What are spot rates and forward rates? Suppose you open the newspaper today and observe the following indirect exchange rate quotations for the British pound: Forward Exchange Rates 60 Days 0.5412 Spot Exchange Rates 30 Days 90 Days 0.5435 British pound (pound / dollar) 0.5376 0.5395 The British pound is selling at a in the forward market. Suppose you make a E 450,000 sale to a British customer who has 60 days to pay you in cash. The customer will pay you in British pounds, but your company is based in the United States, so you are most concerned with the dollar value of the payment. If the customer pays you E 450,000 today, how much is that worth in dollars? O $627,791 O $837,054 O $795,201 O $585,938 Assume that the forward market is correct and the 60-day forward exchange rate quoted in the newspaper today (above) is the spot exchange rate 60 days from now. If the customer waits the full 60 days and pays you £450,000, how much have you lost (in dollar terms) due to exchange rate fluctuations? O $4,733 O $5,568 $4,454 0 $4,176

What are spot rates and forward rates? Suppose you open the newspaper today and observe the following indirect exchange rate quotations for the British pound: Forward Exchange Rates 60 Days 0.5412 Spot Exchange Rates 30 Days 90 Days 0.5435 British pound (pound / dollar) 0.5376 0.5395 The British pound is selling at a in the forward market. Suppose you make a E 450,000 sale to a British customer who has 60 days to pay you in cash. The customer will pay you in British pounds, but your company is based in the United States, so you are most concerned with the dollar value of the payment. If the customer pays you E 450,000 today, how much is that worth in dollars? O $627,791 O $837,054 O $795,201 O $585,938 Assume that the forward market is correct and the 60-day forward exchange rate quoted in the newspaper today (above) is the spot exchange rate 60 days from now. If the customer waits the full 60 days and pays you £450,000, how much have you lost (in dollar terms) due to exchange rate fluctuations? O $4,733 O $5,568 $4,454 0 $4,176

Chapter3: International Financial Markets

Section: Chapter Questions

Problem 1IEE

Related questions

Question

Transcribed Image Text:What are spot rates and forward rates?

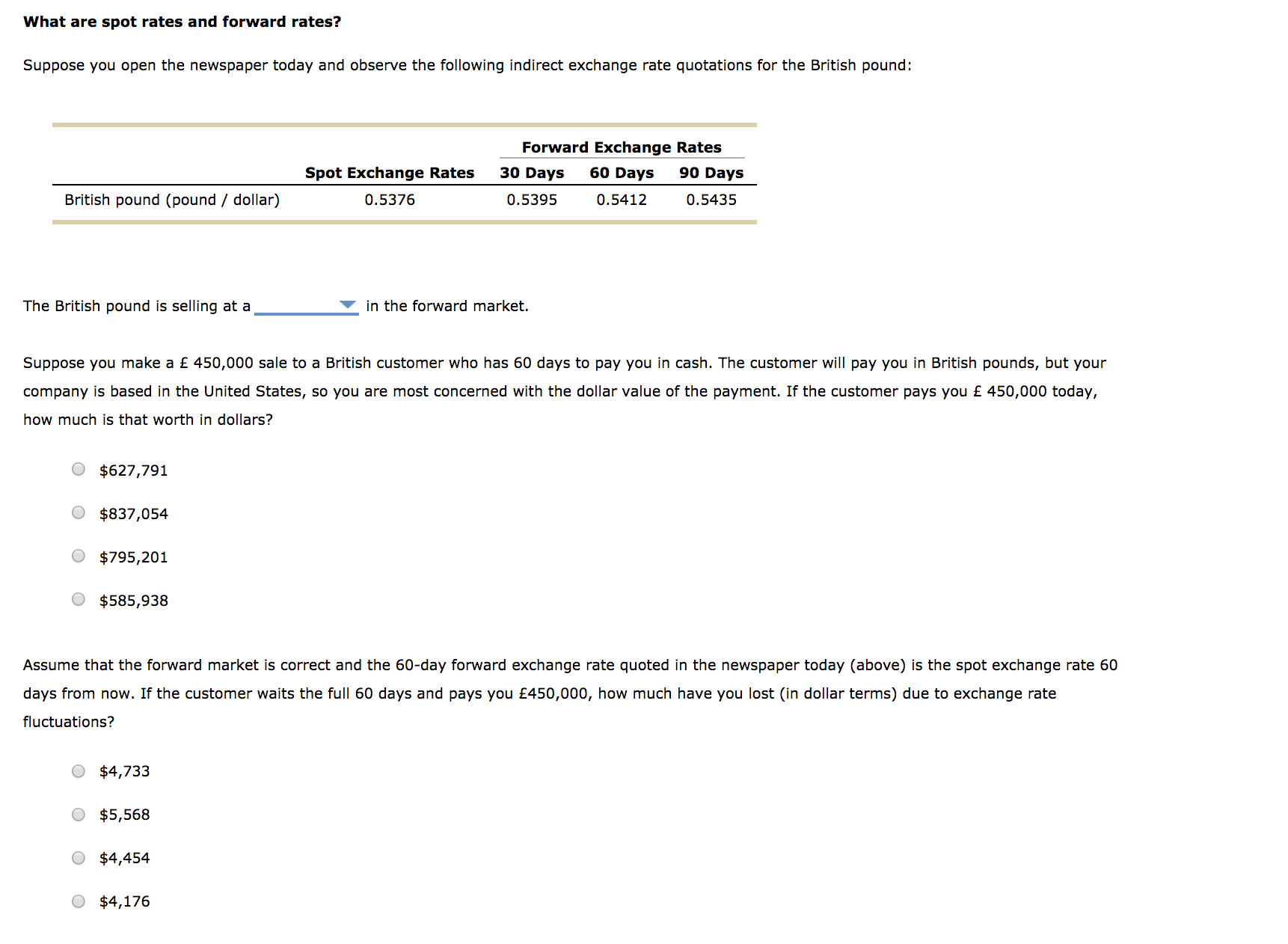

Suppose you open the newspaper today and observe the following indirect exchange rate quotations for the British pound:

Forward Exchange Rates

60 Days

0.5412

Spot Exchange Rates

30 Days

90 Days

0.5435

British pound (pound / dollar)

0.5376

0.5395

The British pound is selling at a

in the forward market.

Suppose you make a E 450,000 sale to a British customer who has 60 days to pay you in cash. The customer will pay you in British pounds, but your

company is based in the United States, so you are most concerned with the dollar value of the payment. If the customer pays you E 450,000 today,

how much is that worth in dollars?

O $627,791

O $837,054

O $795,201

O $585,938

Assume that the forward market is correct and the 60-day forward exchange rate quoted in the newspaper today (above) is the spot exchange rate 60

days from now. If the customer waits the full 60 days and pays you £450,000, how much have you lost (in dollar terms) due to exchange rate

fluctuations?

O $4,733

O $5,568

$4,454

0 $4,176

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 3 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT