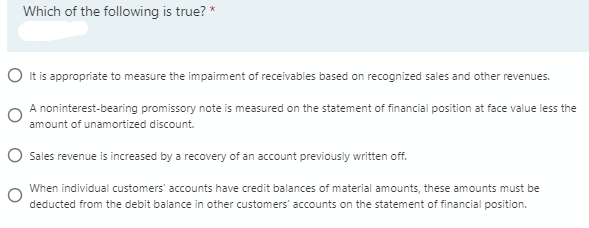

Which of the following is true? * O It is appropriate to measure the impairment of receivables based on recognized sales and other revenues. A noninterest-bearing promissory note is measured on the statement of financial position at face value less the amount of unamortized discount. O Sales revenue is increased by a recovery of an account previously written off. When individual customers' accounts have credit balances of material amounts, these amounts must be deducted from the debit balance in other customers' accounts on the statement of financial position.

Which of the following is true? * O It is appropriate to measure the impairment of receivables based on recognized sales and other revenues. A noninterest-bearing promissory note is measured on the statement of financial position at face value less the amount of unamortized discount. O Sales revenue is increased by a recovery of an account previously written off. When individual customers' accounts have credit balances of material amounts, these amounts must be deducted from the debit balance in other customers' accounts on the statement of financial position.

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter9: Auditing The Revenue Cycle

Section: Chapter Questions

Problem 20MCQ

Related questions

Question

question 41

Transcribed Image Text:Which of the following is true? *

O It is appropriate to measure the impairment of receivables based on recognized sales and other revenues.

A noninterest-bearing promissory note is measured on the statement of financial position at face value less the

amount of unamortized discount.

O Sales revenue is increased by a recovery of an account previously written off.

When individual customers' accounts have credit balances of material amounts, these amounts must be

deducted from the debit balance in other customers' accounts on the statement of financial position.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College