Which of the following statements is not true about mortgages? O Mortgages are examples of amortized loans. O The ending balance of an amortized loan contract will be zero. O The payment allocated toward principal in an amortized loan is the residual balance-that is, the difference between total payment and the interest due. O Mortgages always have a fixed nominal interest rate.

Which of the following statements is not true about mortgages? O Mortgages are examples of amortized loans. O The ending balance of an amortized loan contract will be zero. O The payment allocated toward principal in an amortized loan is the residual balance-that is, the difference between total payment and the interest due. O Mortgages always have a fixed nominal interest rate.

Chapter9: Obtaining Affordable Housing

Section: Chapter Questions

Problem 4DTM

Related questions

Question

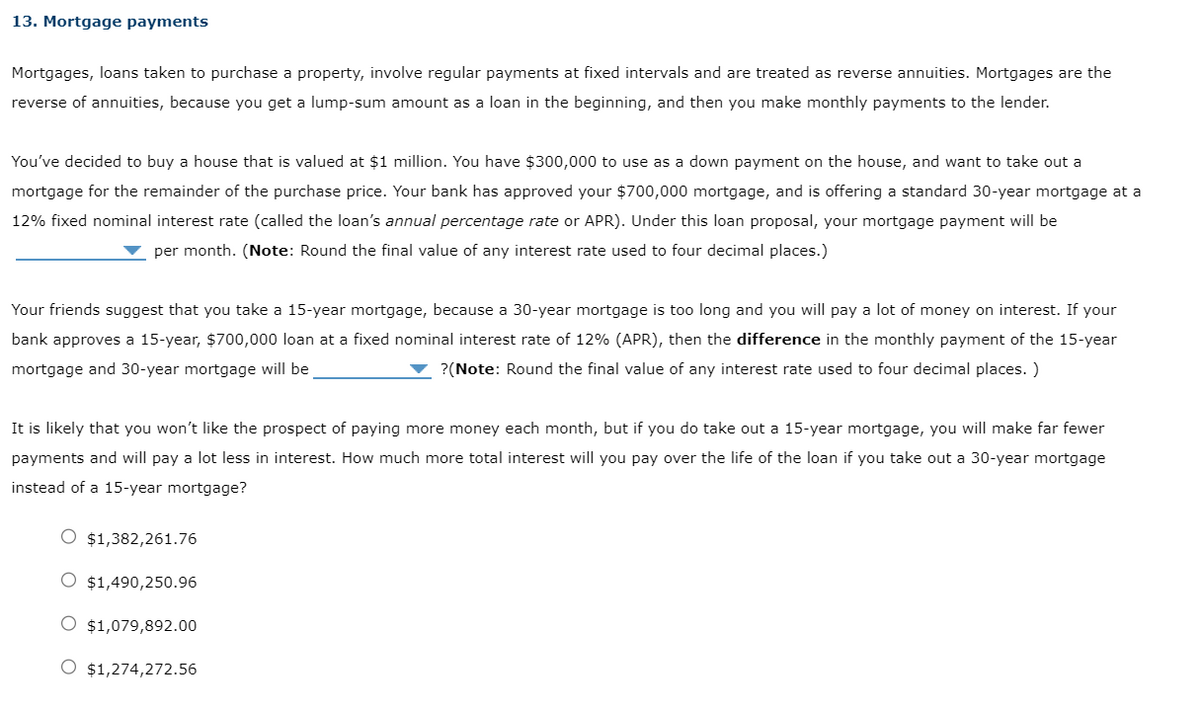

Transcribed Image Text:13. Mortgage payments

Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the

reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender.

You've decided to buy a house that is valued at $1 million. You have $300,000 to use as a down payment on the house, and want to take out a

mortgage for the remainder of the purchase price. Your bank has approved your $700,000 mortgage, and is offering a standard 30-year mortgage at a

12% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be

per month. (Note: Round the final value of any interest rate used to four decimal places.)

Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your

bank approves a 15-year, $700,000 loan at a fixed nominal interest rate of 12% (APR), then the difference in the monthly payment of the 15-year

mortgage and 30-year mortgage will be

?(Note: Round the final value of any interest rate used to four decimal places. )

It is likely that you won't like the prospect of paying more money each month, but if you do take out a 15-year mortgage, you will make far fewer

payments and will pay a lot less in interest. How much more total interest will you pay over the life the loan if you take out a 30-year mortgage

instead of a 15-year mortgage?

O $1,382,261.76

O $1,490,250.96

O $1,079,892.00

O $1,274,272.56

Transcribed Image Text:Which of the following statements is not true about mortgages?

O Mortgages are examples of amortized loans.

O The ending balance of an amortized loan contract will be zero.

O The payment allocated toward principal in an amortized loan is the residual balance-that is, the difference between total payment and

the interest due.

O Mortgages always have a fixed nominal interest rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:13. Mortgage payments

Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the

reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender.

You've decided to buy a house that is valued at $1 million. You have $300,000 to use as a down payment on the house, and want to take out a

mortgage for the remainder of the purchase price. Your bank has approved your $700,000 mortgage, and is offering a standard 30-year mortgage at a

12% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be

per month. (Note: Round the final value of any interest rate used to four decimal places.)

Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your

bank approves a 15-year, $700,000 loan at a fixed nominal interest rate of 12% (APR), then the difference in the monthly payment of the 15-year

mortgage and 30-year mortgage will be

?(Note: Round the final value of any interest rate used to four decimal places. )

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College