Which is not an issue in the context of Fintech regulation? O Increased technological costs. O Weighing the costs and benefits of regulation for consumers and innovation. O Decentralizing Fintech regulation, which is harder to override by centralized, federal regulation. O Supporting Fintech companies with government funding. O Creating "safe spaces" for Fintech companies to test our their businesses. QUESTION 2 Excess reserves are Insurance from deposit outflow. Suppose you hold 14 million required reserves and 46 million excess reserves at the central bank. The total interest payment on reserves from the central bank is 0,3%. If you do not hold your excess reserves at the bank, you may take loans and earn 4 In average. What is the cost of holding excess reserve at the central bank? O $60.000,000 O $1.665,000 O $1.702.000 O $555.000 O $518,000

Which is not an issue in the context of Fintech regulation? O Increased technological costs. O Weighing the costs and benefits of regulation for consumers and innovation. O Decentralizing Fintech regulation, which is harder to override by centralized, federal regulation. O Supporting Fintech companies with government funding. O Creating "safe spaces" for Fintech companies to test our their businesses. QUESTION 2 Excess reserves are Insurance from deposit outflow. Suppose you hold 14 million required reserves and 46 million excess reserves at the central bank. The total interest payment on reserves from the central bank is 0,3%. If you do not hold your excess reserves at the bank, you may take loans and earn 4 In average. What is the cost of holding excess reserve at the central bank? O $60.000,000 O $1.665,000 O $1.702.000 O $555.000 O $518,000

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter6: Losses And Loss Limitations

Section: Chapter Questions

Problem 5RP

Related questions

Question

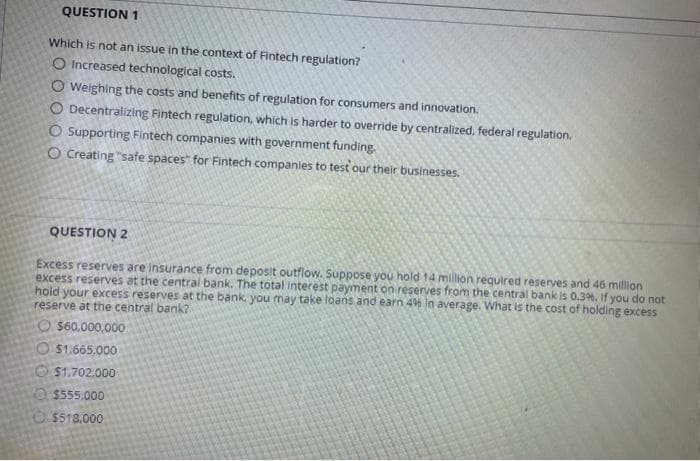

Transcribed Image Text:QUESTION 1

Which is not an issue in the context of Fintech regulation?

O Increased technological costs.

O Weighing the costs and benefits of regulation for consumers and innovation.

O Decentralizing Fintech regulation, which is harder to override by centralized, federal regulation.

O Supporting Fintech companies with government funding.

O Creating "safe spaces" for Fintech companies to test our their businesses.

QUESTION 2

Excess reserves are Insurance from deposit outflow. Suppose you hold 14 million required reserves and 46 million

excess reserves at the central bank. The total Interest payment on reserves from the central bank is 0,3%. If you do not

hold your excess reserves at the bank, you may take loans and earn 4% in average. What is the cost of holding excess

reserve at the central bank?

O $60.000,000

O $1.665,000

O $1.702.000

O $555.000

O $518.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT