures. The following data apply to the production of the fittings for year 1: Direct materials per unit 2.0 pounds of steel at 50.80 per pound 1.2 pounds of alloy at $16.00 per pound Direct labor per unit 0.04 hours at $30 per hour Overhead per unit Indirect materials Indirect labor Utilities Machine depreciation Other overhead Total overhead per unit $ 0.40 0.80 0.60 1.10 0.60 $ 3.50 The machine depreciation and other overhead costs are fixed and are based on production of 100,000 units annually, Plant capacity is 120,000 units annually. All other overhead costs are variable, The following are forecast for year 2. A wage increase of 6 percent for both direct and indirect labor, which was negotiated recently. will go into effect. Steel prices are expected to decrease by 5 percent while alloy prices are expected to increase by 10 percent. Machine depreciation costs are expected to increase by 4 percent. All other unit overhead costs are expected to remain constant. West Partners expects to sell 84,000 units in year 2. The current inventory of fittings is 8,000 units. Management is forecasting much higher sales volume in year 3, so wants to have 11.000 units on hand by the end of year 2. Steel and alloy inventories will not change. Sales are approximately uniform over the year. Required: a. Prepare a production budget for the coming year. b. Estimate the direct materials, direct labor, and overhead costs for the coming year.

Chapter6: Activity-based, Variable, And Absorption Costing

Section: Chapter Questions

Problem 2PA: Five Card Draw manufactures and sells 24,000 units of Diamonds, which retails for $180, and 27,000...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:West Partners manufactures metal fixtures. Each fitting requires both steel and an alloy that can withstand extreme temperatures. The

following data apply to the production of the fittings for year 1:

Direct materials per unit

2.0 pounds of steel at 50.80 per pound

1.2 pounds of alloy at $16.00 per pound

Direct labor per unit

0:04 hours at $30 per hour

Overhead per unit

Indirect materials

Indicect labor

Utilities

Machine depreciation

Other overhead

Total overhead per unit

*$ 0.40

0.80

0.60

1.10

8.60

$ 3.50

The machine depreciation and other overhead costs are fixed and are based on production of 100,000 units annually. Plant capacity is

120,000 units annually. All other overhead costs are variable.

The following are forecast for year 2. A wage increase of 6 percent for both direct and indirect labor, which was negotiated recently.

will go into effect. Steel prices are expected to decrease by 5 percent while alloy prices are expected to increase by 10 percent.

Machine depreciation costs are expected to increase by 4 percent. All other unit overhead costs are expected to remain constant.

West Partners expects to sell 84,000 units in year 2. The current inventory of fittings is 8,000 units. Management is forecasting much

higher sales volume in year 3, so wants to have 11.000 units on hand by the end of year 2. Steel and alloy Inventories will not change.

Sales are approximately uniform over the year.

Required:

a. Prepare a production budget for the coming year.

b. Estimate the direct materials, direct labor, and overhead costs for the coming year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,