Whippet Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2017, at a cost of $131,000. Over its 4-year useful life, the bus is expected to be driven 240,000 miles. Salvage value is expected to be $7,400. Compute the depreciation cost per unit. (Round answer to 3 decimal places, e.g. 6.251) Depreciation cost per unit $4 LINK TO TEXT VIDEO: APPLIED SKILLSS Prepare a depreciation schedule assuming actual mileage was: 2017, 52,400; 2018, 68,120; 2019, 53,710; and 2020, 35,370. (Round depreciation cost per unit to 3 decimal places, e.g. 0.125 and other answers to 0 decimal places, e.g. 125) Computation End of Year Units of Activity x Depreciation Cost/Unit = Annual Depreciation Expense Accumulated Depreciation Years Book Value 2017 2$ $4 $ 2018 2019 2020

Whippet Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2017, at a cost of $131,000. Over its 4-year useful life, the bus is expected to be driven 240,000 miles. Salvage value is expected to be $7,400. Compute the depreciation cost per unit. (Round answer to 3 decimal places, e.g. 6.251) Depreciation cost per unit $4 LINK TO TEXT VIDEO: APPLIED SKILLSS Prepare a depreciation schedule assuming actual mileage was: 2017, 52,400; 2018, 68,120; 2019, 53,710; and 2020, 35,370. (Round depreciation cost per unit to 3 decimal places, e.g. 0.125 and other answers to 0 decimal places, e.g. 125) Computation End of Year Units of Activity x Depreciation Cost/Unit = Annual Depreciation Expense Accumulated Depreciation Years Book Value 2017 2$ $4 $ 2018 2019 2020

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 8PB: Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is...

Related questions

Question

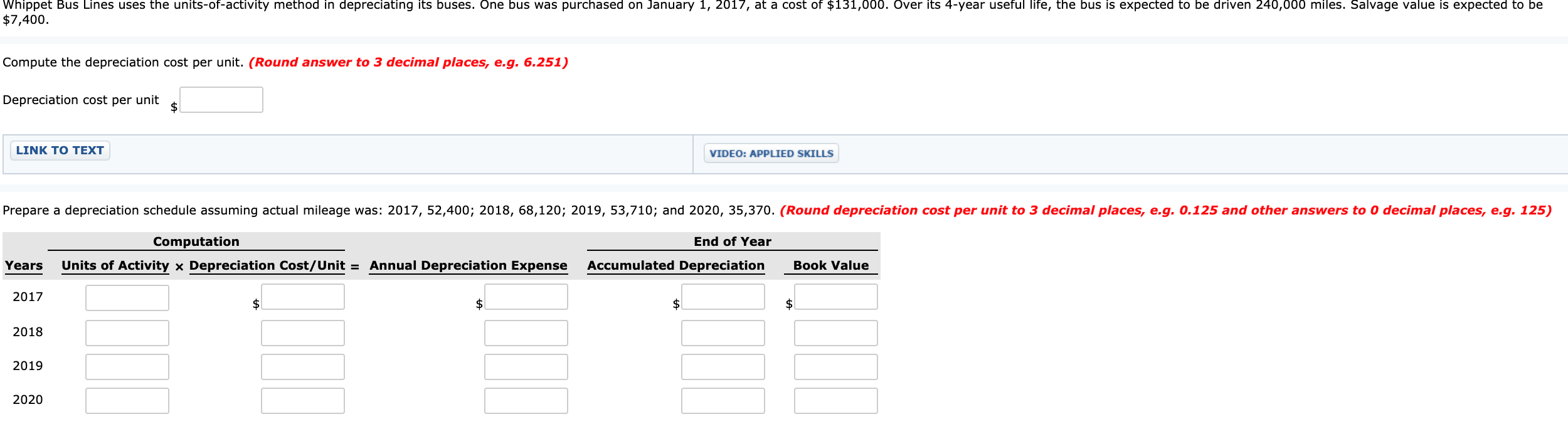

Transcribed Image Text:Whippet Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2017, at a cost of $131,000. Over its 4-year useful life, the bus is expected to be driven 240,000 miles. Salvage value is expected to be

$7,400.

Compute the depreciation cost per unit. (Round answer to 3 decimal places, e.g. 6.251)

Depreciation cost per unit

$4

LINK TO TEXT

VIDEO: APPLIED SKILLSS

Prepare a depreciation schedule assuming actual mileage was: 2017, 52,400; 2018, 68,120; 2019, 53,710; and 2020, 35,370. (Round depreciation cost per unit to 3 decimal places, e.g. 0.125 and other answers to 0 decimal places, e.g. 125)

Computation

End of Year

Units of Activity x Depreciation Cost/Unit = Annual Depreciation Expense

Accumulated Depreciation

Years

Book Value

2017

2$

$4

$

2018

2019

2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning