what amount of stockholders' equity will be reported? a. P355,000 b. P397,000 c. P419,500 d. P495,000

Q: HIJ and KLM exchanged equity interest resulting to HIJ obtaining control over KLM. Relevant…

A: Combined assets:- It means when assets of parent and subsidiary company get merged in one statement…

Q: Use the following information for the next two questions: A, B, and C formed a joint operation. The…

A: Solution 21: Correct option is C. 40 Solution 22: Correct option is B. 20 receipt

Q: erging with Target Corporation. Equity values were gathered as follows: ABC, separate equity value =…

A: Intrinsic value of merged entity depends on net income of the merged entity and required rate of…

Q: Companies X, Y and Z, parties to a consolidation, have the following data:…

A: Issue of shares or stock is one of the important source of finance being used by the business. These…

Q: Tangy is attempting to acquire Target. Selected financial data is presented for both companies in…

A: Earning per share depicts the earnings of equity shareholders against the amount of capital invested…

Q: On January 1, 20x1, the partners in ABC Co. decided to admit other investors and convert the…

A: Partnership ratio A - 20% B - 30% C - 50%

Q: X, Y and Z were partners sharing profits in the ratio of 3:2:1. Y retires, X and Z have agreed that…

A: New profit sharing ratio between X & Z = 3 : 1 X's share in capital of new firm = $2,00,000×34…

Q: Rules for the Distribution of Profits or Losses Stephanie Calamba and Allan Brillantes decided to…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: 18 If RE on 1/1 for P is 170000 JD and for S is 100000 JD, consolidated net income is 58000 JD and…

A: Consolidation is a business process wherein two or more business entities are being merged into one…

Q: he following does not indicate an investor company's ability to significance an investee? A.…

A: The investment in subsidiiary or another company is said to be accounted for using the equity…

Q: The XYZ partnership has the following balance sheet: and both have the same sharing rights.…

A: a) As FMV and the selling price are the same $30,000 but its book price is $21000. So X accounting…

Q: The partners Aces, Hearts, Cloves and Joker share profit and loss equally. Capital balances before…

A: The loss absorption proportion is calculated by prioritizing the payment to the partner by using a…

Q: A, B and C are partners contributed the following: A- P6,000.00; B -P4,000; and C-industry. They…

A: Solution.. Profit sharing ratio between A,B and C is 35%,25% and 40% respectively . Loss incurred…

Q: Sa, Nah, Pasa formed a joint operation. Sa is to act as managing joint operator and is designated to…

A: Joint Operations:-Joint operation is the joint arrangement between the parties where parties are…

Q: d accounting form AAA, BBB, and CCC are partners sharing profits and losses in the ratio of 5:3:2.…

A: In liquidation of partnership first we pay outside liabilities , then partners loan if any and…

Q: An acquirer with a P/E ratio of 13 and earnings of $1.99 seeks to take over another target firm with…

A: The combined P/E ratio is calculated by dividing the combined value by the combined earnings.

Q: , C, and D are companies to be combined. Just prior to the combination, their individual…

A: Concept of companies account

Q: rted by Alakdan Co. ii. The total assets of Alakdan Co. after the business combination. iii. The…

A: Goodwill is referred to as amount which exceeds the fair value of assets and liabilities assumed by…

Q: The shareholders of ABC Corporation would like to know the valuation of their ownership in the…

A:

Q: Lourdes and Annie are combining separate businesses to form a partnership. Cash and noncash assets…

A: Any non cash asset contributed by the partners should be valued at Current Fair Values.

Q: X, Y & Z are partners sharing profits in the ratio of 4:3:3. Assets with book value of P1,000,000…

A: Given that, Profit-sharing ratio = 4:3:3 Book value of assets = P1000000 realized value of assets =…

Q: At the end of 2021, Panther and Stark prepared the following statements for consolidation. Stark…

A: Allocation of excess of fair value over book value Amount ($) Consideration…

Q: The carrying values of the identifiable assets and liabilities are equal to their fair values except…

A: Given: 1500 shares issued in exchange of 200 shares of zomaro company @P150 Incurred P20,000 for new…

Q: On January 1, 20x1, the partners of ABC Partnership decided to admit other investors. As a result,…

A: Revaluation terms comes when the assets or the liabilities of the entities are again re- valued on…

Q: BUOT INIVS ABC, DEF and GHI decided to form a partnership contributing the following from each of…

A: Partnership: It is the agreement between the two or more person to carry the business with profit…

Q: 1. The Profit Attributable to Equity Holders of Parent/ Controlling Interest (Parent's Interests) in…

A: “Since you have posted a question with many sub-parts, we will solve three sub-parts for you. To get…

Q: Use the follouing information for the next two questions: On January 1, 20x1, Entity A acquires…

A: It is pertinent to note that as per PFRS 3 in a business combination all the identifiable net assets…

Q: ilable: account, P1,500,000; Expenses paid, P100,000 d, what is the balance of the Investment in…

A: Joint venture: It is an agreement between two or more person or entity to pool their resources and…

Q: What balance in Retained earnings will the combined entity report immediately following the…

A: Consolidated financial statements: When an investor company holds above 50% in the outstanding stock…

Q: HU and KLM exchanged equity interest resulting to HIJ obtaining control over KLM. Relevant…

A: Hello. Since your question has multiple parts, we will solve the first question for you. If you want…

Q: Separate balance sheets of Pellman Corporation and Shire Company on May 31 20X1, together with fair…

A: a) Prepare required journal as follows: Result:

Q: partners. They share profit and losses in the ratio of 2:1:2. Their balance sheet was as under:…

A: d) All the available balance of cash after considering the above transaction distributed among…

Q: Choose the correct. Aceton Corporation owns 80 percent of the outstanding stock of Voctax, Inc.…

A: Given case is: Aceton Corporation owns 80 percent of the outstanding stock of Voctax, Inc. During…

Q: HIJ and KLM exchanged equity interest resulting to HIJ obtaining control over KLM. Relevant…

A: When one company acquires another company that is called an acquisition.

Q: Sa, Nah, Pasa formed a joint operation. Sa is to act as managing joint operator and is designated to…

A: The balance of joint operation's account is calculated by deducting the joint stock loss from…

Q: On January 1, 20x1, Entity A acquires Entity B in a business combination. The financial statements…

A: Consolidated assets is referred to as all the assets, which owns directly through the corporation or…

Q: Sa, Nah, Pasa formed a joint operation. Sa is to act as managing joint operator and is designated to…

A: Profit or loss of the company is measured by preparing income statement which shows the difference…

Q: If the non-cash assets are sold for P700,000 and both partners agree to make up for any capital…

A: Solution:- Given, Partners Biore and Selisana each have a P450,000 capital balance Profits and…

Q: b. Prepare the following consolidation entries required to prepare a consolidated balance sheet…

A: The question is based on the concept of Financial Accounting.

Q: ssume that Company A acquires 70 per cent of Company B for a cash price of $14 million when the…

A: Solution: Calculation of goodwill when NCI is measured at Fair Value: Fair value of Consideration…

Q: HIJ and KLM exchanged equity interest resulting to HIJ obtaining control over KLM. Relevant…

A: After Consolidation: The increase in identifiable assets is 3,600,000-2,200,000= 1,400,000. The…

Q: 1. Carrot joins the partnership of Apple and Banana. The partnership's statement of financial…

A: Partnership dissolution takes place when there is a death of a partner or admission of a new…

Q: ABC will be merging with Target Corporation. Equity values were gathered as follows: ABC, separate…

A: Where the present value of combined enterprise is grater than the sum of present value of individual…

Q: On October 1, A and B pooled their assets to form a Partnership, with the firm to take over the…

A: The partners are pooling the assets for formation of partnership. The total contribution is based on…

Q: Problem Admission by Investment and Division of Profits The condensed statement of financial…

A: Problem #16 Matuguinas and Sorima shared profit and losses = 40% and 60% respectively On 02.01.2019,…

Q: Entity X obtains control over a join arrangement for an investment of P220,000. The investment gives…

A: When an entity has a significant influence on another entity, the equity method of accounting for…

Q: Identify which one of the following accounting entry for transfer of net profit at the end of the…

A: We need to consider all the partners related expenses and income in profit and loss appropriation…

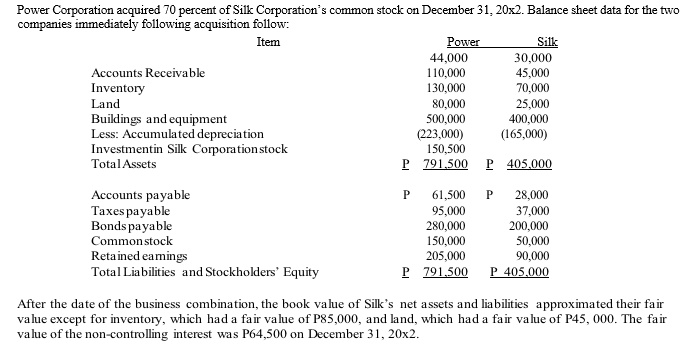

After the business combination on the basis of full-

a. P355,000

b. P397,000

c. P419,500

d. P495,000

Step by step

Solved in 3 steps

- Peace Computer Corporation acquired 75 percent of Symbol Software Company’s stock on January 2, 20X3, by issuing bonds with a par value of $85,250 and a fair value of $102,750 in exchange for the shares. Summarized balance sheet data presented for the companies just before the acquisition follow: Peace Computer Corporation Symbol Software Company Book Value Fair Value Book Value Fair Value Cash $ 216,000 $ 216,000 $ 62,000 $ 62,000 Other Assets 406,000 406,000 137,000 137,000 Total Debits $ 622,000 $ 199,000 Current Liabilities $ 82,000 82,000 $ 62,000 62,000 Common Stock 290,000 62,000 Retained Earnings 250,000 75,000 Total Credits $ 622,000 $ 199,000 Required: Prepare a consolidated balance sheet immediately following the acquisition.Phone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $98,000. At that date, the fair value of the noncontrolling interest was $42,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Item Phone Corporation Smart Corporation Cash $ 52,300 $ 39,000 Accounts Receivable 99,000 59,000 Inventory 136,000 92,000 Land 66,000 49,000 Buildings & Equipment 417,000 268,000 Less: Accumulated Depreciation (151,000) (73,000) Investment in Smart Corporation 98,000 Total Assets $ 717,300 $ 434,000 Accounts Payable $ 141,500 $ 27,000 Mortgage Payable 300,800 288,000 Common Stock 72,000 40,000 Retained Earnings 203,000 79,000 Total Liabilities & Stockholders’ Equity $ 717,300 $ 434,000 At the date of the business combination, the book values of Smart’s assets and liabilities approximated fair value except for inventory, which had a fair value of…Phone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $98,000. At that date, the fair value of the noncontrolling interest was $42,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Item Phone Corporation Smart Corporation Cash $ 52,300 $ 39,000 Accounts Receivable 99,000 59,000 Inventory 136,000 92,000 Land 66,000 49,000 Buildings & Equipment 417,000 268,000 Less: Accumulated Depreciation (151,000) (73,000) Investment in Smart Corporation 98,000 Total Assets $ 717,300 $ 434,000 Accounts Payable $ 141,500 $ 27,000 Mortgage Payable 300,800 288,000 Common Stock 72,000 40,000 Retained Earnings 203,000 79,000 Total Liabilities & Stockholders’ Equity $ 717,300 $ 434,000 At the date of the business combination, the book values of Smart’s assets and liabilities approximated fair value except for inventory, which had a fair value of…

- Phone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $97,300. At that date, the fair value of the noncontrolling interest was $41,700. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Item Phone Corporation Smart Corporation Cash $ 58,300 $ 22,000 Accounts Receivable 109,000 49,000 Inventory 144,000 79,000 Land 73,000 36,000 Buildings & Equipment 426,000 266,000 Less: Accumulated Depreciation (166,000) (75,000) Investment in Smart Corporation 97,300 Total Assets $ 741,600 $ 377,000 Accounts Payable $ 142,500 $ 26,000 Mortgage Payable 331,100 233,000 Common Stock 68,000 39,000 Retained Earnings 200,000 79,000 Total Liabilities & Stockholders’ Equity $ 741,600 $ 377,000 At the date of the business combination, the book values of Smart’s assets and liabilities approximated fair value except for inventory, which had a fair value of…Blank Corporation acquired 100 percent of Faith Corporation’s common stock on December 31, 20X2, for $207,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Item Blank Corporation Faith Corporation Assets Cash $ 66,000 $ 36,000 Accounts Receivable 85,000 39,000 Inventory 107,000 65,000 Buildings and Equipment (net) 224,000 151,000 Investment in Faith Corporation Stock 207,000 Total Assets $ 689,000 $ 291,000 Liabilities and Stockholders’ Equity Accounts Payable $ 82,000 $ 23,000 Notes Payable 142,000 61,000 Common Stock 99,000 43,000 Retained Earnings 366,000 164,000 Total Liabilities and Stockholders’ Equity $ 689,000 $ 291,000 At the date of the business combination, the book values of Faith’s net assets and liabilities approximated fair value. Assume that Faith Corporation’s accumulated depreciation on buildings and equipment on the acquisition date was $16,000. Required:…Paste Corporation acquired 70 percent of Stick Company's stock on January 1, 20X9, for $105,000. At that date, the fair value of the noncontrolling interest was equal to 30 percent of the book value of Stick Company. The companies reported the following stockholders’ equity balances immediately after the acquisition: Paste Corporation Stick Company Common Stock $ 120,000 $ 30,000 Additional Paid-in Capital 230,000 80,000 Retained Earnings 290,000 40,000 Total $ 640,000 $ 150,000 Paste and Stick reported 20X9 operating incomes of $90,000 and $35,000 and dividend payments of $30,000 and $10,000, respectively. Required: Compute the amount reported as net income by each company for 20X9, assuming Paste uses equity-method accounting for its investment in Stick. Compute consolidated net income for 20X9.

- Paste Corporation acquired 70 percent of Stick Company's stock on January 1, 20X9, for $105,000. At that date, the fair value of the noncontrolling interest was equal to 30 percent of the book value of Stick Company. The companies reported the following stockholders’ equity balances immediately after the acquisition: Paste Corporation Stick Company Common Stock $ 120,000 $ 30,000 Additional Paid-in Capital 230,000 80,000 Retained Earnings 290,000 40,000 Total $ 640,000 $ 150,000 Paste and Stick reported 20X9 operating incomes of $90,000 and $35,000 and dividend payments of $30,000 and $10,000, respectively. Compute the reported balance in retained earnings at December 31, 20X9, for both companies. Compute consolidated retained earnings at December 31, 20X9.On 1 January 20X9, JB Enterprises acquired 70 per cent of the shares of Good Company. The separate condensed statements of financial position of JB Enterprises and of Good Company immediately after the acquisition appeared as shown below: (all amounts in €) JB Good Company Assets Property, plant and equipment (net) 18.750.000 2.600.000 Investment in Good Company 3.600.000 - Inventories 1.000.000 740.000 Cash 13.550.000 560.000 Trade and other receivables 4.400.000 660.000 41.300.000 4.560.000 Equity and Liabilities Share capital 10.000.000 2.000.000 Reserves 16.200.000 1.600.000 Profit for the year 20X4 1.600.000 240.000 Provisions 100.000 250.000 Current liabilities 13.400.000 470.000 41.300.000 4.560.000 Additional information (at acquisition…X Corporation acquired 80 percent of Y Corporation’s outstanding capital stock for $430,000 cash. Immediately before the purchase, the balance sheets of both corporations reported the following: XCO Y CO Assets $2,000,000 $750,000 Liabilities $ 750,000 $400,000 Common Stock 1,000,000 310,000 Retained Earnings 250,000 40,000 Liabilities & Stockholders’ Equity $2,000,000 $750,000 At the date of purchase, the fair value of Y assets was $50,000 more than the Book value amounts. In the consolidated balance sheet prepared immediately after the purchase,the non controlling interest should amount to Select one: a. 137,500 b. 215,000 c. 107,500 d. 86,000

- Puzzle Corporation acquired 100 percent of the common stock of Solver Company by issuing 10,000 shares of $10 par common stock with a market value of $60 per share. Summarized balance sheet data for the two companies immediately preceding the acquisition are as follows: Puzzle Corporation Solver Corporation Book Value Fair Value Book Value Fair Value Total Assets $ 1,200,000 $ 1,500,000 $ 900,000 $ 1,300,000 Total Liabilities $ 800,000 $ 700,000 $ 600,000 $ 750,000 Total Stockholders Equity 400,000 300,000 $ 1,200,000 $ 900,000 Required: Determine the dollar amounts to be presented in the consolidated balance sheet for (1) total assets, (2) total liabilities, and (3) total stockholders' equity.On January 1, 2025, P Corporation acquired 100 percent of the voting stock of S Corporation in exchange for $2,347,500 in cash and securities. On the acquisition date, S had the following balance sheet: Cash $ 24,800 Accounts payable $ 1,891,800 Accounts receivable 102,000 Inventory 223,000 Equipment (net) 2,310,000 Common stock 800,000 Trademarks 920,000 Retained earnings 888,000 Total assets $ 3,579,800 Total liabilities and equity $ 3,579,800 At the acquisition date, the book values of S's assets and liabilities were generally equivalent to their fair values except for the following assets: Asset Book Value Fair Value RemainingUseful Life Equipment $ 2,310,000 $ 2,483,000 8 years Customer lists 0 234,000 4 years Trademarks 920,000 1,009,500 indefinite During the next two years, S has the following income and dividends in its own separately prepared financial reports to its parent. Net Income…On January 1, 20X5, Peery Company acquired 100 percent of Standard Company's common shares at underlying book value. Peery uses the equity method in accounting for its ownership of Standard. On December 31, 20X5, the trial balances of the two companies are as follows: Item Peery Company Standard Company Debit Credit Debit Credit Current Assets $ 238,000 $ 95,000 Depreciable Assets 300,000 170,000 Investment in Standard Company 100,000 Other Expenses 90,000 70,000 Depreciation Expense 30,000 17,000 Dividends Declared 32,000 10,000 Accumulated Depreciation $ 120,000 $ 85,000 Current Liabilities 50,000 30,000 Long-Term Debt 120,000 50,000 Common Stock 100,000 50,000 Retained Earnings 175,000 35,000 Sales 200,000 112,000 Income from Standard Company 25,000 $ 790,000 $ 790,000 $ 362,000 $ 362,000 Required: Prepare the consolidation entries needed as of December 31, 20X5, to complete a…